February 2025

Wheat Outlook

Upside:

- StatsCan showed December 31st non-durum wheat stocks slightly lower than last year, at 20.8 mln tonnes.

- Global supplies will be tight going into the next harvest, and conditions are vulnerable in some key regions.

- Futures prices are pushing higher, while world cash values have also been firming.

Downside:

- USDA is forecasting global import demand to be down in 2024/25, including a sizeable drop from China.

- US tariffs would slow their imports from Canada.

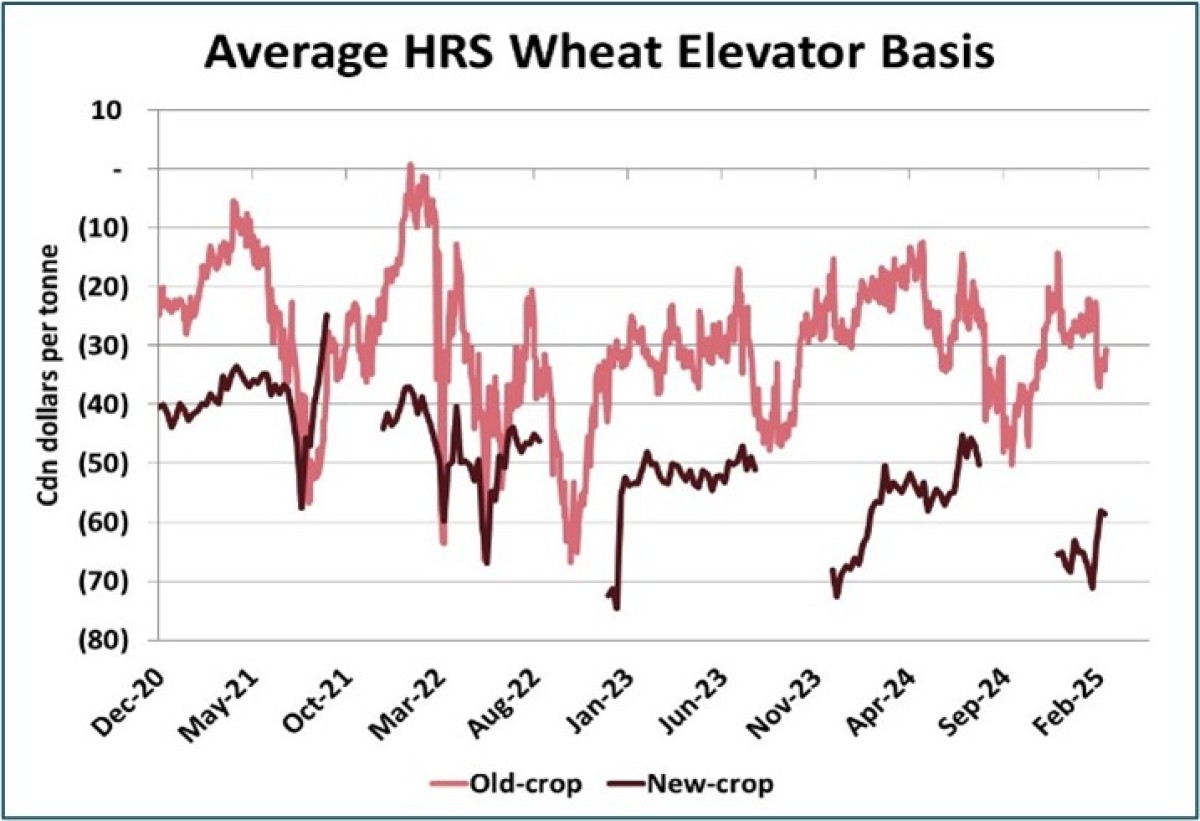

- Prairie hard red spring wheat basis levels have been easing, and fall delivery basis levels are very weak.

Key Notes:

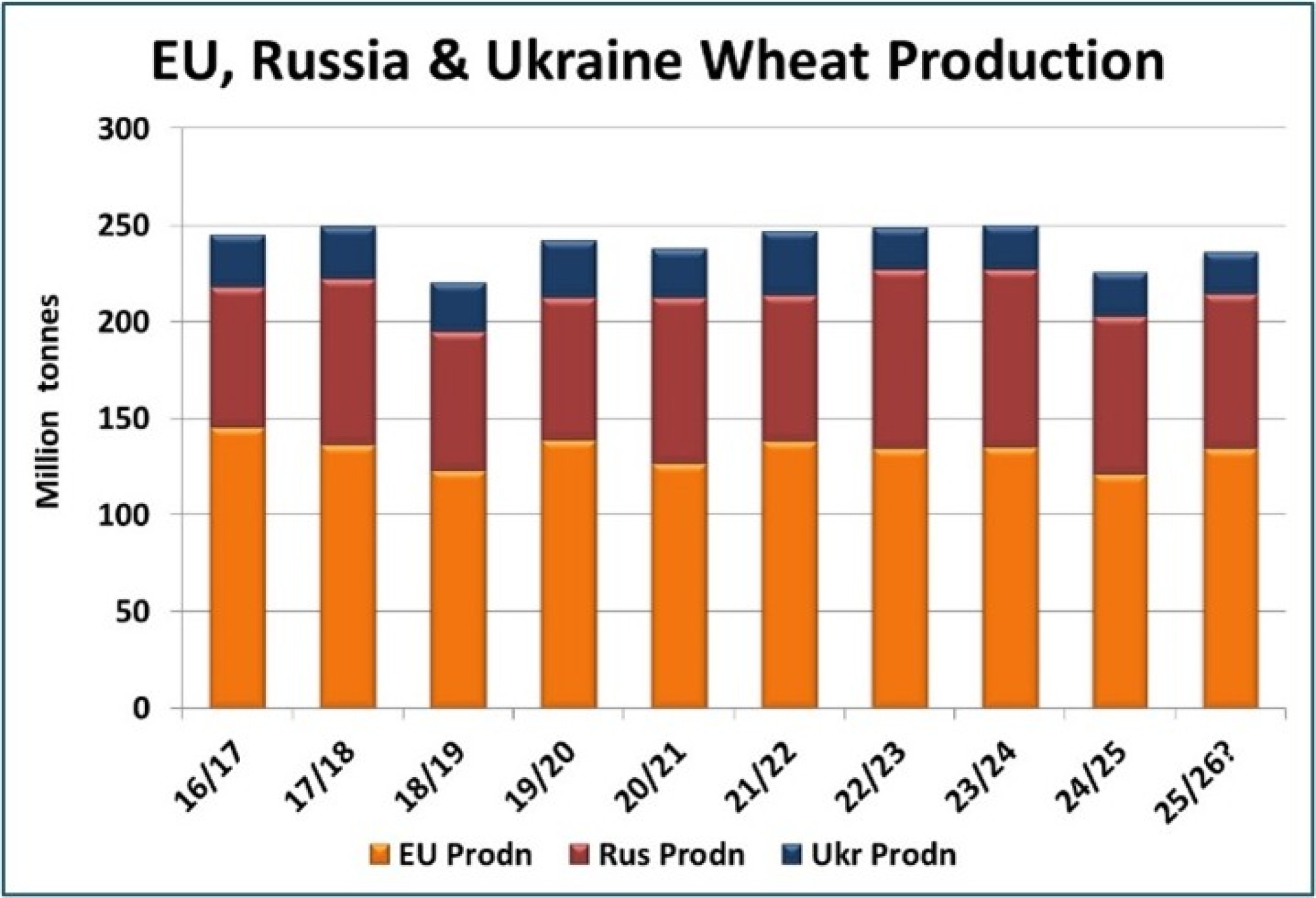

- Indications point to a smaller Russian wheat crop in 2025/26, perhaps near 79 mln tonnes vs 81.5 mln in 2024/25. Ukraine’s production could also be 1 mln tonnes lower. This sets up for tightening stocks in two key global suppliers. However, it’s possible this is more than offset by bigger EU production, with some forecasts close to 135 mln tonnes. Combined production between the three would still be lower than the 2021/22 to 2023/24 seasons, and the critical weather is ahead. But at this early stage we caution against getting too far ahead on smaller Black Sea crops without factoring in the potential for larger production elsewhere.

- While trailing the record pace of 2023/24, Canada’s non-durum wheat exports have been strong this season, at 8.9 mln tonnes through the end of December. This is drawing down on-farm inventories in western Canada, and stocks will be low going into the next harvest.

- The average old-crop CWRS basis level has eased in recent weeks as cash bids have been giving back a portion of the firmness in futures values. This may be hinting at a temporary slowing of export demand, although we don’t anticipate a sharp decline, while tight on-farm stocks tend to be supportive for cash markets. The average new-crop basis level saw improvement in the past two weeks, but remains very weak.

Bottom Line:

- Futures markets have started to move higher. There is the potential for some further technical momentum, helped by fund short-covering.

- Global import demand has been a bit soft, but stocks will be low going into next harvest. This keeps attention focused on regions with potential production issues (Black Sea, EU and the US), setting up for volatile trade.

- Local basis levels have been easing as the futures market strengthened, which is a bit of a cautionary signal.

Barley Outlook

Upside:

- StatsCan reported December 31st barley stocks at 4.96 mln tonnes, 9% below last year and slightly less than the 5-year average.

- Feed barley prices are showing more signs of strength in key exporting countries.

- Corn imports into western Canada are down.

Downside:

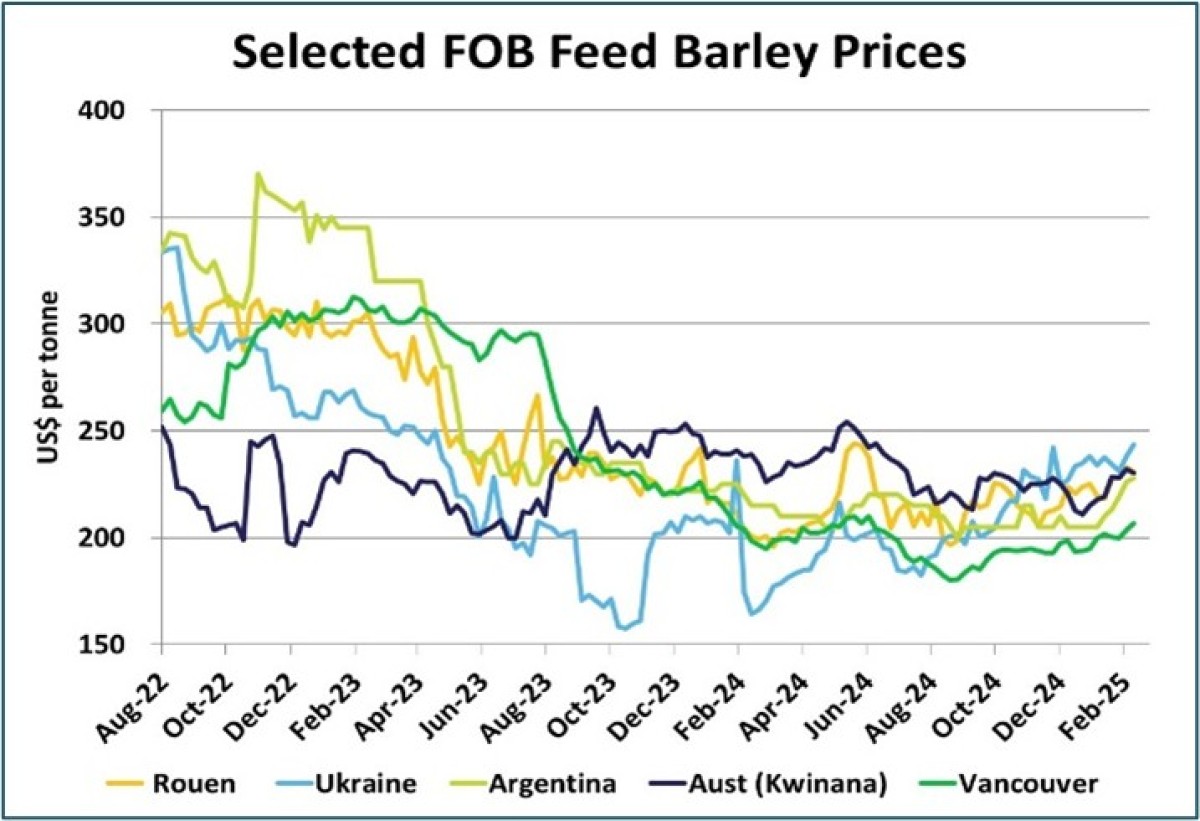

- While Australia’s barley exports slipped in December, a larger 2024/25 crop will ensure they remain competitive in global markets.

Key Notes:

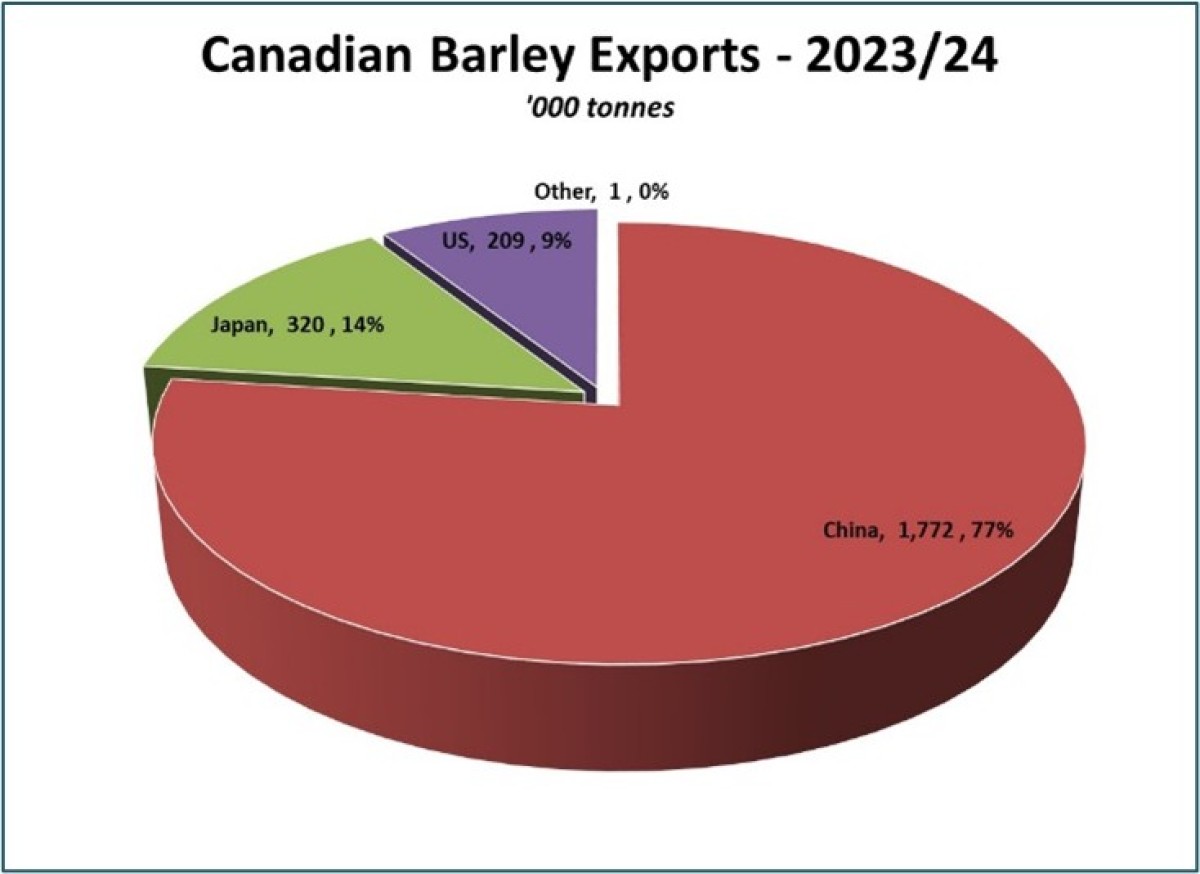

- Canada’s barley exports are dominated by China, followed by Japan. The US was in third place in 2023/24, taking 9% of exports, although that can vary from one year to the next. This makes barley exports somewhat less vulnerable to US tariffs than some other crops. However, over half of Canada’s malt shipments go to the US. Given most of Canada’s malt production gets exported, the impact of tariffs could be significant.

- A weak Canadian dollar and stronger corn futures prices are helping feed barley values in western Canada. There is also a seasonal tendency for the market to firm into the spring. When combined with the potential for decent export movement, the overall setup could be supportive for prairie barley prices in the coming months.

- Feed barley prices in key exporting countries are showing more signs of strength in recent weeks. That’s particularly noticeable in Ukraine, where low supplies are pushing prices into a premium position, in contrast to the more typical discount spot. That low-priced position is now occupied by Canadian barley, which has been helping Canadian exports to some degree but not as much as expected. That said, rising prices in Argentina and Australia should help pull the Canadian export market higher as well.

Bottom Line:

- A stronger corn futures market and weak Canadian dollar have been supportive factors for feed barley. Both have levelled off for now, although there could still be volatility in either direction for both of those markets.

- While the US takes a relatively small share of Canada’s barley exports, they are the largest destination for malt. There are also indirect effects to monitor of potential US import tariffs, including on the livestock industry and corn imports into western Canada.

- Tight global supplies and firming international values are supportive for export movement and domestic prices, particularly if China remains a solid buyer.

Durum Outlook

Upside:

On-farm supplies are getting drawn down quickly in western Canada. StatsCan showed big exports of 766,000 tonnes in December. Even if volumes start to slow, Canadian ending stocks will be tight in 2024/25. Prices have started to turn higher in Italy, with their domestic values now above that for imported Canadian durum. There is also some firming in North African tender prices.

Downside:

- The US is an important export market for Canadian durum, with potential import tariffs putting trade at risk.

- Kazakhstan’s production in 2024 was nearly double the previous year. While exports have been slow so far, this could be another source of supply for global markets.

Key Notes:

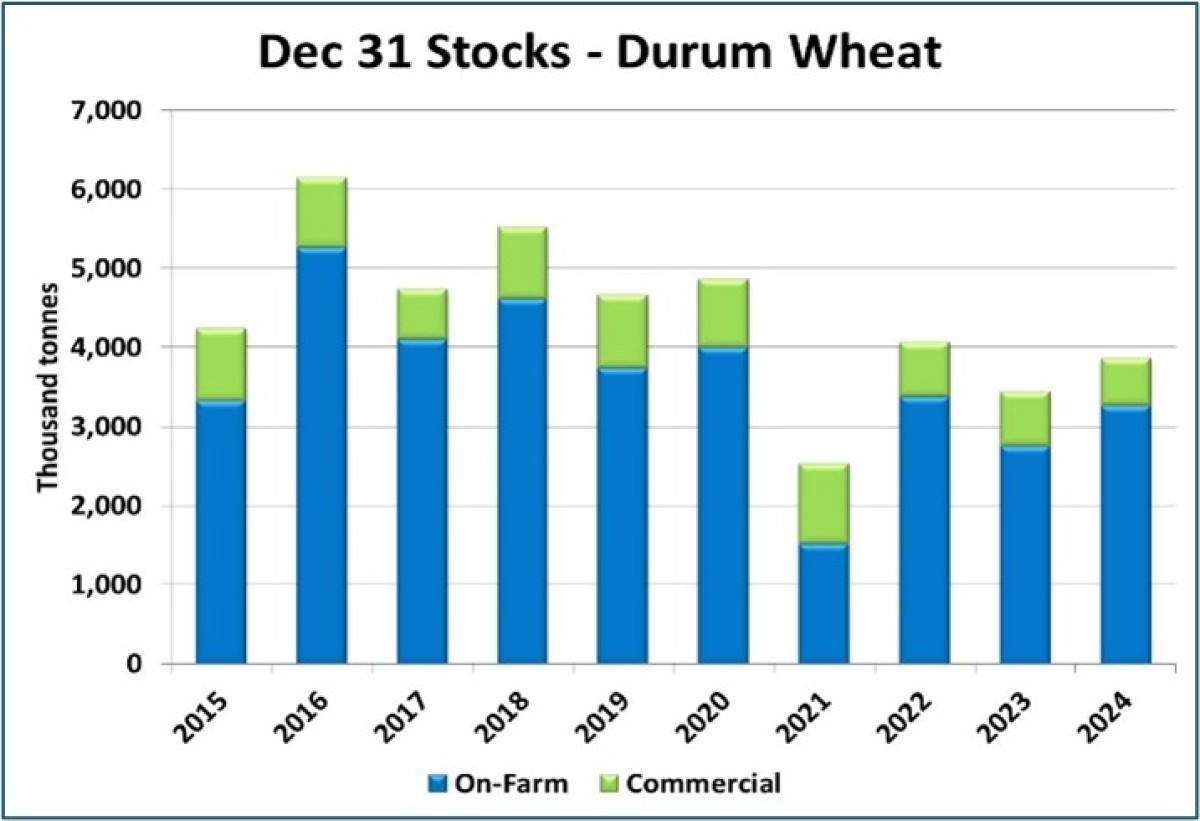

- The StatsCan December 31st stocks report showed durum stocks at 3.6 mln tonnes, up 13% from last year’s low point of 3.2 mln tonnes. Even so, these stocks aren’t historically large. Keep in mind, we added 250,000 tonnes to the 2023 crop to offset StatsCan’s impossibly low 2023/24 ending stocks, but that still doesn’t make supplies heavy by any means. Based on the CGC data at the end of December, on-farm supplies were 290,000 tonnes above average but with very heavy farmer deliveries in January (including 212,000 tonnes in week 26), that gap has now disappeared. The trajectory of deliveries suggests on-farm supplies will drop below average within a few weeks.

- The fundamentals are looking friendlier, but bids in western Canada haven’t yet shown a meaningful response.

- Firming values in key destinations should provide more support for domestic prairie prices.

- On-farm stocks are being drawn down at a quick pace, which should also start to help bids, particularly if farmers slow down the pace of their selling.