October 2024

Prices in wheat, durum and barley markets have seen a typical seasonal recovery out of the harvest lows. Export prospects look favorable, although there are risks to monitor as well. Supplies are generally adequate enough to limit the extent of any upside potential in the months ahead.

Wheat Outlook

Upside:

- Canadian exports are off to a strong start again this season, helped by global supplies that are relatively tight across the major exporters in aggregate.

- Russia is looking to set a minimum price for international tenders, which would narrow its discount to other key shippers.

Downside:

- USDA is forecasting US wheat ending stocks to be the highest in four years.

- There are questions about the strength of import demand into some key markets.

- Supplies across the major exporters have been tight ‘on paper’ for the past couple of years, and that hasn’t stopped values from trending lower.

Key Notes:

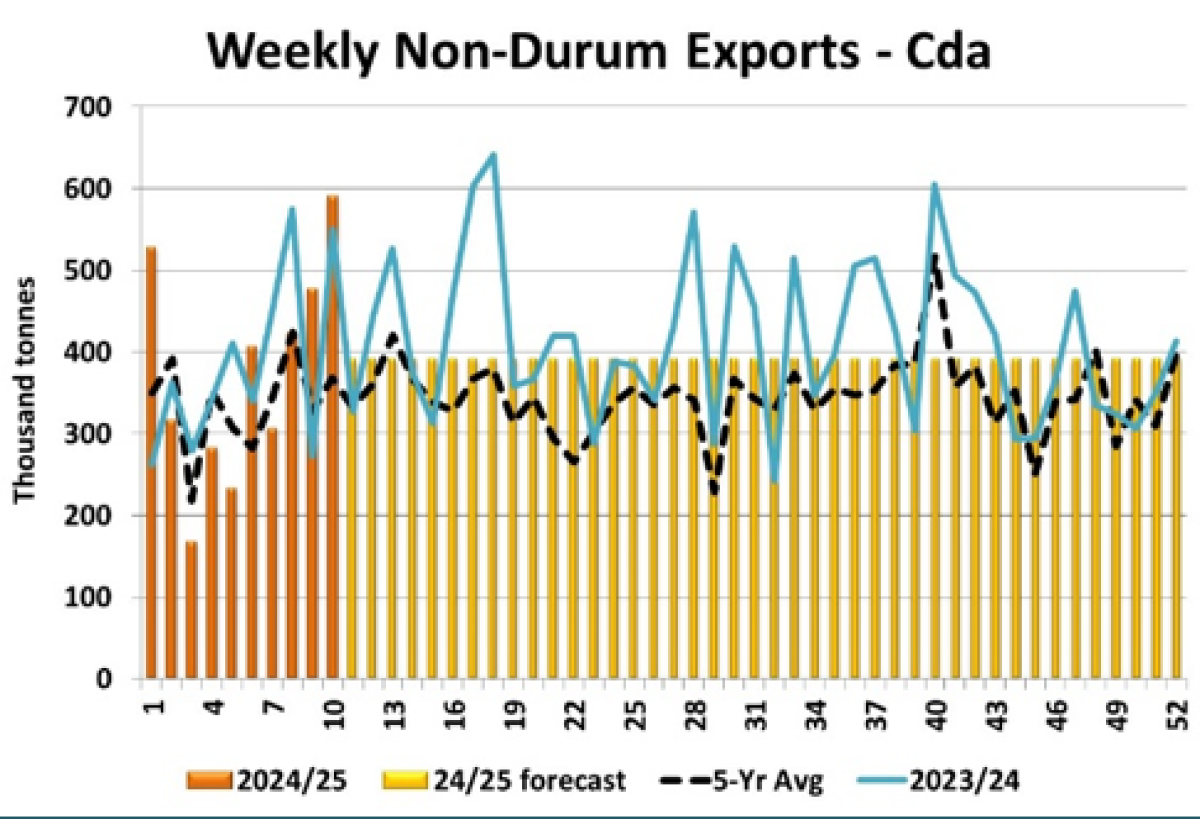

- Statistics Canada reported August non-durum exports at 1.35 mln tonnes, below the 5-year average for the month. Canadian wheat stocks were low going into harvest, so a slower August is not a surprise. CGC data shows a notable pickup in September and early October, including a strong 590,700 tonnes shipped in week 10. Total CGC-reported exports are 3.75 mln tonnes so far, just behind last year, which ultimately ended in record movement in 2023/24. Exports may not quite reach last year’s total, but should be strong again in 2024/25.

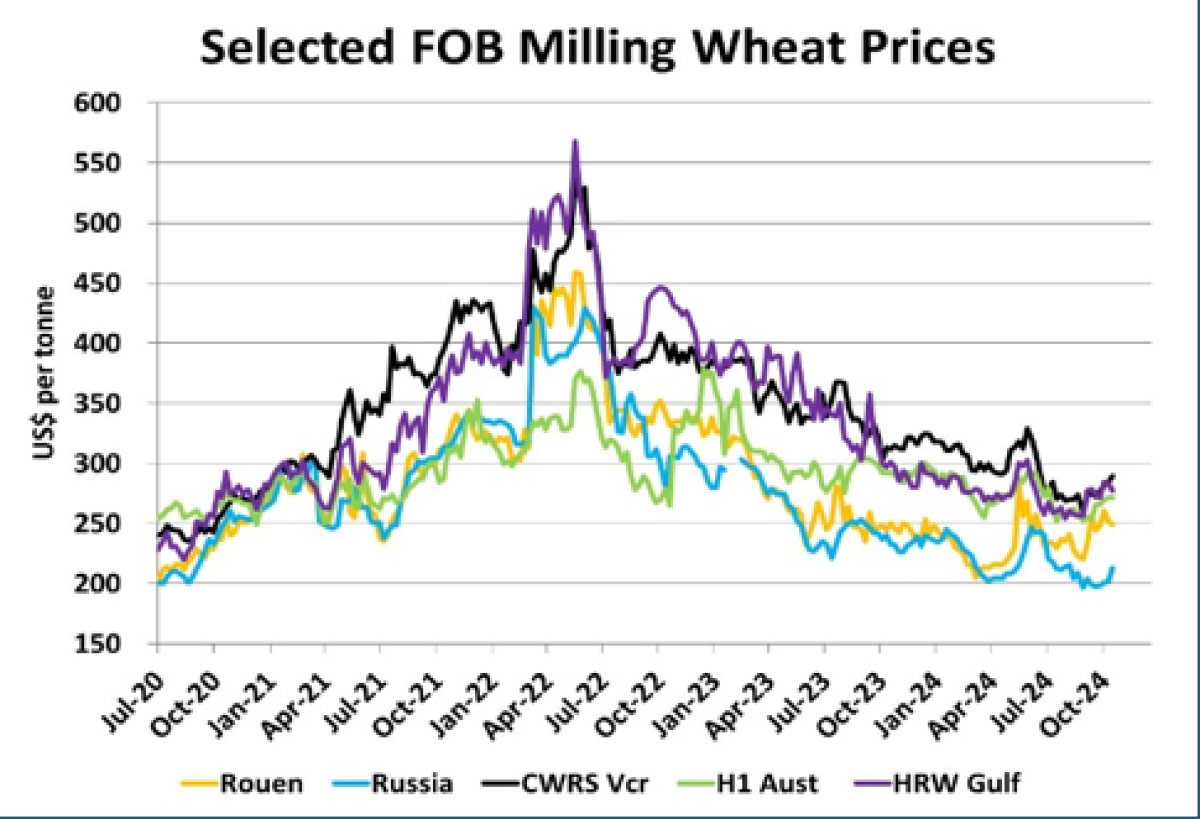

- World wheat prices have been steady-to-firmer across most key geographies in recent weeks. Of note is some appreciation of Russian values as they look to set a minimum price for international tenders. While it’s still uncertain how exactly that may play out, any increase in Russian prices or slowdown in shipments is supportive for global markets.

Bottom Line:

- The recent strength in futures markets was largely driven by fund short covering and dryness in the Black Sea region. Both of those have largely run their course, triggering a pullback and potentially setting up for a period of rangebound trade.

- Western Canadian prices should be helped by good export demand, which could also be supportive for basis levels.

- Unless there are renewed threats to the Australian and Argentine crops, or increased early concerns about 2025 Northern Hemisphere production, any upside potential is likely to be relatively moderate.

Barley outlook

Upside:

- Barley production among major exporters is down in 2024/25, and smaller corn crops in some of those countries also mean less export availability.

- Canadian barley exports are off to a strong start in 2024/25 with firm demand expected from China.

- Alberta Ag reported 26% of the 2024 crop as malt quality, on the snug side for maltsters and exporters.

Downside:

- A weak US corn market is acting as a ceiling for Alberta feed barley prices as corn imports from the US are readily available.

- More thin but high-protein wheat and durum will compete in the domestic feed market.

Key Notes:

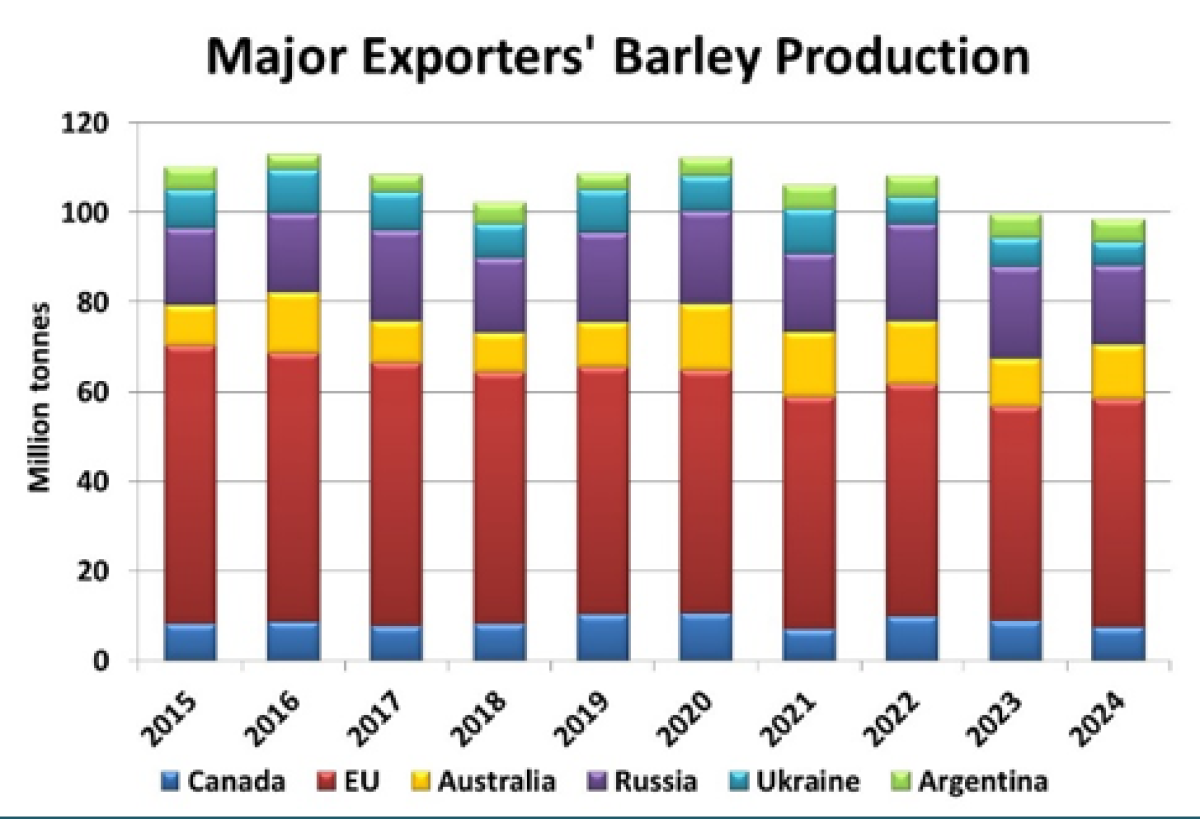

- While the global barley crop is up slightly in 2024, the USDA is showing a 1.0 mln tonne decline among major exporters, the lowest production since 2012. Just as important, several of these exporters, including the EU, Russia and Ukraine are facing smaller corn crops, which mean more feed barley will be needed within their own borders and less will be available for exports. This could be one of the factors supporting the strong start to Canada’s 2024/25 export program.

- Canadian barley exports were 119,000 tonnes in August, well above average, with the CGC showing large totals for September as well.

- Reports indicate barley inventories at Chinese ports have dropped below 1.0 mln tonnes for the first time since mid-February. While new-crop arrivals will raise inventories again, the drawdown in stocks is an encouraging signal of strong Chinese barley usage.

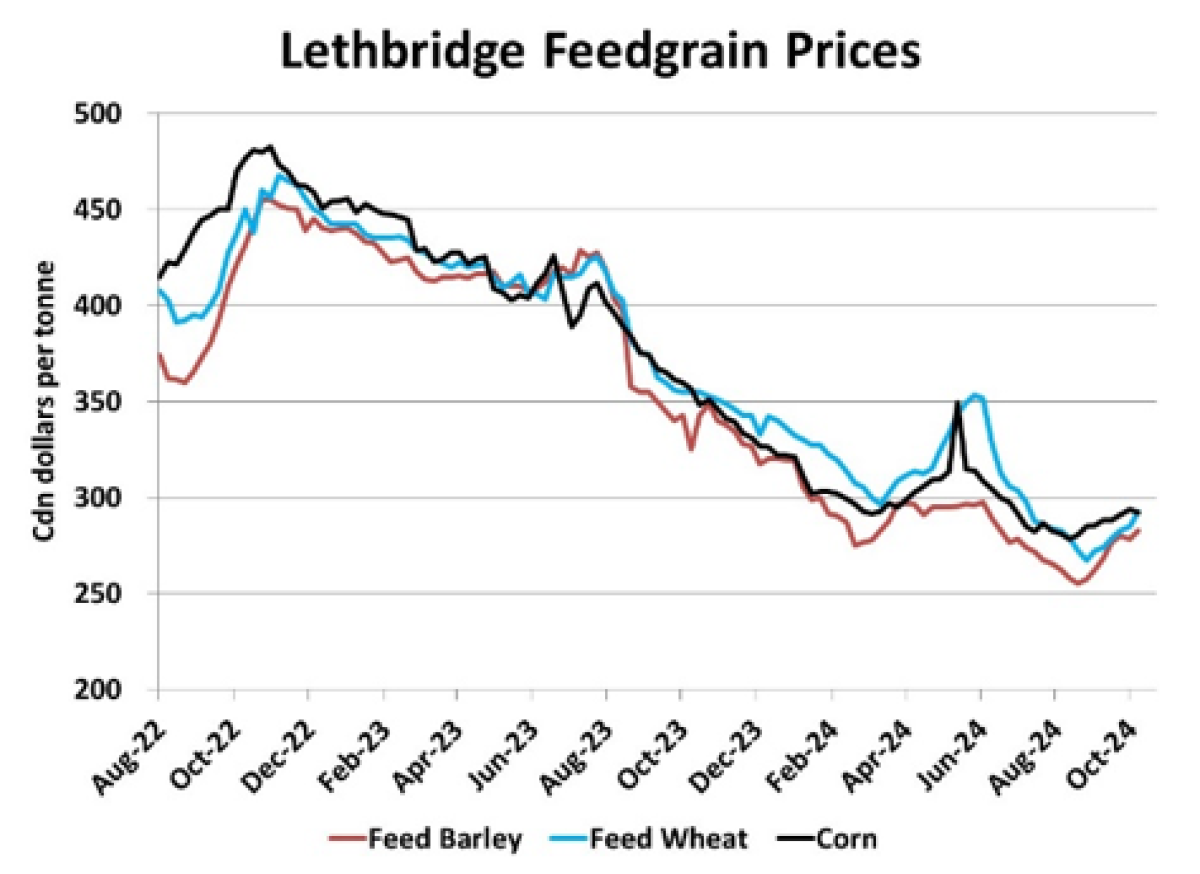

- Feed barley prices in the key Lethbridge market rebounded sharply in the first half of September, gaining nearly $30 per tonne from the lows. Since then however, the upward momentum has faded a bit as barley is now running up against corn prices, reflecting the free flow of feedgrains across the border. This indicates that for feed barley prices to rise further, the US corn market needs to recover from its current weakness.

Bottom Line:

- t’s still early, but it looks like the export channel is going to be the stronger performer in the 2024/25 Canadian barley market. Even if China’s total demand is flat, Canada should get a larger piece of the pie. Strong exports would mean elevator barley bids will be more competitive than usual with feeders in 2024/25.

- Corn prices in the US will keep a lid on Canadian feed values, with more substitution possible.

- Seasonal price patterns suggest there’s more upside potential now that harvest is complete. The fall peak tends to occur in early December, with a higher peak in mid-May.

Durum Outlook

Upside:

- StatsCan will likely trim its durum production estimate in the future, currently at a large 6.0 mln tonnes.

- So far, Türkiye is not exporting durum aggressively, but that does remain a risk to the outlook.

- Exports seem to be warming up more recently, causing elevator bids to strengthen.

Downside:

- The USDA is forecasting a 35% increase in the US durum crop, which could mean less imports and more export competition in 2024/25.

- Prices for Canadian durum in Italy risen more sharply than domestic durum and could become uncompetitive.

Key Notes:

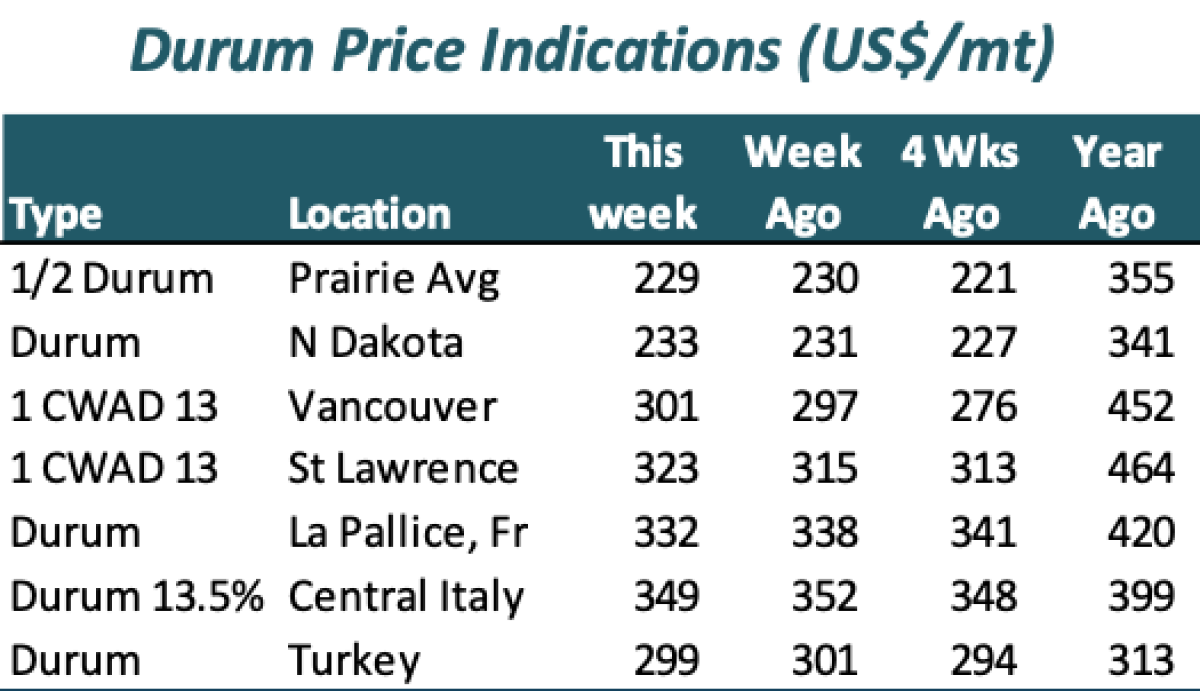

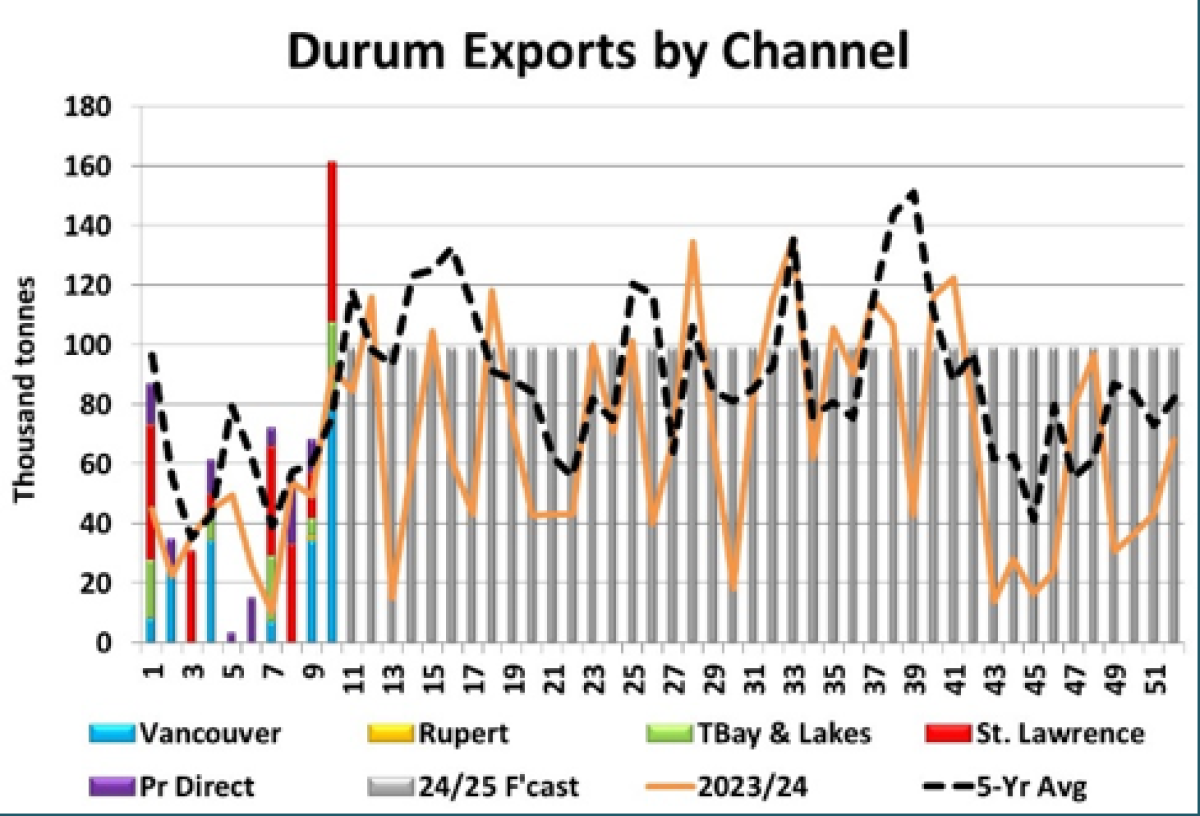

- Through the first few weeks of 2024/25, Canadian durum exports have been lackluster, but that changed in shipping week 10 with 162,000 tonnes exported. That was the largest total since April 2023 and included sizable shipments through the St. Lawrence and Thunder Bay. This direction suggests an increase in exports to the EU, which is critical for the Canadian outlook. The European Commission is forecasting record durum imports in 2024/25, but volumes have been quiet so far.

Bottom Line:

- Canadian durum bids have shown meaningful gains in the last few weeks, which has likely triggered more selling. These stronger prices are positive signs of more export movement ahead.

- The seasonal highs for durum tend to show up in mid-November but it’s not clear if 2024/25 will hold to that pattern due to large uncertainty for exports. There are still some risks in the market, including the possible return of Türkiye as an exporter. If it doesn’t reenter the market, the pull on Canadian durum will be strong.