April 2025

Wheat Outlook

Upside:

- CGC data continues to show strong activity in terms of farmer deliveries, shipments and exports of non-durum wheat.

- Prairie CWRS basis levels remain strong.

Downside:

- USDA increased the 2024/25 US wheat carryout.

- US winter wheat conditions are below last year but in line with the longer-term average.

- Conditions in most other key global wheat growing regions are generally non-threatening at this point.

Key Notes:

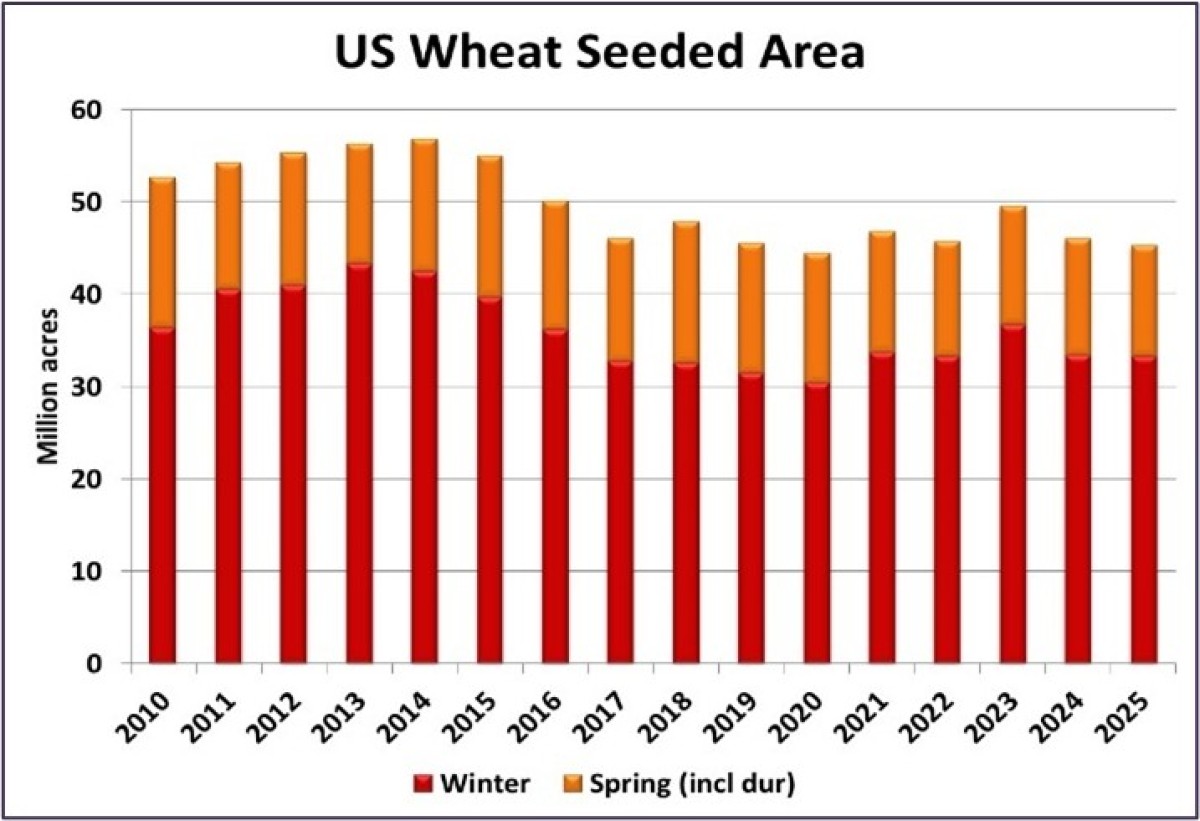

- USDA showed a total of 2025 US wheat plantings at 45.4 mln acres, nearly 1 mln less than expected. This includes winter wheat at 33.3 mln acres and non-durum spring wheat at 10.0 mln acres, 500,000 less than anticipated and a new low. Weather is ultimately more important than the smaller area, and a trend yield could still see the 2025/26 carryout remain similar to the current season.

- Global conditions are mostly non-threatening across most key regions. It’s still very early, but estimates for Russia have been creeping higher and EU production is projected to be up by 10% or more. US acres are down, but this could be largely offset by bigger plantings in Canada. Early expectation are for a smaller crop in Australia, although indications suggest Argentina could be higher. In short, unless there is a setback in more than one region (which is possible), total production across the key exporters could be flat-to-higher from last year.

- Global wheat prices have been mostly sideways-to-lower the past few weeks. Import demand remains a bit soft, reduced Russian exports are being made up for by other suppliers, and a lack of meaningful weather threats leaves little need for ‘urgency’ ahead of the next harvest. It will require some weather challenges to trigger a meaningful move higher, while favorable conditions could mean drifting lower is the path of least resistance.

-large.png)

Bottom Line:

- Stocks will be on the tighter side going into the Northern Hemisphere harvest, but a lack of meaningful yield threats (so far) means production will be ‘adequate’. This lends itself to values holding support, but also not having a compelling reason to trade significantly higher.

- There is plenty of weather ahead, and some regions warrant close monitoring, but it will take tangible deterioration of production potential to trigger a sustained rally.

- Tight old-crop supplies will help underpin prairie spring wheat bids in the short-term.

-large.png)

Barley Outlook

Upside:

- Elevator shipments of barley have been solid recently, suggesting steady but not spectacular exports ahead.

- Canadian barley exports improved slightly to 122,000 tonnes in February but that's still below average.

- Elevator bids for old-crop feed and malt barley have shown a bit of strength lately while new-crop is sideways.

Downside:

- Barley exports from Australia are remaining very strong while Ukrainian exports have faded.

- USDA is forecasting large US corn acres in 2025, which will act as a headwind for feed grain prices.

Key Notes:

- Canadian barley ending stocks are projected to be around 750,000 tonnes 2024/25, based on expectations for 5.1 mln tonnes of livestock feeding and 2.4 mln tonnes of exports. This is lower than 2023/24, but above the three years prior. There is still lots of uncertainty for the 2025/26 outlook, but early indications are for only a small increase in the carryout despite the likelihood of larger plantings. Of course, yields this coming season are important, while export shipments to China will also be influential.

-large.png)

- While USDA trimmed the 2024/25 US corn carryout in their last update, the forecast for 95.3 mln acres in 2025 sets up for a large crop in the coming season, depending on weather. If grain can flow freely between Canada and the US, the potential for big US corn production could put a ceiling on prairie feed grain prices.

- Stronger pricing from elevators has pushed feed barley values higher in western Canada. This compares to other feed grains that have generally been steady-to-modestly-lower. The export pull has forced some feeders to bump their feed barley bids as well. It’s possible export demand allows feed barley to remain relatively stronger than the rest of the complex, although at a certain point some convergence is likely. Firming prairie milling wheat prices could force feed wheat bids higher as well.

-large.png)

Bottom Line:

- On paper, global supplies of barley are very tight, particularly among major exporters, but that hasn’t been able to trigger a meaningful rally, as Australian and Argentine crops have been filling the gap for now.

- The opportunity for a seasonal rally hasn’t closed yet but without a surge in Chinese demand, prospects are looking limited.

- The global outlook for 2025/26 is showing a bit more comfortable supplies, which would keep a lid on next year’s markets, although it’s far too early to draw conclusions.

-large.png)

Durum Outlook

Upside:

- Movement of durum has been firm in recent weeks, suggesting the strong export pace will continue.

- Canadian durum exports dropped to 292,000 tonnes in February but a recovery will show up in the March data.

- The latest Algerian durum tender showed slightly higher values while Italian durum prices are slipping.

Downside:

- USDA cut its estimate of 2024/25 durum ending stocks, but it remains at a multiyear high.

- While down slightly from last year, US durum acres will be large in 2025. Canadian area will be relatively high as well, setting up for sizeable North American production if weather conditions are favorable.

Key Notes:

- The USDA forecast for 2025 US durum area came in at 2.02 mln acres, down 2% from the 6-year high last season. Compared to the previous few years though, the 2025 acreage isn’t exactly small. Assuming an average yield of 30.9 bu/acre, 2025 production would end up at 75.2 mln bushels or 2.05 mln tonnes, down 6% from last year but still well above the 5-year average of 62.0 mln bushels. Another large US durum crop could weigh on prices and discourage imports from Canada, even if tariffs aren’t in place.

-large.png)

Bottom Line:

- While durum movement continues to run at a good clip in western Canada, prices still aren’t reflecting tightening stocks, raising more questions about StatsCan’s production estimates.

- Prices in Europe are fading and it appears the seasonal tendency for Canadian bids, normally lower at this time of year, is re-exerting itself. This makes it more difficult to justify a rally, barring a sizable weather issue developing in North America or Europe.

-large.png)