Tariff War Turmoil: How Proposed U.S. Tariffs Impact Alberta Wheat and Barley Exports

Despite the many uncertainties and risks that farmers typically face heading into any growing season, they tend to show resilience, optimism and a readiness to work through challenges often beyond their control. This growing season, farmers are preparing to navigate the uncertainty of a mounting trade war with the United States and the broader implications for the free trade they have come to rely on.

Canadian wheat and barley exports to the U.S. began in earnest in the late 1980s and early 1990s. While Canadian cereals were previously subject to tariffs, the signing of the North American Free Trade Agreement (NAFTA) changed the trade dynamic with the U.S.

In 2024, Canadian wheat exports to the U.S. amounted to over $1 billion, with barley exports totaling around $100 million. The U.S. is Alberta’s largest market for durum wheat, the fifth largest for non-durum wheat and the third largest for barley. While Canadian wheat and barley are globally recognized for their high quality and consistency, disruptions to trade due to proposed U.S. tariffs are expected to have immediate, direct and indirect impacts on farmers. A 25 per cent tariff, combined with proposed reciprocal tariffs, will effectively close the border to trade or significantly erode farmers’ bottom lines.

The impacts beyond direct exports are difficult to quantify but will be far-reaching. These include effects on the availability and cost of inputs, supply chain logistics, trade integration, rail service and demand, as well as reductions in global and domestic value-added processing demand for grains. There will also be tertiary impacts on packaging and other peripheral industries, services and supply chains.

Wheat Trade to the U.S.

Seven per cent of Alberta’s wheat exports go to the U.S., amounting to roughly $288 million in trade annually. Conversely, wheat is the third-largest crop grown in the U.S., but due to policy changes, production has fallen drastically—by approximately 800 million bushels—over the last several decades. U.S. markets have come to depend on Canadian wheat exports for their superior quality characteristics, including gluten strength, high protein content and consistency, providing a reliable supply for agri-food processors south of the border.

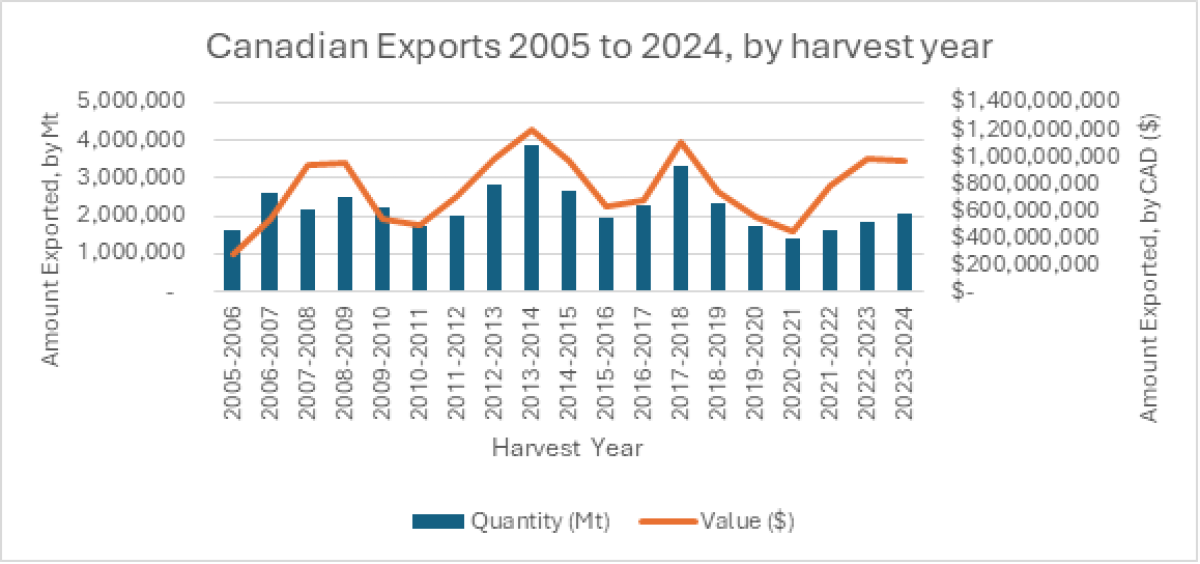

The figure below shows U.S. imports of Canadian wheat over the past 20 years, demonstrating consistent demand despite annual variations.

Canada represents about 98 per cent of wheat imports into the U.S. Despite falling U.S. wheat production, milling capacity for semolina (durum) has grown 20 per cent, while wheat flour capacity has increased by 24 per cent. U.S. farmers do not produce enough durum wheat domestically to meet demand, with domestic production declining to about 30 per cent while durum demand for food use has risen to 30 per cent. Additionally, non-durum hard wheat production in the U.S. has remained flat, while imports from Canada have grown by a staggering 870 per cent since 1990, highlighting the U.S. milling industry’s reliance on Canadian producers for expansion.

Canada is also a top destination for U.S. baked goods, importing approximately $1.3 billion in baked goods in 2023. Conversely, Canada exports a significant portion of the $7.2 billion in bread and bakery products entering the U.S. Proposed reciprocal tariffs and import duties will inevitably impact demand for Canadian wheat, either domestically or for export, where it has become an essential player in U.S. agriculture and agri-food sectors. Due to diversification efforts and strong global demand for high-quality Canadian wheat, we are fortunate to serve over 80 markets worldwide. Nonetheless, Alberta grain farmers remain adamant about maintaining a mutually beneficial and integrated trading relationship with their closest neighbour and ally.

Barley Trade to the U.S.

Approximately two-thirds of Canadian barley production is used domestically, with that number rising to 80 per cent in Alberta, while roughly 20 per cent is exported. Alberta’s barley exports to the U.S. averaged approximately $44 million in 2024. Due to the province’s strong livestock sector, most Alberta-grown barley is used for animal feed. With Alberta live cattle and beef exports to the U.S. amounting to around $4 billion, domestic barley demand is expected to be affected by the proposed tariffs. This may be offset by trade barriers on other feed imports, such as U.S. corn, which typically competes with local feed barley on price.

The Canadian cattle market is highly integrated with the U.S. More than half of Canadian beef production is exported, with 75 per cent destined for the U.S. Due to limited processing capacity in Canada, a significant number of live cattle are shipped to the U.S. for processing. At the same time, U.S. ranchers send live cattle to Canada for finishing, drawing on demand for local feed supplies.

Currently, American herd sizes are not meeting domestic beef demand, creating opportunities for Canadian cattle to help fill the gap. However, Canadian herd sizes are at their lowest since 1988, already impacting feed demand. These tariffs could further hinder herd growth, exacerbating effects on barley demand. While both countries have benefited from an interconnected cattle market, the tariffs and trade war could disrupt this balance.

Barley growers may also feel the impact through other markets. Canada is a leading exporter of malted barley, with the U.S. being its primary market, accounting for over 57 per cent of exports worth roughly $307.2 million. Canada also exports around $131 million worth of beer to the U.S., which relies on locally grown barley for malt processing. With lower U.S. demand, Canadian maltsters may purchase less barley, reducing prices for farmers. Potential shifts in U.S. production during this period could make it difficult for Canada to regain market share in a post-tariff trade environment.

Fortunately, 93 per cent of beer consumed in Alberta consists of domestically processed brands. However, concerns about packaging material supplies, such as aluminum, could drive up costs and impact availability. Organizations like the Canadian Malting Barley Technical Centre, of which Alberta Grains is a member, continue to work on market development, diversification and expansion to reduce reliance on any single market.

Final Thoughts

Alberta Grains is actively monitoring and discussing this issue with elected officials and other stakeholders. Not only will these tariffs harm farmers’ bottom lines, but they will also raise input and machinery costs, further tightening margins and creating indirect impacts that may not yet be fully understood.

In response, Alberta Grains is calling for greater diversification efforts, increased investment attraction, further development of domestic processing, and improved logistics and infrastructure investments. As rail service currently stands in Canada, there is a freight disadvantage in transporting products from west to east rather than north to south, making it difficult for western producers to serve agri-food processing needs in Eastern Canada. As the trade war unfolds and volatility extends to other markets such as China, Alberta’s crop sector cannot afford to be collateral damage—strategic trade diversification and policy action are essential to protecting farmers' livelihoods.