December 2024

The updated StatsCan production estimates largely came in as expected, which leaves the market outlooks largely unchanged. Export movement out of western Canada has been good, although there are risks to monitor in global markets in the months ahead.

Wheat Outlook

Upside:

- CGC continues to show big farmer deliveries, driven by a strong export demand pull. This is drawing down on-farm stocks, which is supportive for basis levels.

- USDA bumped up their export forecast for US wheat.

- Russian exports will slow in the new calendar year.

- Stocks will be relatively tight across the major exporters in aggregate going into the next growing season.

Downside:

- Aggressive Russian exports continue to cap upside in global markets for now.

- Australia and Argentina will have larger crops this year.

- Import demand is projected to be down across the major world buyers in aggregate.

Key Notes:

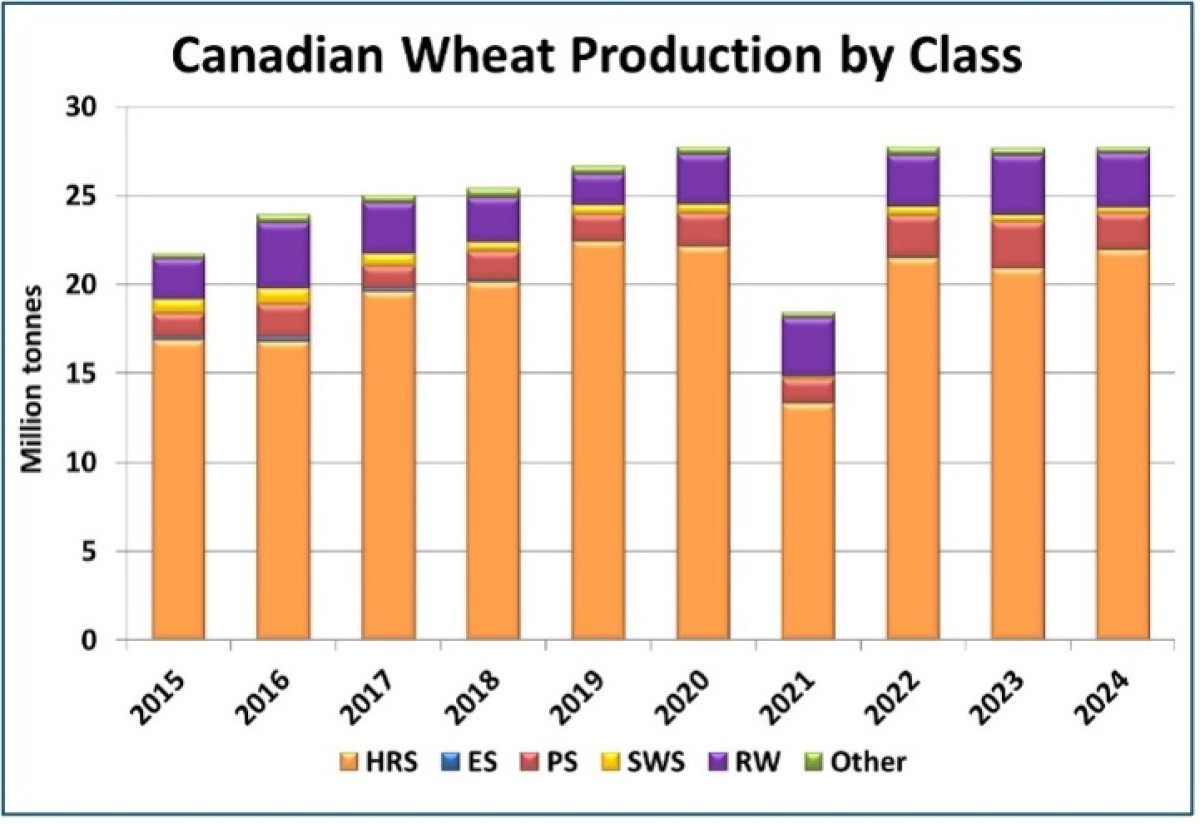

- StatsCan’s updated production figure saw an increase in spring wheat to 26.1 mln tonnes, from 25.3 mln previously. Winter wheat was bumped up to 3.0 mln tonnes. The breakdown by type included 21.95 mln tonnes of hard red spring, which is a typical share of total spring wheat production, and 2.01 mln tonnes of CPS wheat. Non-durum production has been essentially flat at 29 mln tonnes for four of the past five years, with the only exception being the 2021 drought.

- The latest ABARES estimate for Australia’s wheat crop came in at 31.8 mln tonnes, above the 26.0 mln tonnes last year. USDA is estimating Argentina’s crop at 17.5 mln tonnes, up from 15.9 mln the previous season, with some suggesting it could be even higher.

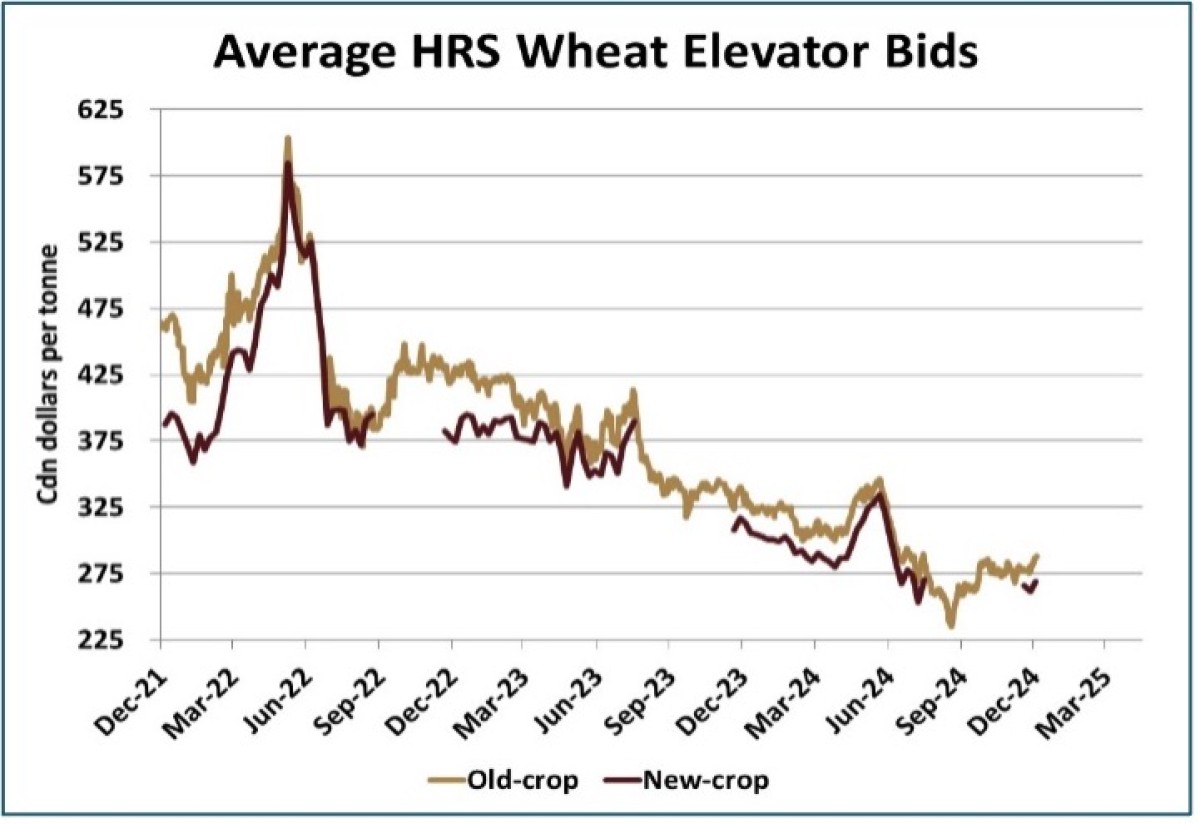

- Despite a carry in the futures market from the nearby March contract to December 2025, prairie new-crop hard red spring bids are at a discount to spot values. Strong export movement and tightening on-farm stocks are pushing old crop basis levels higher, while new-crop basis levels are weak. It’s not uncommon for fall basis levels to start out very soft at this point in the calendar, with likely improvement in the coming months.

Bottom Line:

- Prices continue to drift in a range, with several factors contributing to support levels holding (firming futures spreads, some strength in Russian values, good export demand out of North America).

- Global supplies are not heavy, although current aggressive Russian exports and softer global import demand temper upside potential for now.

- The market may see rangebound trade in the coming weeks, with the prospects for firming into later winter and spring, depending on 2025 crop conditions.

Barley Outlook

Upside:

- Canadian barley exports have been running well ahead of last year’s pace.

- Prices in export markets are showing some signs of strength, while a weaker Loonie helps Canada’s competitiveness.

- Australian barley supplies will be down 1.2 mln tonnes from last year, limiting export capabilities.

Downside:

- Farmer deliveries of barley have been slower in recent weeks and are trailing the average pace.

- Canadian exports of malted barley have been quieter than usual so far in 2024/25, reflecting lower malt use.

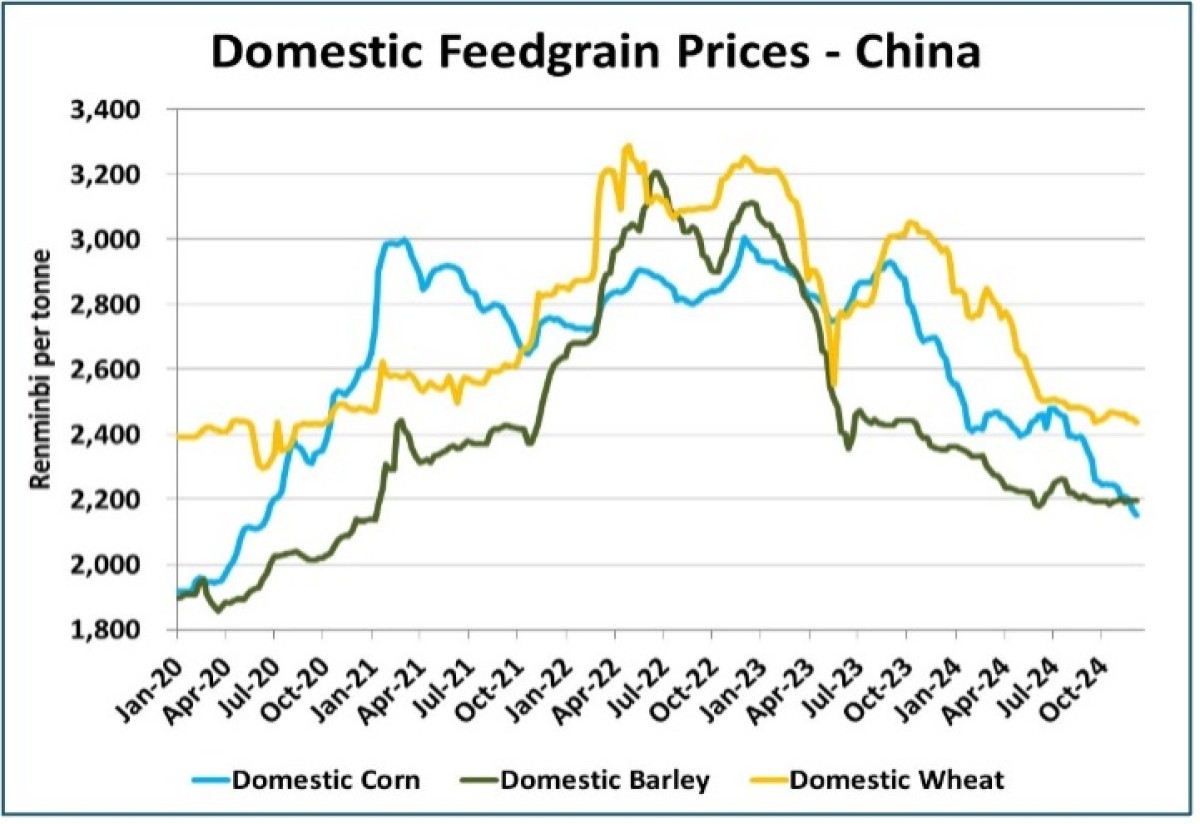

- Corn prices in China have now dropped below barley, which will tend to discourage feed barley imports.

Key Notes:

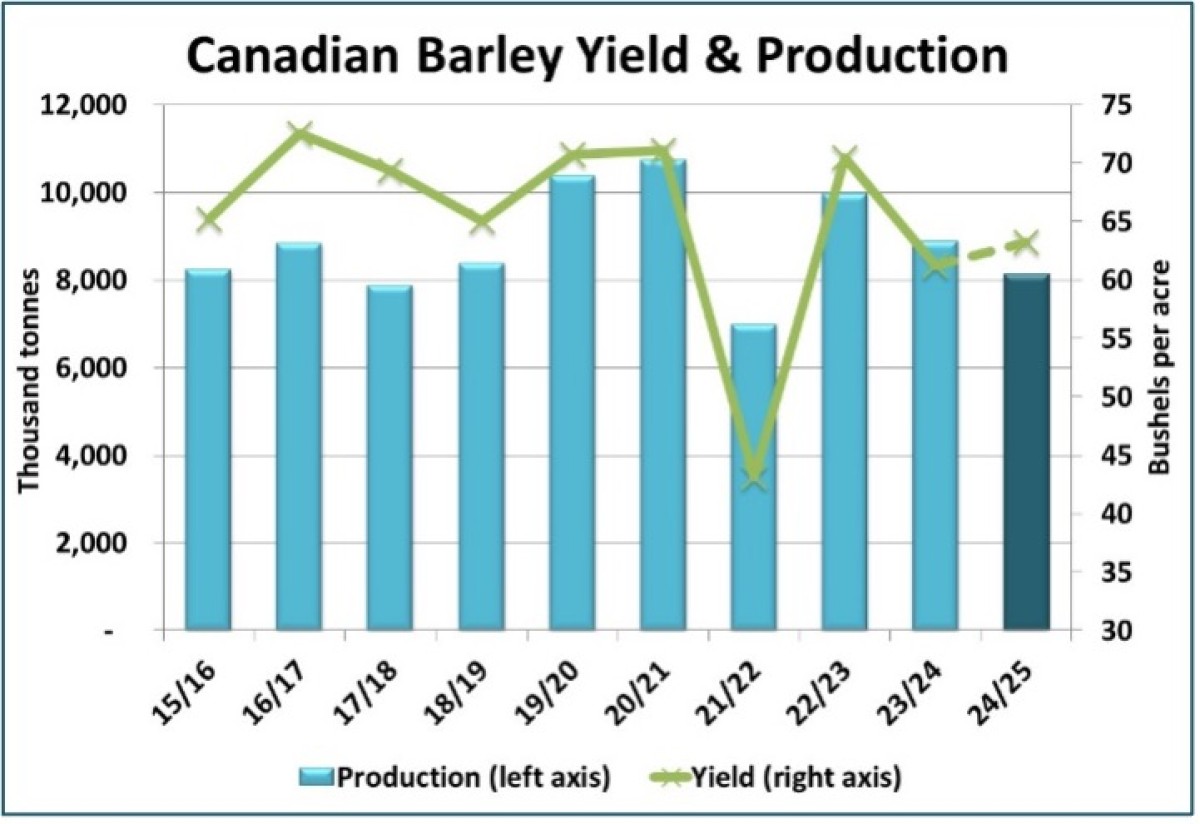

- StatsCan bumped up its 2024 barley production estimate to 8.14 mln tonnes, from 7.6 mln in September. This was largely expected and fits the pattern of StatsCan revisions from the past few years. The yield of 63.2 bu/acre was two bushels higher than last year but still below pre-2021 levels. The 500,000 tonne increase in the production estimate won’t necessarily make the S&D heavier, as it will simply allow higher domestic feed usage, with more exports also possible. Ending stocks are likely to remain under 1 mln tonnes in 2024/25.

- Last week’s USDA report tightened up the US corn S&D, as higher export and ethanol demand came out of the projected 2024/25 carryout. While corn futures have struggled to break out to the upside, it’s possible the floor has been raised.

- In the last few months, Chinese barley imports haven’t seen nearly the drop-off that’s occurred in corn and wheat, but that situation could be changing, and not for the better. Domestic corn prices in China have been dropping much more sharply than barley and are now at a discount to barley. The situation with corn prices below barley also occurred in 2022 and early 2023. During that timeframe, Chinese barley imports averaged 370,000 tonnes per month, well below the average of the most recent six months at 1.1 mln tonnes..

Bottom Line:

- There are some warning signals about lower barley demand from China in the months ahead. That said, reduced availability from competing exporters could still leave Canadian barley with a larger market share.

- On the domestic front, stronger corn futures, helped by last week’s USDA report and a weaker Canadian dollar, is raising the ceiling for domestic feed barley prices.

- While feed barley is looking firmer, malt barley demand is still quiet and strength would need to be driven by rising feed barley.

Durum Outlook

Upside:

- Weekly durum exports have been strong recently and are running ahead of average and well above last year.

- European durum imports in 2024/25 are still below average but the pace is starting to improve.

Downside:

- Canadian durum supplies are large enough to support a 4.8 mln tonne export program, or slightly more.

- Durum prices in key global markets are mostly flat to lower, with no signs of concern about supplies. This is showing up in lackluster western Canadian bids as well.

Key Notes:

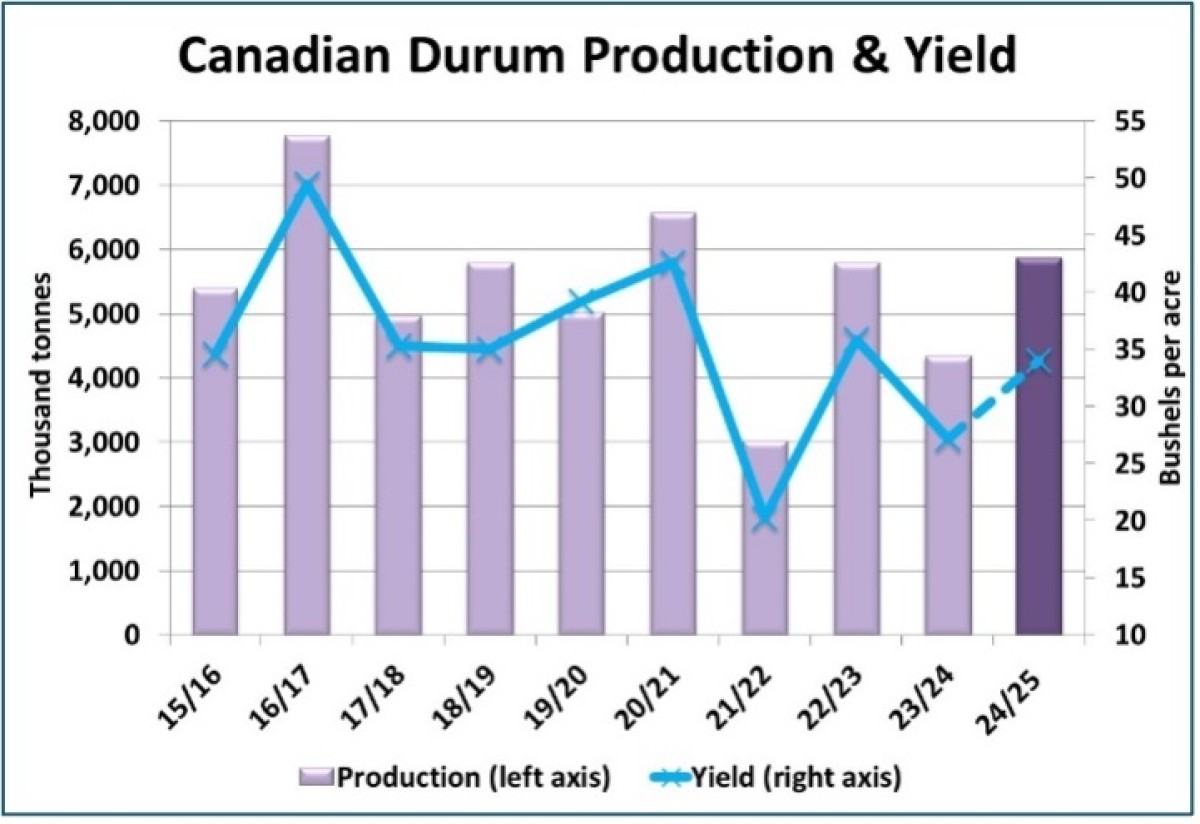

- StatsCan’s updated durum production estimate came in lower than the September figure, as expected. The 2024 crop was reported at 5.87 mln tonnes, down from the 6.0 mln previously but still 16% higher than last year and the largest since 2020. The yield was reported at 34.0 bu/acre, a solid improvement from 27.2 bu/acre in 2023 but still lower than the levels seen prior to the 2021 drought. The reduction doesn’t materially change the market outlook, and there’s a chance the crop eventually gets revised higher at some point in the future.

Bottom Line:

- The strong exports recently are raising the possibility of tighter durum supplies later in 2024/25, but so far that hasn’t had any impact on bids.

- Prices in overseas markets are flat to lower and aren’t reflecting concerns about supplies. Türkiye remains a threat to reenter the export market.

- Even though the market appears friendly, seasonal price patterns are still negative. Until prices rise in Europe or in North African tenders, Canadian durum bids will remain flat, even with a weak Canadian dollar.