January 2025

Wheat Outlook

Upside:

- StatsCan showed strong November exports of 1.9 mln tonnes, and good movement all season is casuing on-farm tocks to dwindle.

- US wheat is becoming more competitive in global markets, which may help export sales.

- World supplies are on the tighter side going into the next growing season, while wheat losing some value to corn could result in a bump in livestock feed consumption.

Downside:

- World markets are being adequatley supplied as the expected slowdown in Russia shipments get partially offset by the Australian and Argentine harvests.

- Global import demand has been a bit soft overall, with China takng notably lower volumes.

- USDA showed larger winter wheat plantings than expected for the 2025 growing season.

Key Notes:

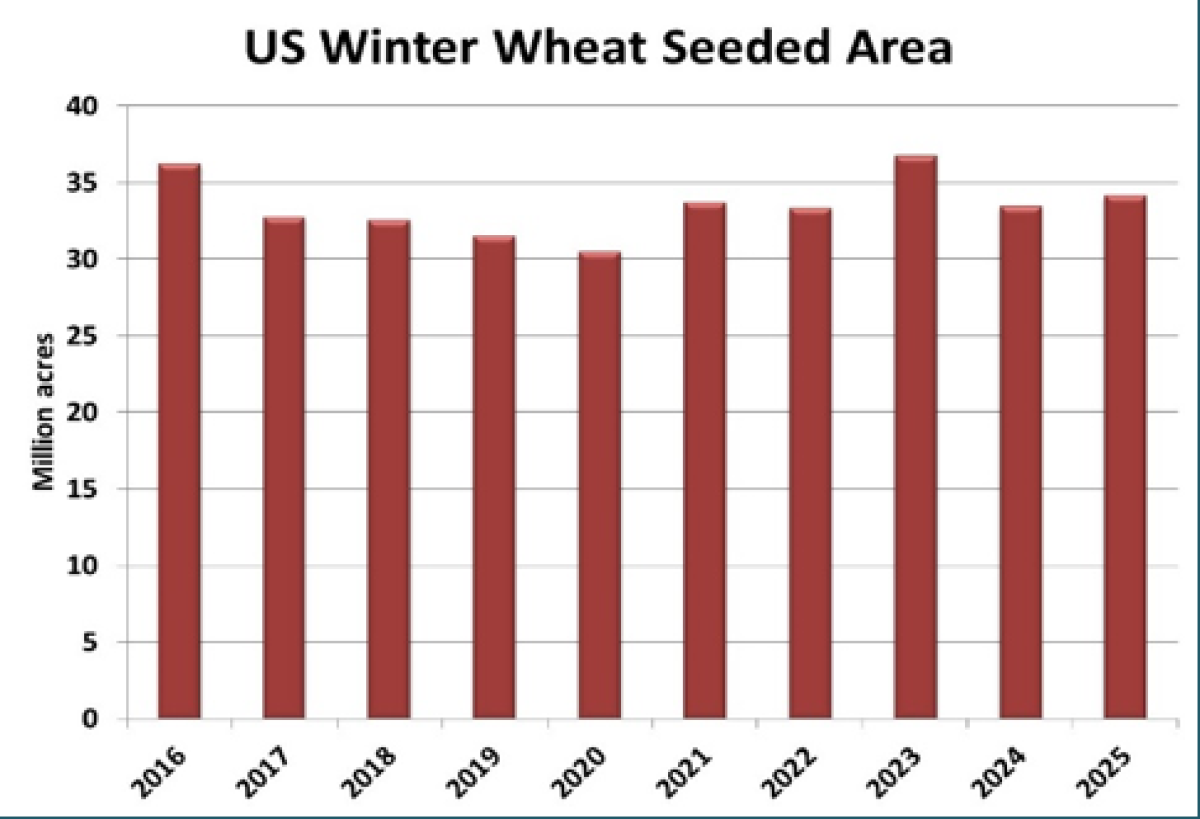

- USDA showed winter wheat seeded area for the 2025/2026 season at 34.1 mln acres, the second highest since 2016 and just above pre-report guesses. Weather in spring and summer will ultimately determine crop size, but an average abandonment rate and yield means this could add close to 1 mln tonnes of production in the US next season.

- CGC data showed visible supplies in week 22 at 2.3 mln tonnes, compared to 2.7 mln last year and for the 5-year average. On-farm stocks are declining as deliveries have kept pace with 2023/24 even as total supplies are lower.

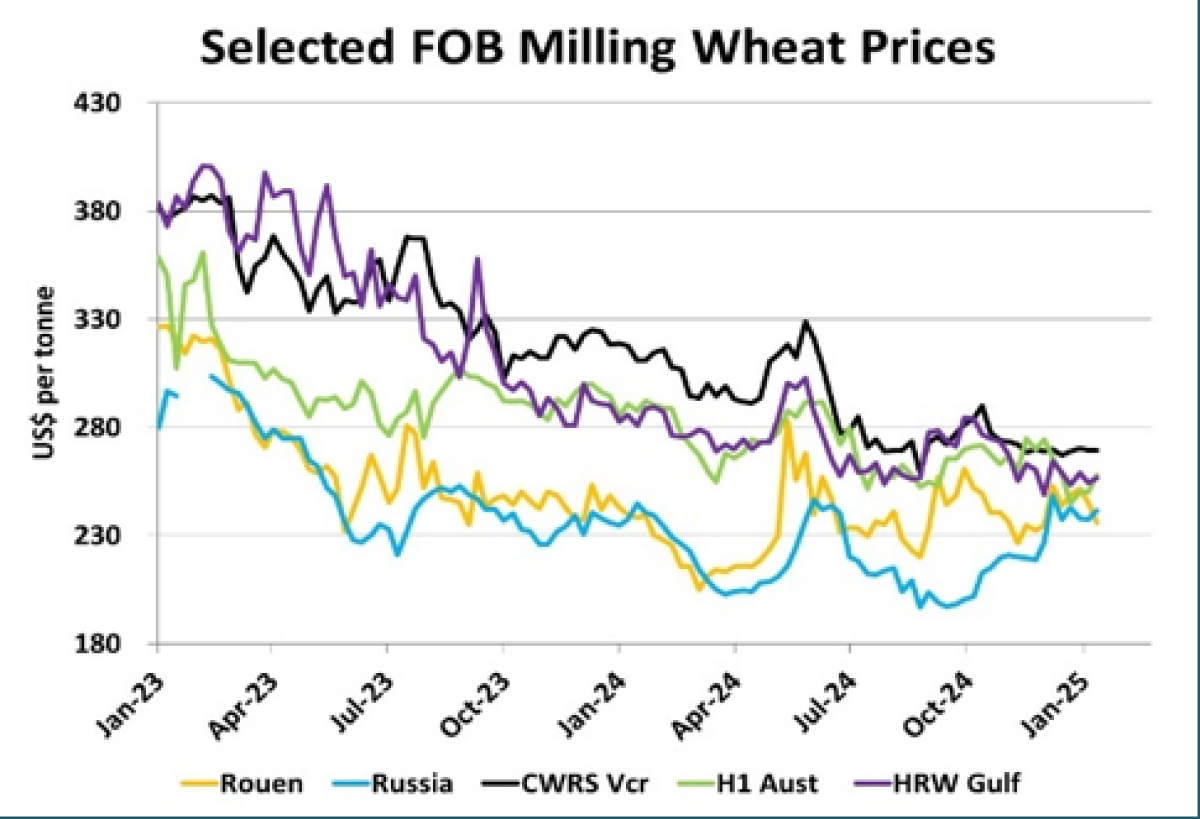

- Global wheat prices have been drifting sideways-to-lower across most key exporting countries. Russian prices are off the fall lows as export volumes will slow going forward. A strong US dollar hurts their competitiveness, but this is being offset by a lackluster futures market, which is resulting in a narrowing of the US price premium. A good harvest out of Australia and Argentina and soft global import demand may keep prices in a range, with potential for some firming into spring, particularly if there are any weather threats going into the Northern Hemisphere growing season.

Bottom Line:

- Prices have largely been trading in a range, both for futures markets and global cash values.

- Good Canadian export volumes are drawing down supplies, which is supportive for local values.

- There is a tendency for prices to firm into later winter and spring, although Northern Hemisphere weather will be the largest influence in the coming months.

Barley Outlook

Upside:

- A stronger corn futures market and soft Canadian dollar is increasing the cost of imported US corn.

- Low barley prices in the US could result in another decline for seeded area in 2025

Downside:

- Canadian exports in November were 305,000 tonnes, below the average for the month.

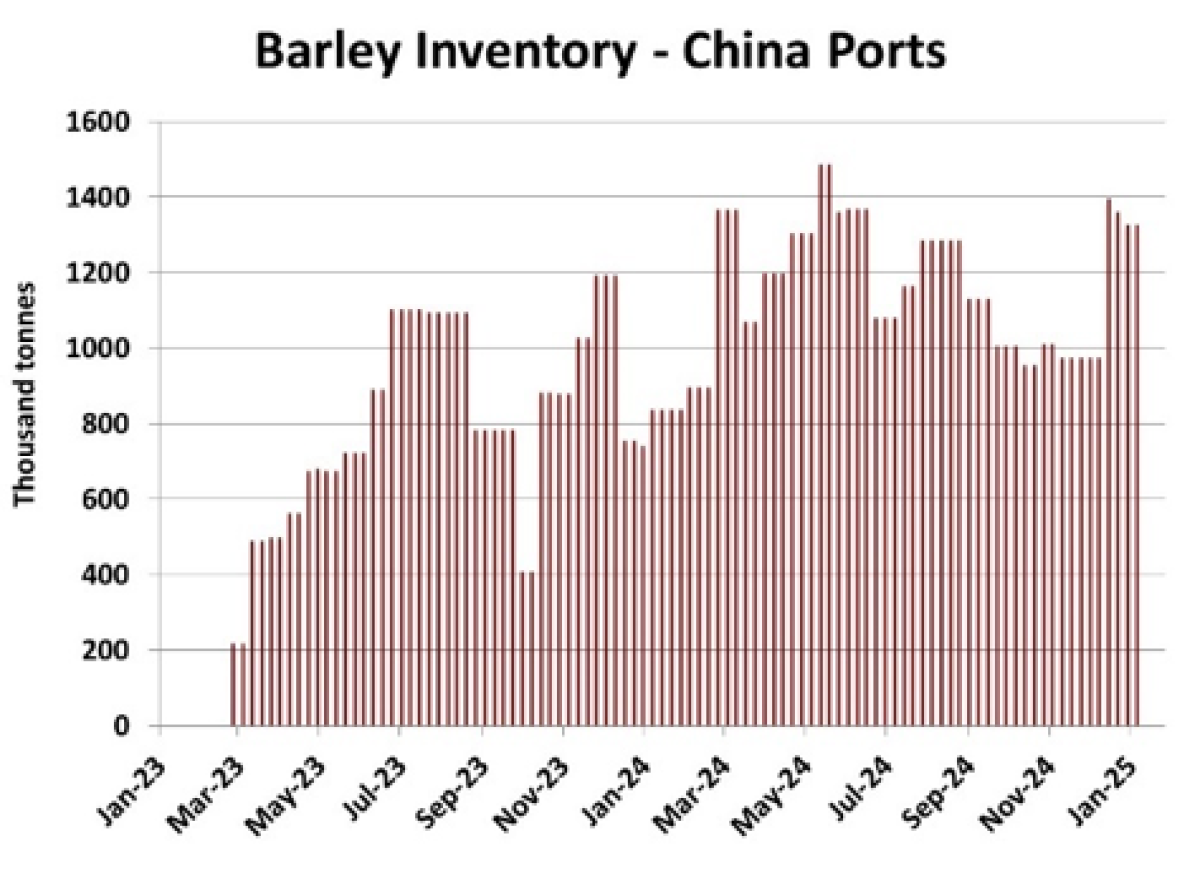

- Barley inventories at Chinese ports jumped in December and are close to record highs.

- Australia is exporting large volumes, including to China.

- Malt barley bids have been quiet due to weaker domestic demand.

Key Notes:

- The spike in Chinese barley port inventories suggest imports have bounced back in December from the lower total in November. At the same time, barley demand from the Chinese feed sector is quieter. Despite very low Chinese corn imports in recent months, its domestic corn prices are at multiyear lows and have dropped below barley, likely a reflection of the larger Chinese corn crop. These large barley inventories and low corn prices suggest Chinese barley imports will be more modest in the coming months.

- The latest USDA report showed a larger drop in corn production than expected, which in turn tightened up the 2024/25 carryout forecast. This has pushed futures prices up to their highest level since early summer, which is supportive for the entire feed grain complex.

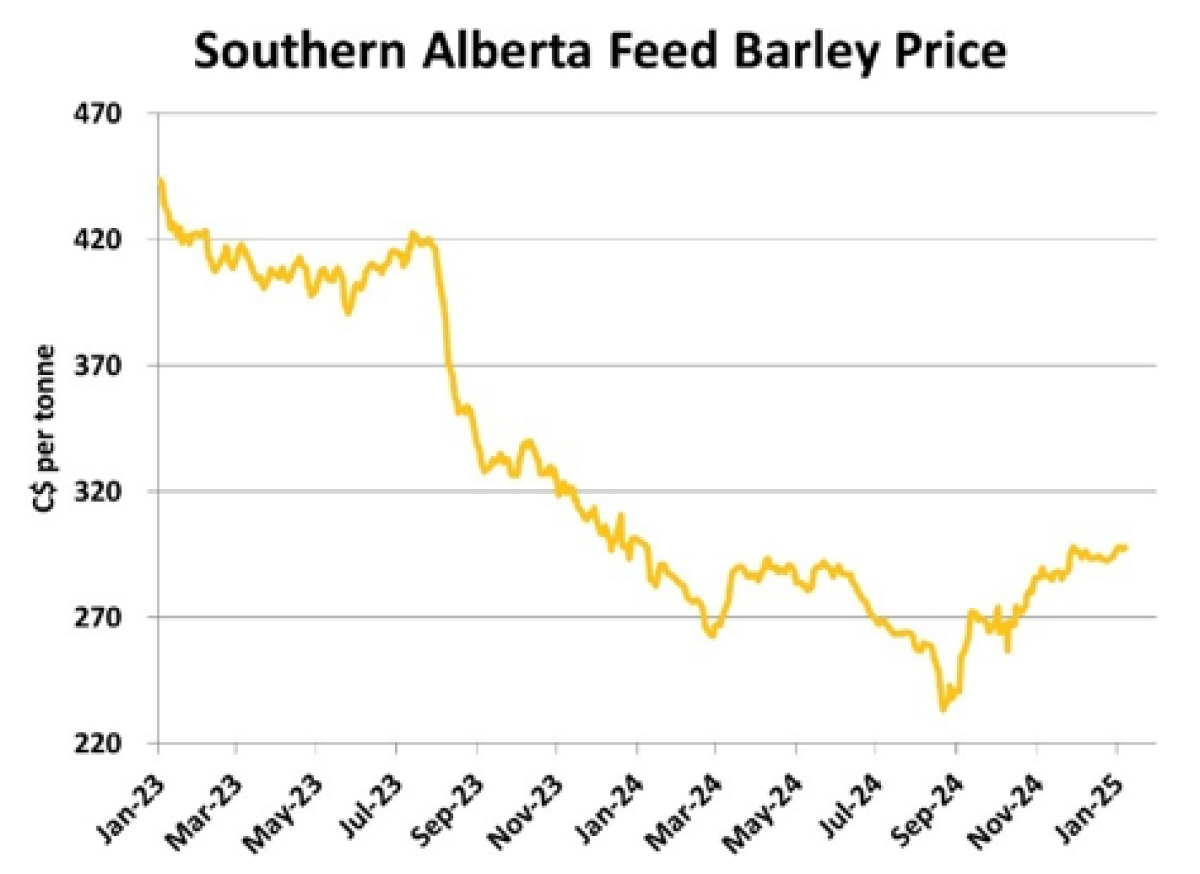

- After rising through the fall and early winter, barley prices in the benchmark southern Alberta region have been moving sideways since mid-December. For the most part, this leveling off is consistent with seasonal tendencies for this time of year with flat direction typically lasting until late February before prices start to rise seasonally into summer. Without any unusual supply or demand developments on the horizon for 2024/25 for barley, specifically, tracking the seasonal pattern is the most likely direction unless corn continues to rally sharply.

Bottom Line:

- There are some signs of modest strength in global barley markets, particularly in Europe and Ukraine although prices in China, the dominant export market are still mostly flat.

- Softer barley demand from China is a concern for the outlook, although Canadian barley is priced competitively and should maintain a good share of the Chinese market.

- Feed barley should also receive support from the domestic market as corn futures continue to trend higher and the loonie remains weak.

Durum Outlook

Upside:

- Canadian durum exports were strong in November, and CGC data points to the December total being even higher.

- CGC is also showing above average farmer deliveries, which is drawing down on-farm stocks at a quicker pace.

- Mexico’s 2025 durum crop estimate has been slashed, taking them out of the export market.

- Morocco imported 140,000 tonnes of durum in October, raising the possibility of a record total in 2024/25.

Downside:

- Durum bids in western Canada have remained flat and haven’t benefitted from the recent weakness in the loonie, despite the strong exports. Seasonally, prices tend to move lower at this time of year.

- Exports to the US could drop if tariffs are imposed.

Key Notes:

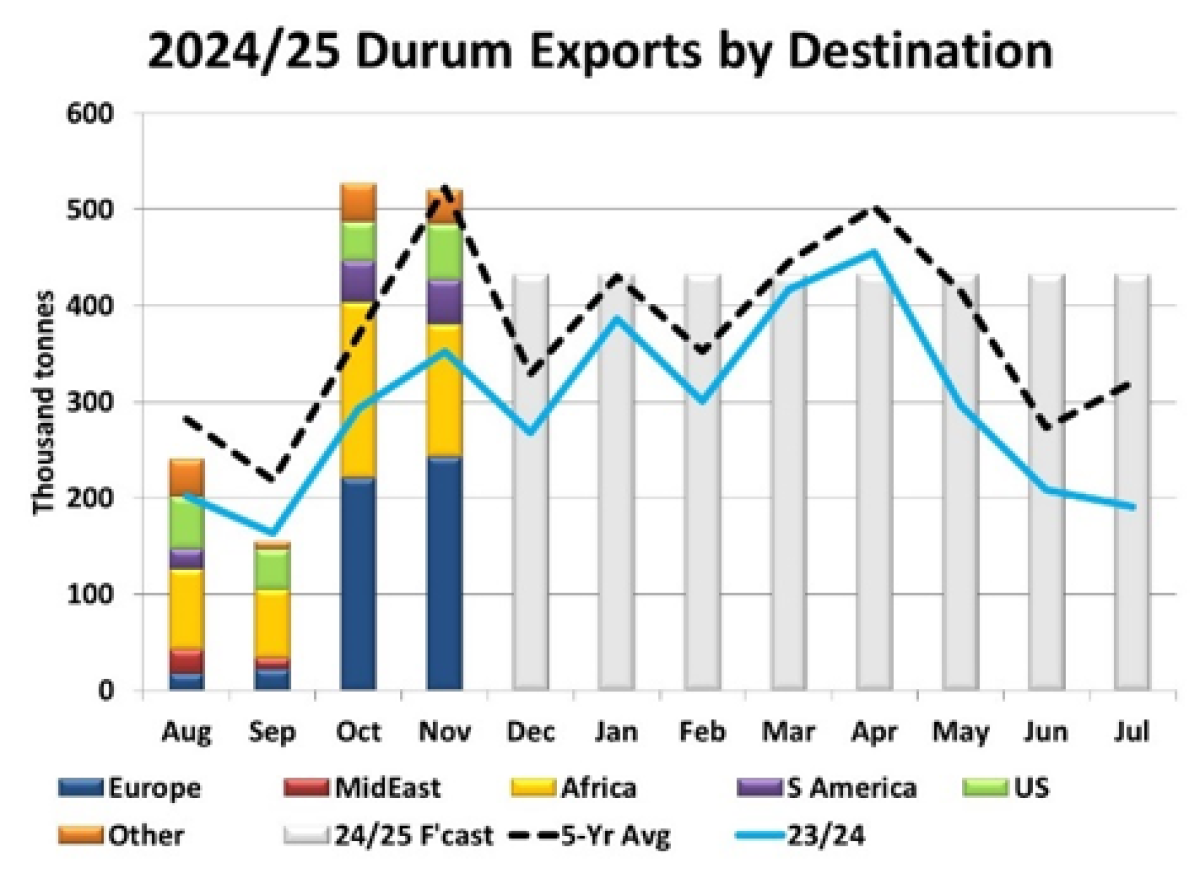

- Canadian durum exports were solid again in November at 520,000 tonnes, in line with the 5-year average and well ahead of last year. Italy was the largest destination at 171,000 tonnes, followed by Spain and Morocco, both around 65,000 tonnes and Algeria and the US at 59,000 tonnes each. This brings the year-to-date pace to 1.44 mln tonnes, far better than last year and slightly ahead of the 5-year average. The CGC weekly data shows the December total will be considerably higher yet. We’ve bumped up our full-year export forecast to 4.9 mln tonnes, which would require a monthly average for the rest of the year of 430,000 tonnes. This revised export target means 2024/25 ending stocks will be drawn down to a low level again.

Bottom Line:

- So far, the strong pace of Canadian exports and the drawdown in on-farm supplies isn’t causing a response in durum bids, and the weaker Canadian dollar hasn’t provided any support either, despite some positive fundamental factors.

- As long as European prices remain flat, it will be difficult for Canadian bids to strengthen significantly.

- Export demand will remain strong, and there that may be room for some gains despite the seasonal tendency for prices to decline as Canadian durum supplies get worked lower.