Where Wheat Prices Go in 2023

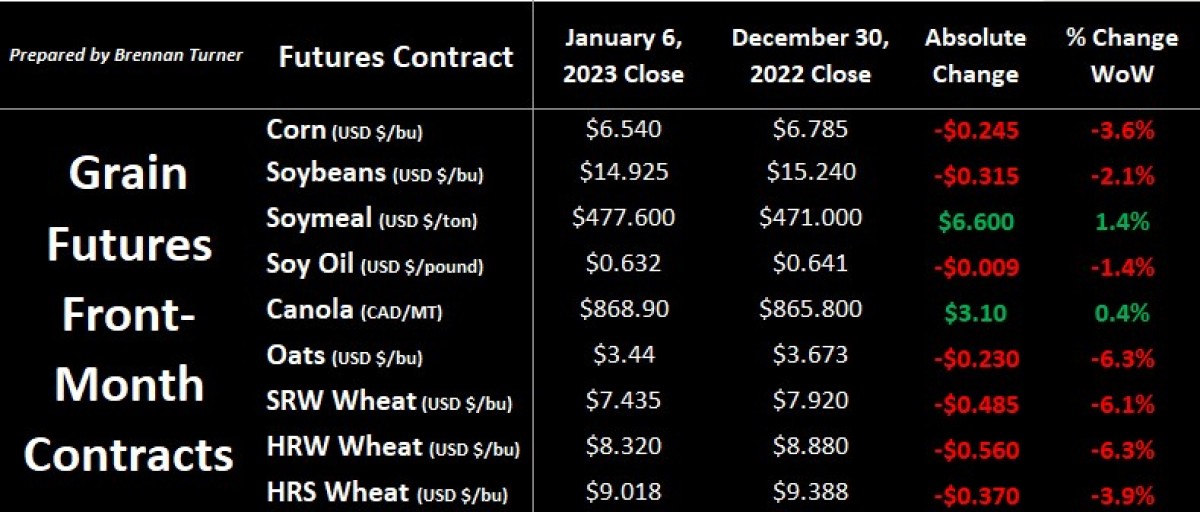

Grain markets started the 2023 calendar year mostly in the read as moisture concerns in South America couldn’t compete with technical selling and global commodity demand concerns. More meteorologists are pointing to a fading La Nina, which could bring much-needed moisture events to the American Southern Plains and Argentina. Albeit, for the latter, it may be too late for a lot of the country’s corn and soybean crops, as of last week, 3/4s of Argentina’s beans and 2/3s of the corn had been planted, with 28% of both crops already rated poor-to-very poor. That said, the market is believing that Brazil could make up for any shortfalls in Argentina, and that’s dragging things lower, including wheat.

As most crops have relatively tight balance sheets, weather continues to be one of the major variables impacting values. If Mother Nature’s pendulum swings from La Nina to El Nino, it would alleviate a lot of production concerns in the Americas, and thereby, help rebuild grain stocks. The question it comes down to is timing, as good rains in the spring would be viewed as bearish, as it would help U.S. corn and wheat production from Texas up to the Dakotas. Elsewhere, some cold temperatures in Russia might increase winterkill numbers, but conditions are generally favourable from there all the way over into Europe. South of the Mediterranean Sea though, North African countries continue to be negatively impacted by ongoing drought, which was only exacerbated over the last 3 months of 2022, thanks to below-average precipitation.

Therein, sentiment seems to building for the potential of at least average crops in Canada, Europe, and Russia, with the biggest wild cards for grain markets being the United States’ production and China’s demand. This is because with the aforementioned tight balance sheets, there’s a fair amount riding on America’s 2023 corn, soybean, and wheat harvests. This in mind, this week, the market will be positioning ahead of the USDA’s monthly WASDE report, released on Thursday, Jan 12th at 12pm EST. The January report can often be a volatile event, given it tends to provide major revisions to South American crops, as well as final U.S. production numbers.

One nation we know we’ll see some bigger production numbers from is Australia, where the wheat harvest is now being estimated by traders at 42 MMT (a new record). While there’s certainly some quality issues from the Eastern part of the country after heavy rains during harvest, Western Australia is exporting record volumes of wheat with ports booked through to May. The latter area’s wheat will compete most against Russia’s own record wheat harvest. This also comes at a time when Europe’s own exportable supplies are running a little thin much earlier than usual, which may lead to their usual customers going to Australia first, given the various logistical, legal, and financial challenges sourcing wheat from Russia.

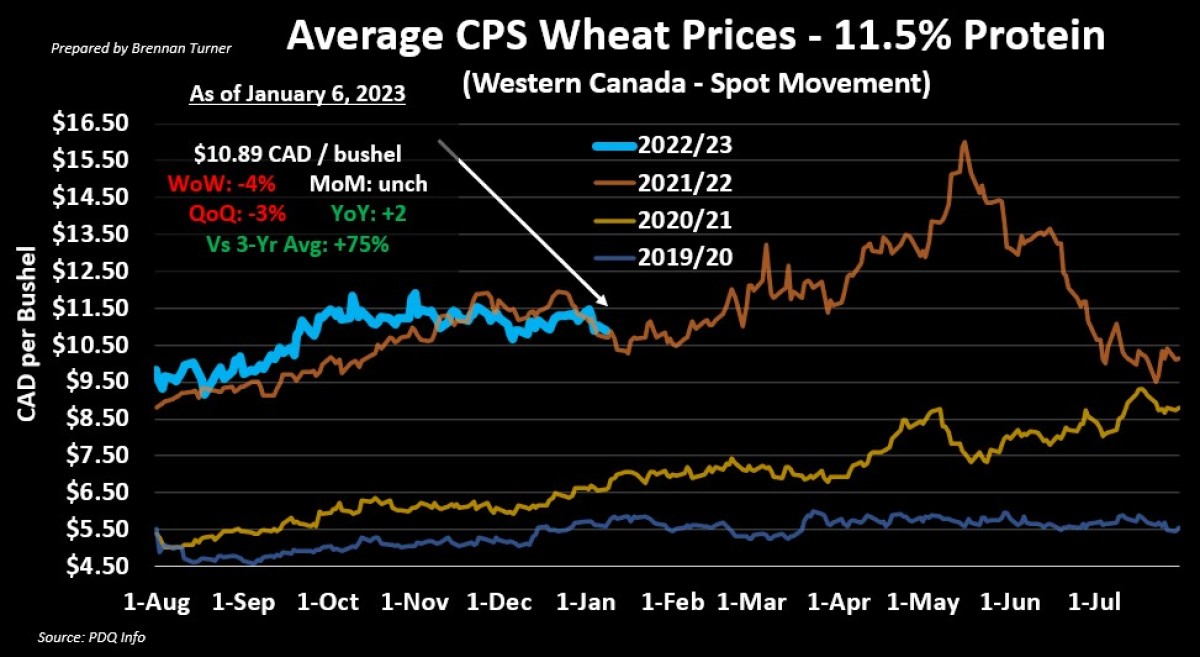

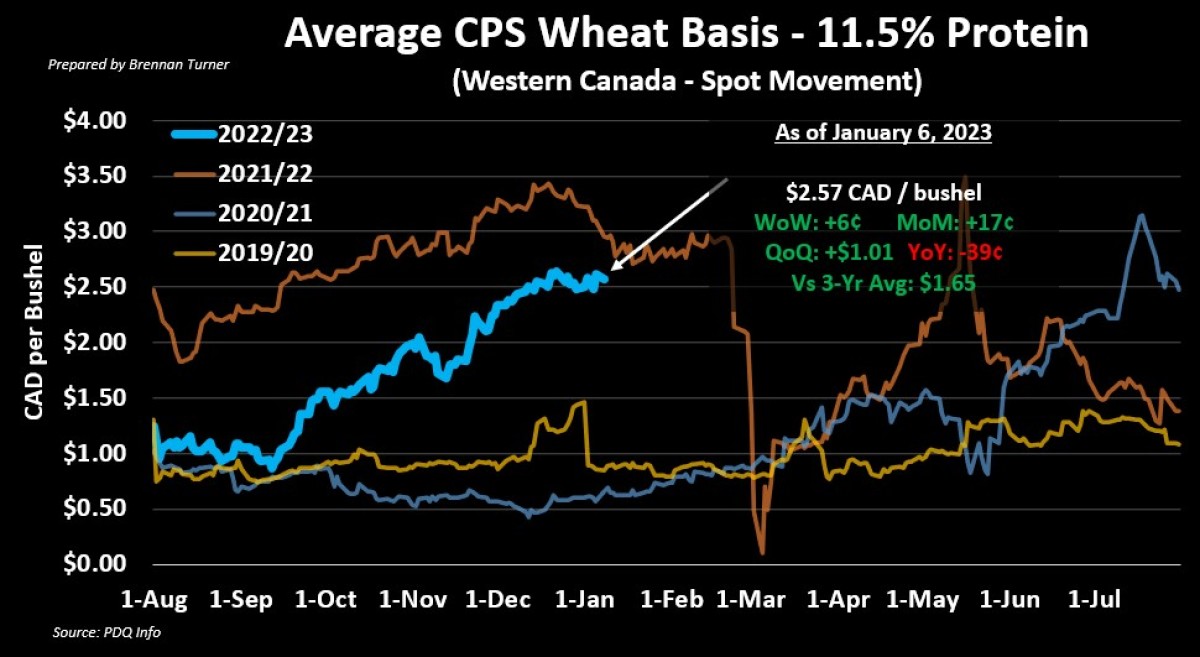

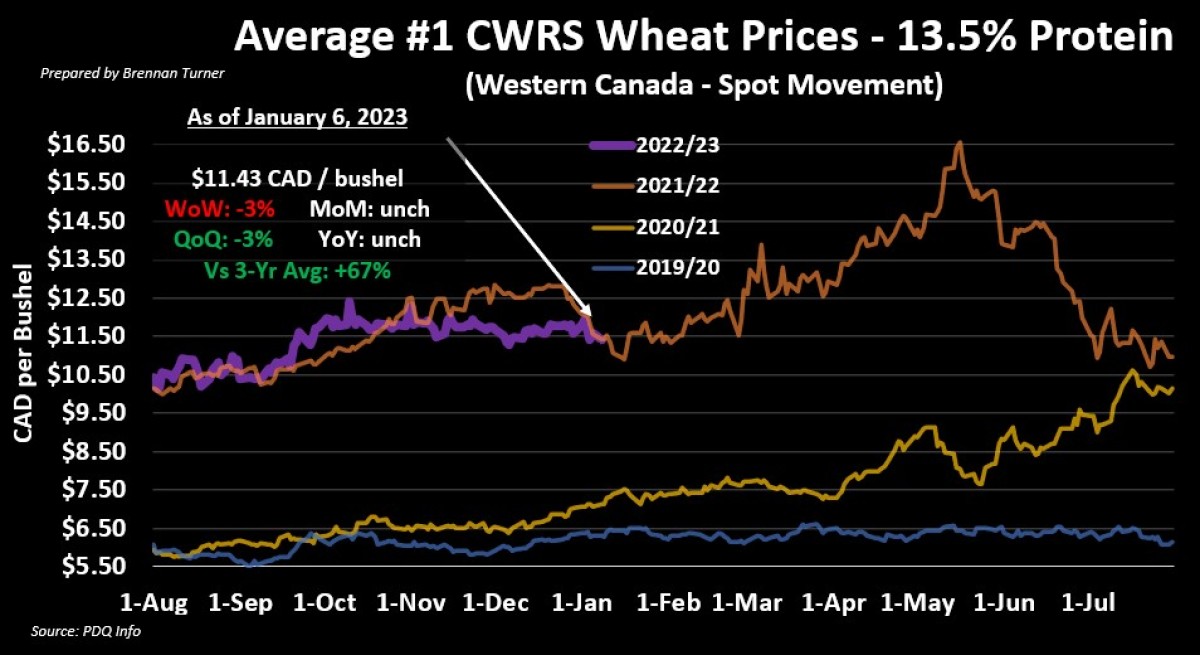

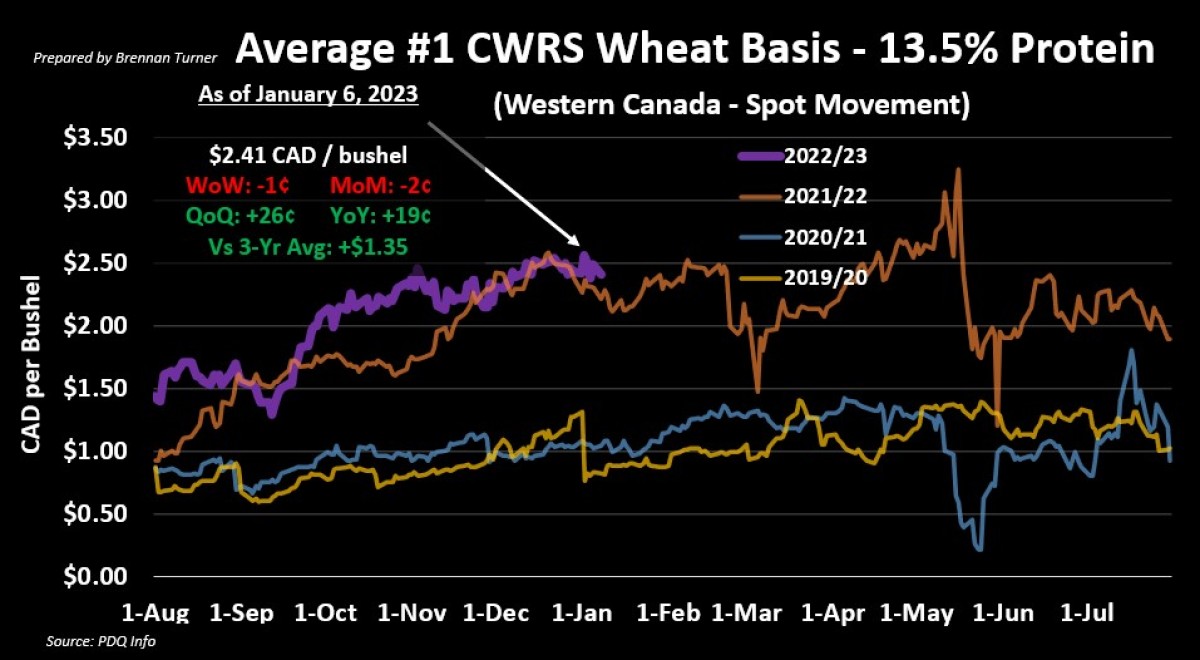

So, where do wheat prices go before we harvest the 2023 crop? Here in Canada, strong demand is helping keep values elevated, albeit they have pulled back a bit in recent weeks with the futures market. Cash CPS and HRS wheat prices for spot movement (1st and 3rd charts below, respectively) are basically the exact same as where they were a year ago. Alternatively,, basis levels for CPS wheat (2nd chart below) are sitting near $2.60, which is about 40 cents below the same time a year ago but more than a dollar better than where we were 3 months ago. HRS wheat basis levels in Western Canada for spot movement (4th chart below) are tracking higher than a year ago, and like CPS wheat, this time of year tends to show us some of the best basis levels of the year. This is something to be cognizant of going into the spring and any cashflow requirements you have.

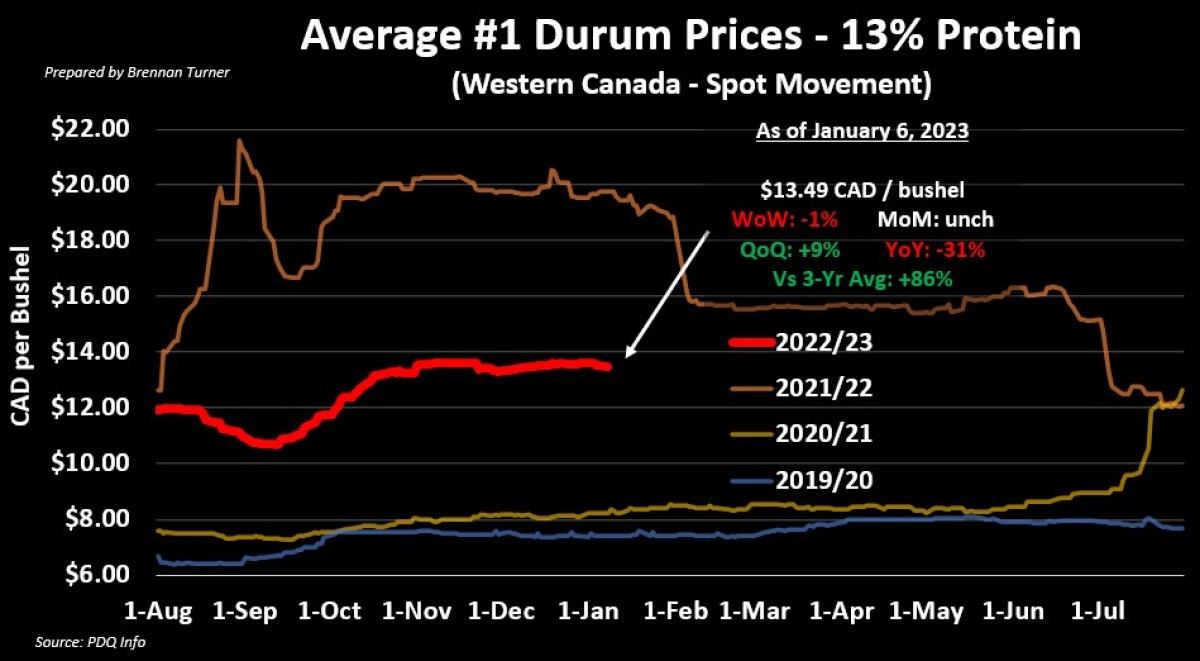

For durum prices, the usual market malaise for this time of year has shown up with more signs pointing to current values being among the highs. Some premiums could be added in the late spring, depending how the North American crop is starting out, and what sort of demand comes out of Europe and North Africa before they harvest their crops. Ultimately though, as we get closer to the start of Plant 2023, as in years past, values are more likely to pull back a bit.

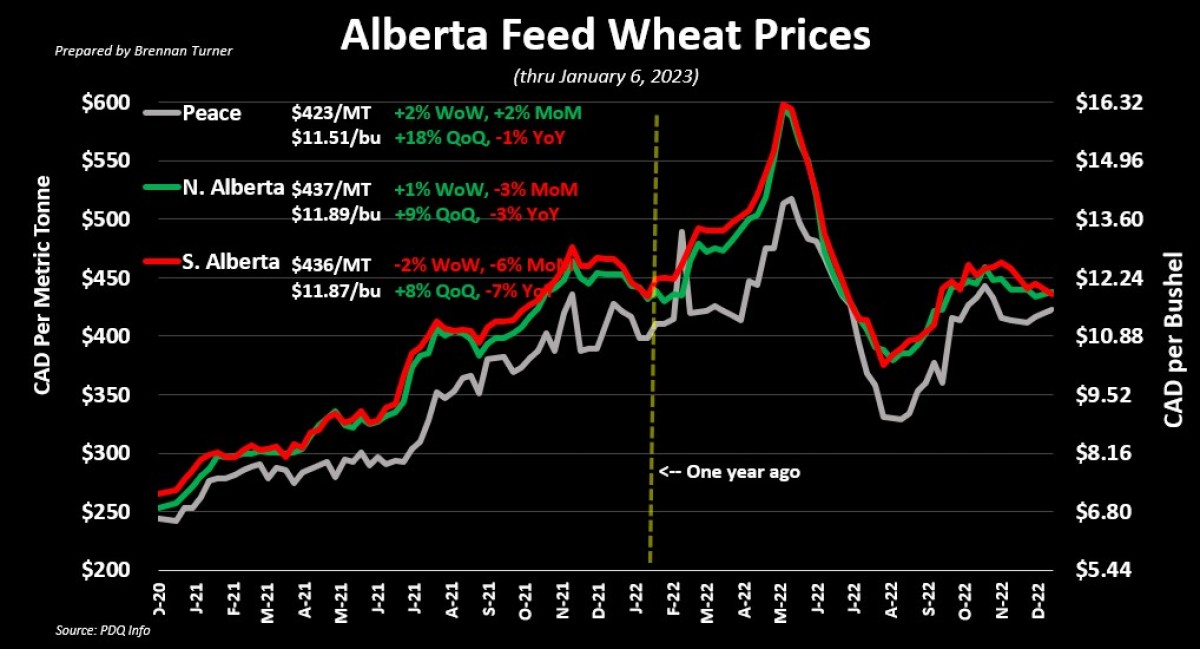

Finally, for feed markets, wheat prices continue to perform well, at least compared to the same time a year ago after a drought-riddled harvest. Southern Alberta feed prices have been a but suppressed by trainloads of corn coming into the market, whereas values in other areas of the province have been buoyed by the extremely cold temperatures. Depending on just how much more corn comes west, I expect feed wheat values to trade sideways for the next few months, much like they did 2 years ago. That said, wait to sell 2 months from now if it’s likely going to be same price?

Overall, while the last few weeks have seen some depression in wheat prices, there are plenty of variables that could catalyze higher highs in the next month or two. The glaringly obvious factor is the Black Sea, as the availability of Ukrainian grain – principally wheat and corn – could change at a moment’s notice depending on how Putin is feeling that day. With China expected to source more grain from Russia and Brazil this year, there could be some musical chairs on the export markets, and this is likely bearish for U.S. grain, especially if the U.S. Dollar stays strong. That said, if things stay dry in the spring, I expect fireworks in winter wheat and corn prices, which has obvious spillovers into HRS wheat and other feed grains. However, while I expect volatility to remain, without a guaranteed major bullish element – i.e. weather or further Ukraine export issues – the market is cognizant of better production potential amidst a sea of broader economic and demand concerns.

To growth,

Brennan Turner

Founder | Combyne Ag