November 2024

There may be upside potential into later winter and spring as Black Sea supplies get drawn down and attention shifts to 2025 production. But that will require patience, and for now the path of least resistance may be sideways-to-lower.

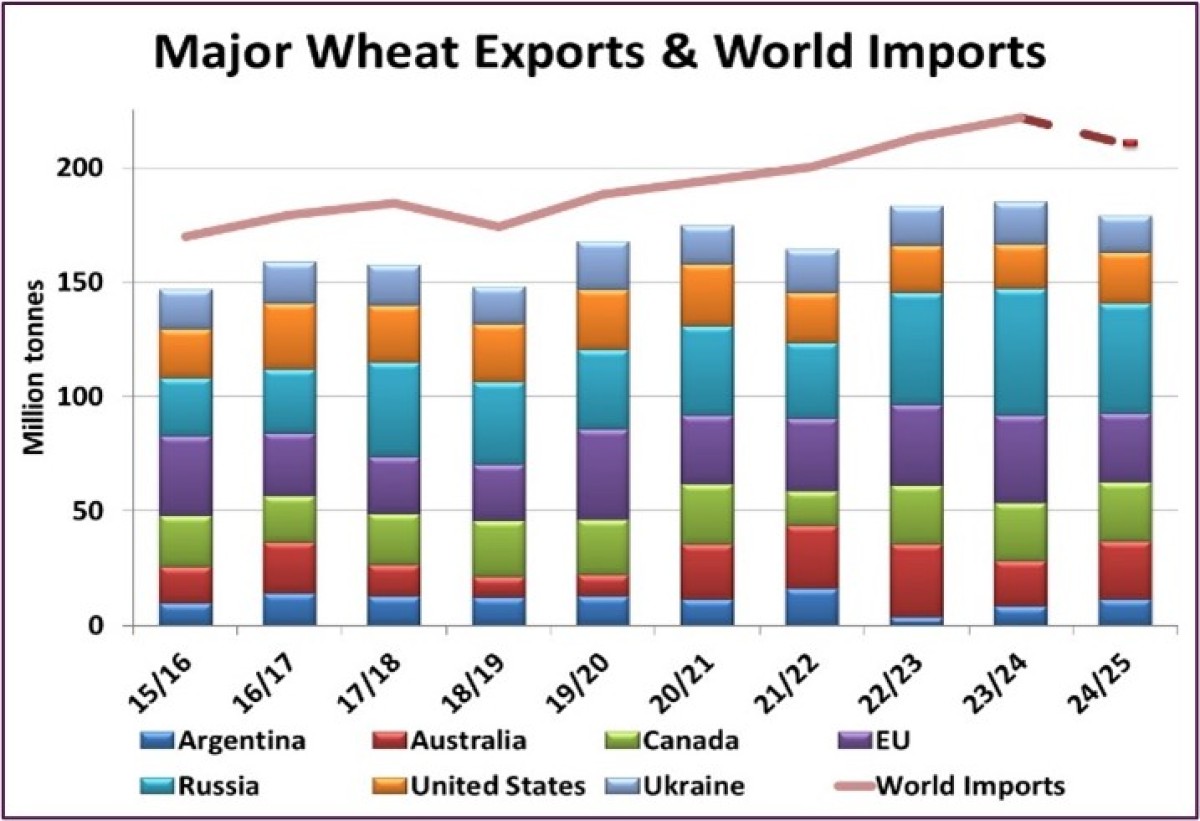

Wheat Outlook

Upside:

- CGC is showing exports continuing to run at a robust pace, while farmer deliveries have also been strong. This is supporting western Canadian basis levels.

- Stocks are tight across the major exporters in aggregate, leaving little room for hiccups to 2025 production.

Downside:

- Russian wheat continues to be aggressively priced.

- The US carryout will be the largest in four years in 2024/25, including for hard red spring wheat.

- Global import demand will be lower this year.

- There is a seasonal tendency for spring wheat prices to soften into the end of the calendar year.

Key Notes:

- Global wheat stocks are relatively tight across the major exporters in aggregate when looking at projected carryouts. However, import demand may also be down, with USDA anticipating world trade to be nearly 12 mln tonnes lower in 2024/25, to 210 mln. In other words, supply is smaller, but against a lower demand base.

- StatsCan will provide an updated production estimate on December 5th. Some are projecting spring wheat production to be higher than in the last report, although that won’t be known until the numbers are out. StatsCan tends to make revisions well after this ‘final’ estimate.

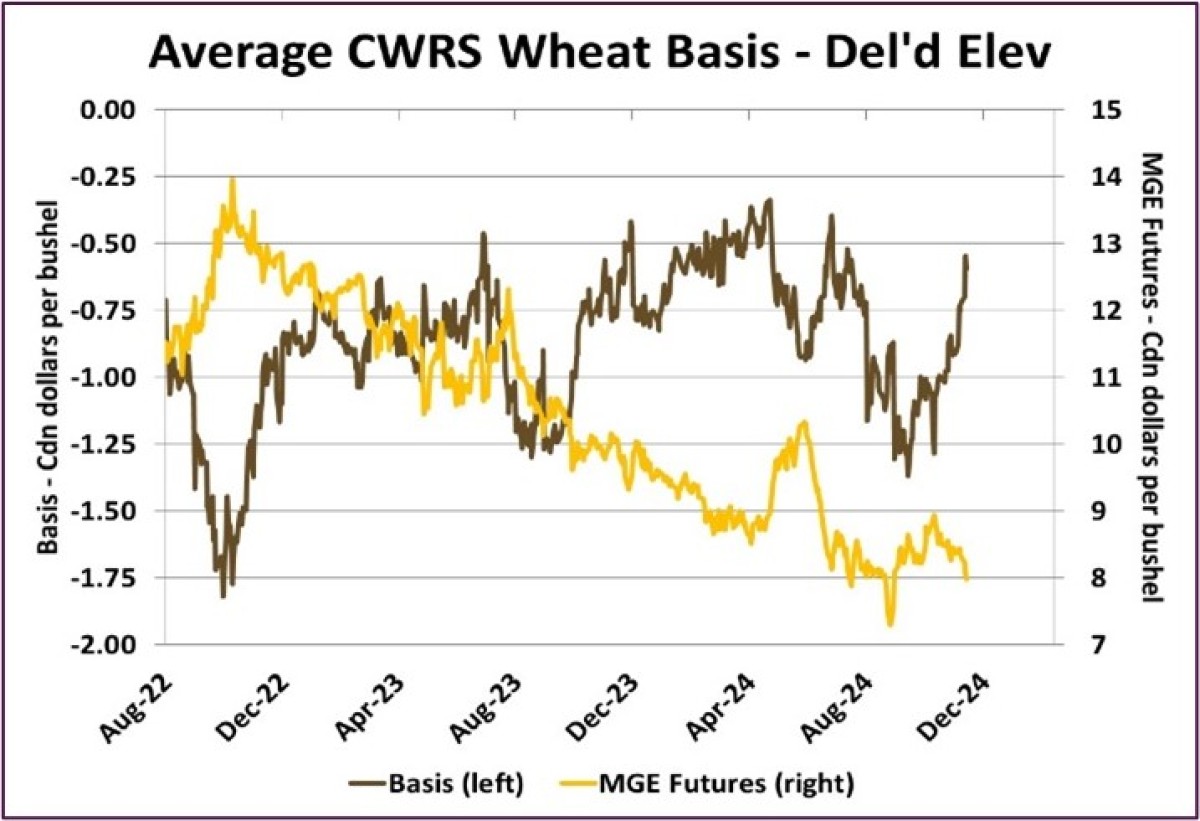

- CWRS basis levels have continued to improve coming out of harvest. Strengthening basis levels can be expected not just from a seasonal perspective, but also due to the strong export pull and as futures markets have been grinding sideways-to-lower. Many farms are generally in a position to be patient on making further sales, which is also supportive for basis levels.

Bottom Line:

- Somewhat soft global import demand and aggressive Russian shipments are more than offsetting the relatively tight stocks situations across the major exporters in aggregate, allowing futures prices and world cash markets to remain lackluster.

- There may be upside potential into later winter and spring as Black Sea supplies get drawn down and attention shifts to 2025 production. But that will require patience, and for now the path of least resistance may be sideways-to-lower.

- Prairie CWRS bids may be partially buffered from a softer futures market by strong exports and a soft Canadian dollar.

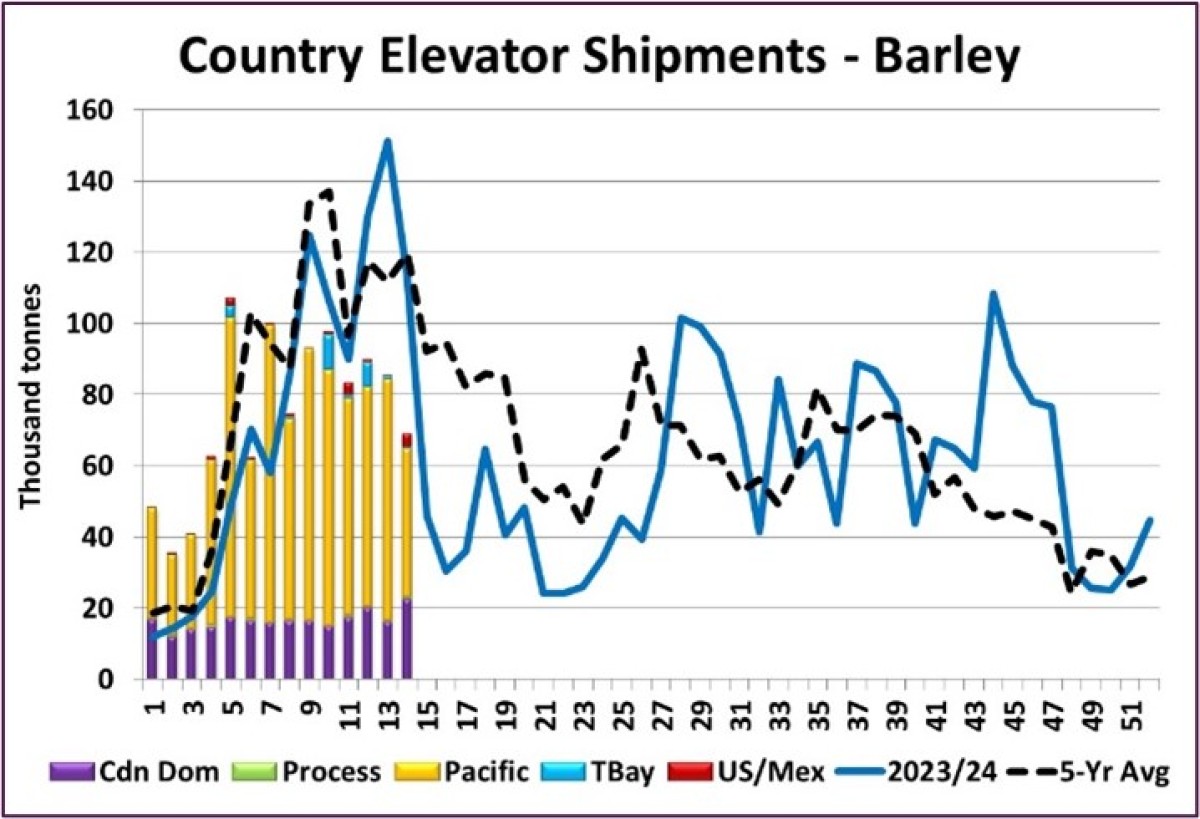

Barley Outlook

Upside:

- The 2024 EU barley crop is down slightly from last year and 2025 acreage is projected to decline.

- Barley prices at Australia's west coast are firming up, even in the midst of a large harvest

- A weaker loonie is making Canadian barley more competitive in world markets, while also increasing the cost of US corn imports.

Downside:

- Movement of barley through the Canadian handling system has been lackluster in recent weeks.

- Barley inventories at Chinese port warehouses aren't showing signs of large new-crop imports.

- Low barley prices in the US are discouraging Canadian barley from moving south.

Key Notes:

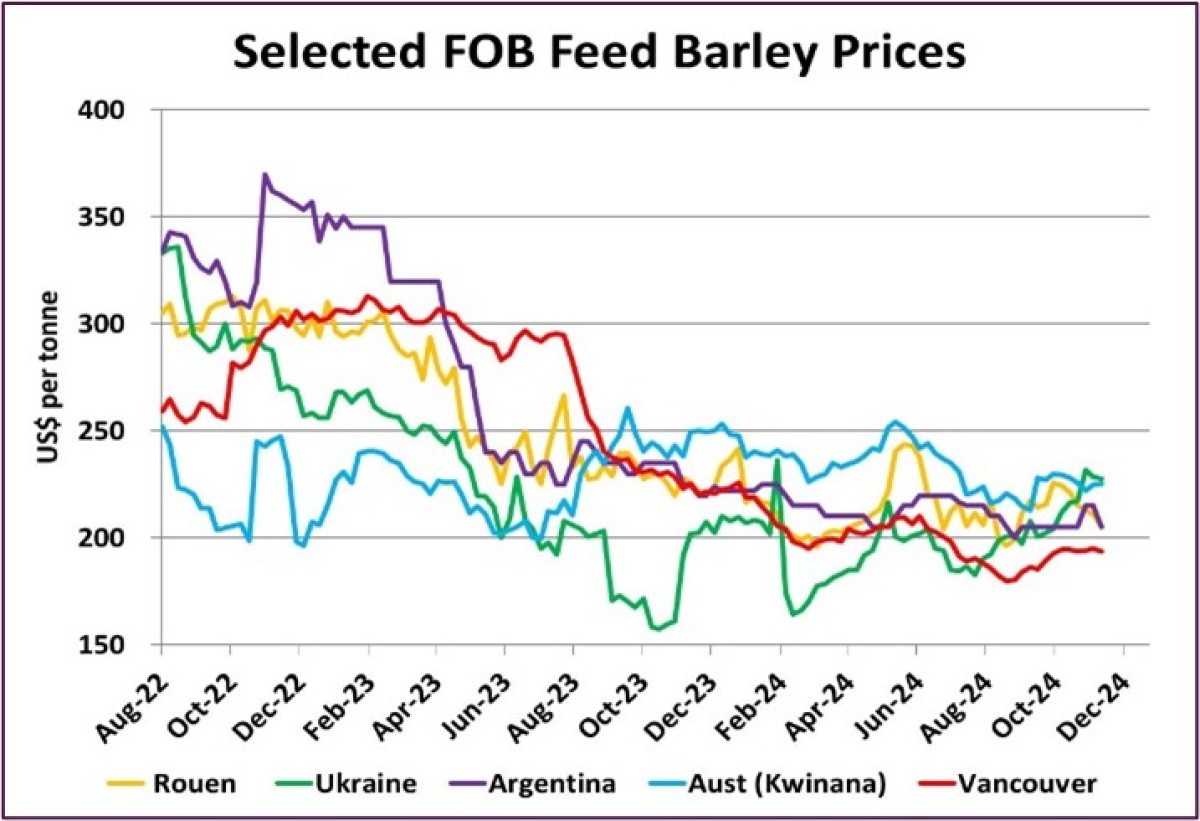

- Shipments of barley out of country elevators have been steady but not spectacular for most of the fall months. In the last few weeks, shipments are running below last year and average. Farmer deliveries show a similar mediocre pattern. Stocks at Vancouver terminals rose in the past two weeks, which means exports may see a short-term bump, but the medium-term pace could remain subdued. Through the first quarter of 2024/25, exports were 578,000 tonnes, up from last year but trailing the 5-year average of 693,000 tonnes.

- China’s imports are being watched closely as this is Canada’s primary export destination. Low wheat and corn imports in recent months raise concerns about overall grains import demand, and if that could spill over to barley.

- While barley prices in most major origins have generally been going sideways, Ukrainian barley has been rallying strongly and is now at a premium to other sources. After spending most of 2022/23 in a premium position and 2023/24 in line with other origins, Canadian feed barley at the west coast is now the lowest FOB price among major exporters. This price level should make Canadian barley more attractive to Chinese buyers, especially with Ukrainian barley less competitive.

Bottom Line:

- Canadian barley exports have not been moving at a pace to trigger much higher bids.

- Feed barley prices in western Canada have been edging higher, but most of that strength is coming from a weaker loonie that makes imported US corn more expensive.

- From a seasonal perspective, there should be more strength later in the marketing year and demand from China will have a large influence on those potential gains.

- Malt barley trade is very quiet with no meaningful price movement.

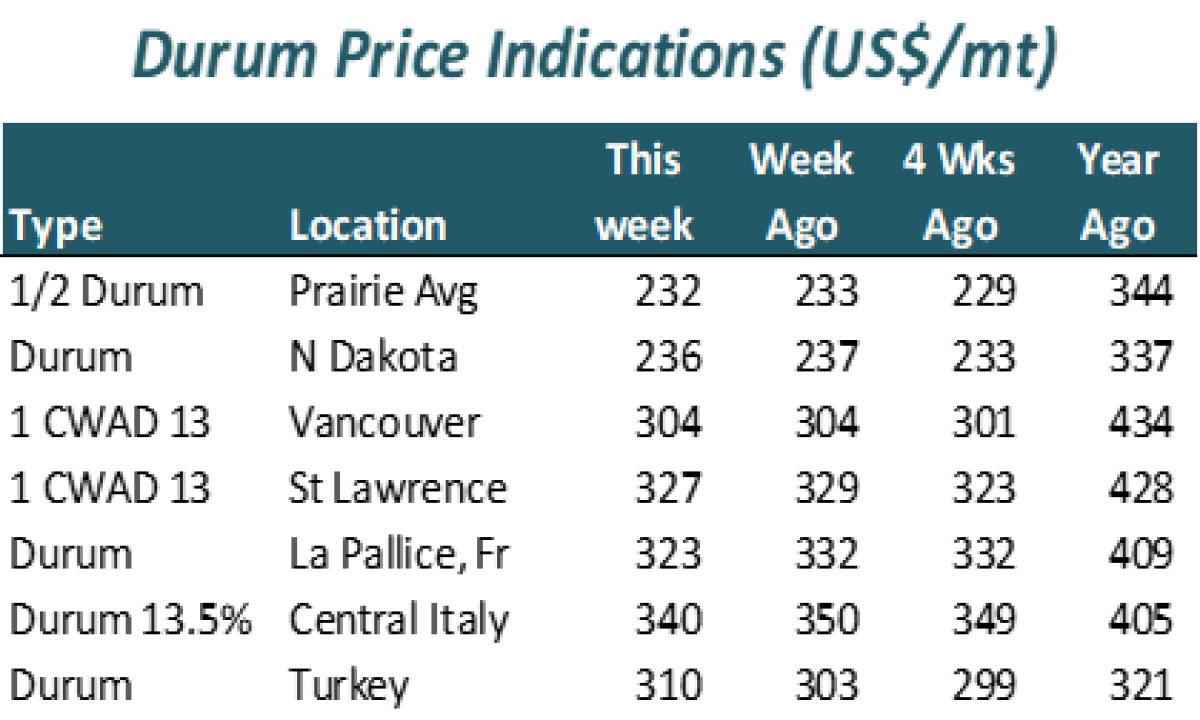

Durum Outlook

Upside:

- Canadian durum has been moving at a good clip in recent weeks, with exports pulling ahead of the average pace.

- European durum production is up slightly from last year but 2025 acreage is projected to dip a few percent.

Downside:

- USDA raised its 2024/25 US ending stocks estimate by cutting the export forecast.

- Durum production in Kazakhstan is reported to be up considerably from last year's low point.

- North African has received some meaningful rain, improving early crop prospects.

Key Notes:

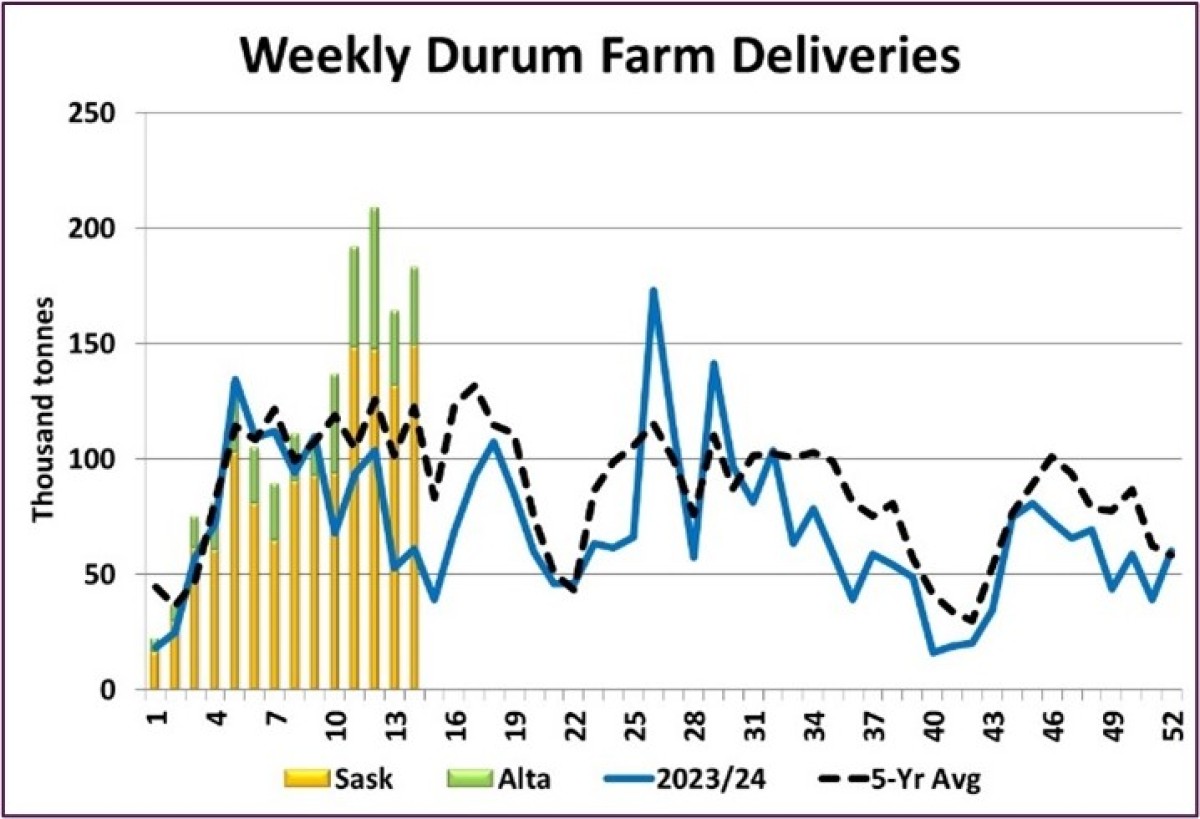

- The pace of durum moving into the elevator system has picked up sharply in recent weeks, going from average levels to well above average. Farmer deliveries are the first indicator of export movement, and CGC data shows shipments have improved. Terminal stocks also point to more exports in the weeks ahead, including a build in Thunder Bay, suggesting Europe as a key destination. While European durum imports have been quiet through the first few months of 2024/25, these signals from the weekly CGC data suggest considerably larger volumes will start to arrive in Europe shortly.

Bottom Line:

- Even though Canadian durum is moving well, bids here haven’t been showing any meaningful movement lately as farmer selling has kept up with the export pace.

- Despite concerns about European supply levels, prices in Italy are stagnant as buyers there wait for Canadian (and other) durum to arrive. If European prices start to move materially higher, this increases the potential for Turkish durum to enter the market

- From a strictly seasonal perspective, it doesn’t look like there’s an opportunity for much more price upside. Canadian supplies will be drawn down later in 2024/25, but there may not be much of a rally without another problem in North Africa.