Wheat Prices Likely Not Done Testing New Limits

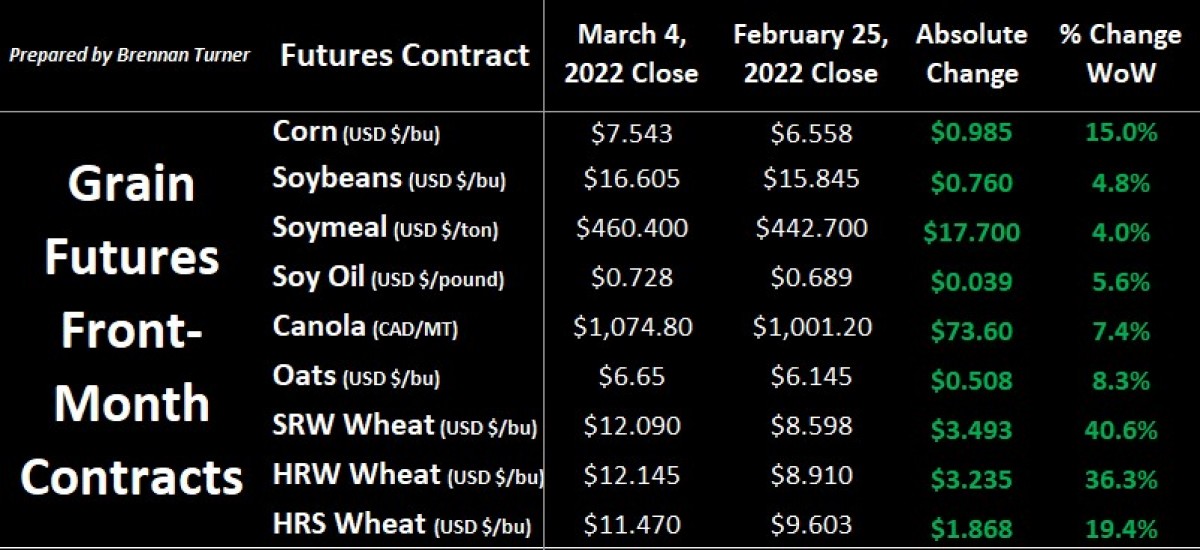

Grain markets continued their aggressive push higher last week, led by wheat, which saw limit up moves in multiple trading sessions. Quite literally, the Chicago SRW wheat May 2022 contract was limit up Tuesday through Friday, helping it claim its biggest one-week increase on record. Kansas City HRW and Minneapolis HRS wheat futures followed Chicago’s meteoric rise, before pulling back on Friday, including HRS wheat going limit down again (a 60¢ move to the downside). And yes, the numbers and percentage changes in the below tables are correct - I had to triple-check myself! Note that also, in early morning trading on Monday, March 7, all front-month wheat futures were limit up again! Given the complex situation the global grain markets are in today, this column will again be a bit longer than usual.

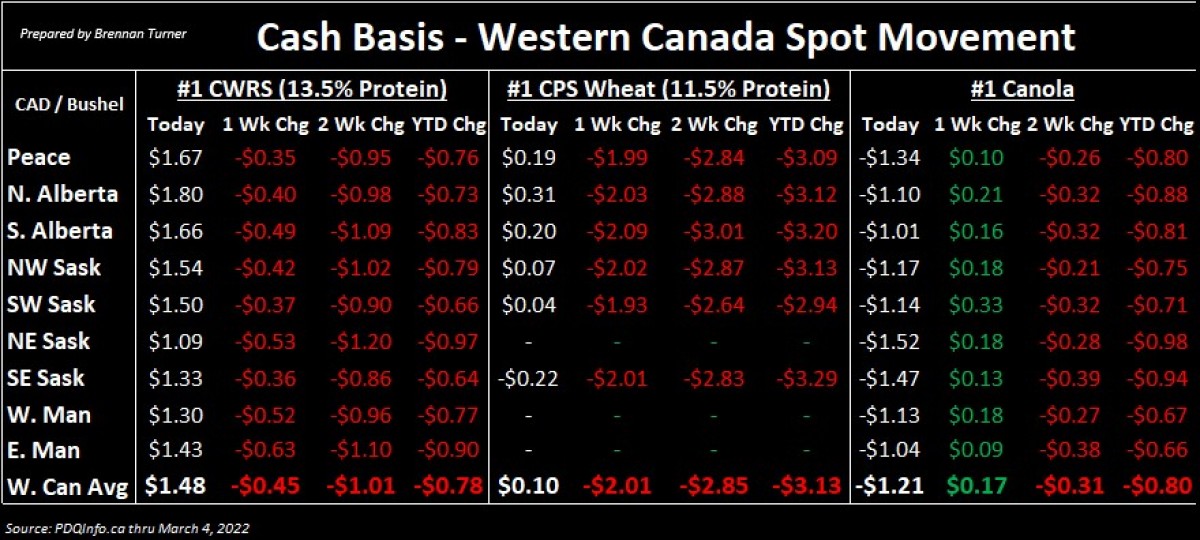

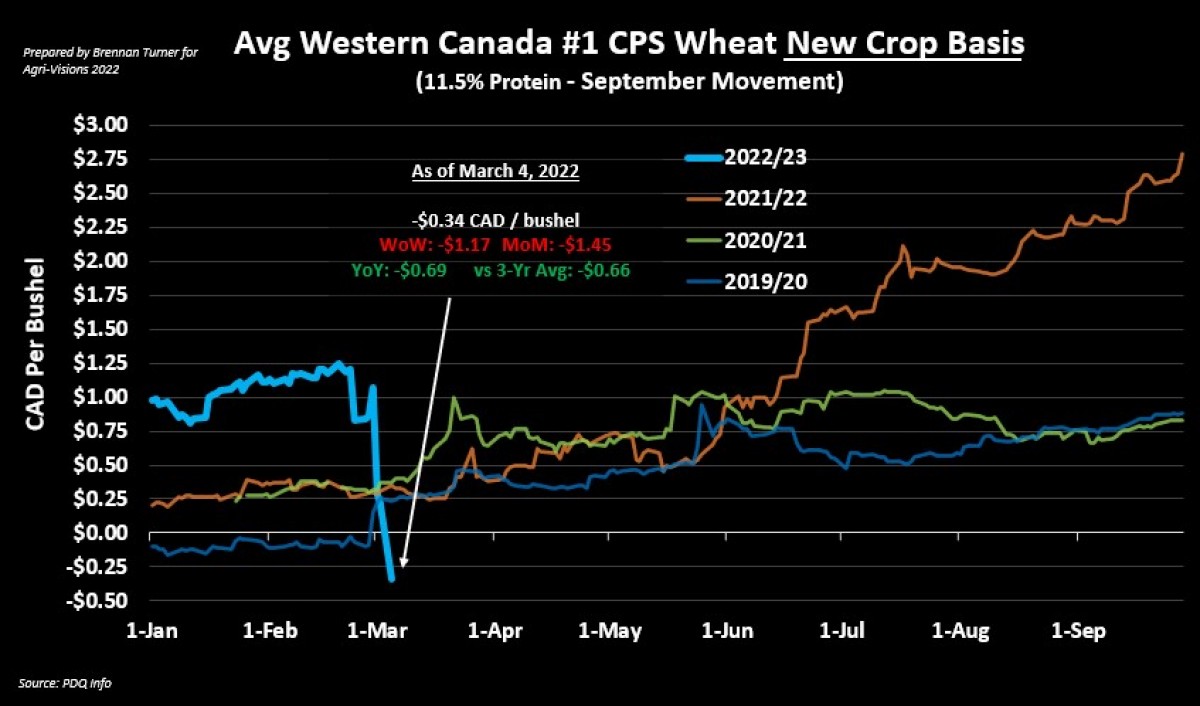

Ultimately, the market is trying to find an acceptable new price equilibrium, relative to the conflict in Ukraine and Russia and, as I mentioned in last week’s Wheat Market Insider column the impact it will have on global grain markets for the next year, possibly more. Specific to grain markets, this is what happens though when 29% of the world’s wheat, 19% of global corn exports, and 80% of all sunflower oil exports basically go offline overnight! That’s on an annualized basis, but as it stands today, there’s basically about 8 MMT of Russian wheat that doesn’t have a home today, while Ukraine has 2.5 MMT of wheat already sold (plus a few more unsold million tonnes), but won’t get shipped any time soon. And until the fighting in Ukraine stops, it’s hard to see when these exports will resume. With futures aggressively racing higher, basis everywhere, and on almost every crop, as worsened. For Western Canada though, CPS wheat takes the cake for the biggest drop-in basis, now down $3.13 CAD/bushel since the beginning of the year, but $2.85 of that being in the last 2 weeks alone.

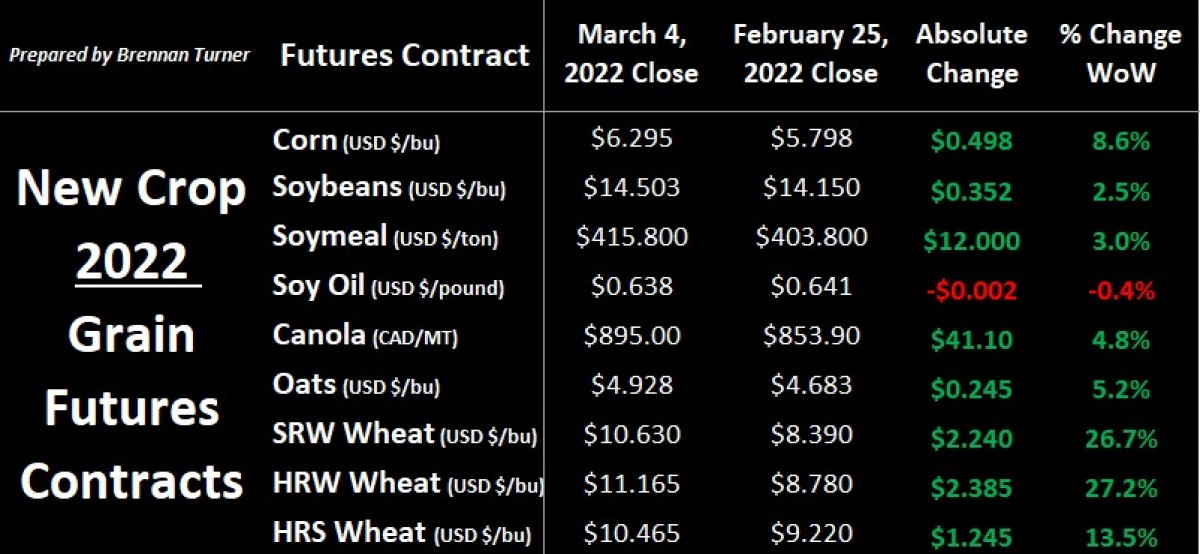

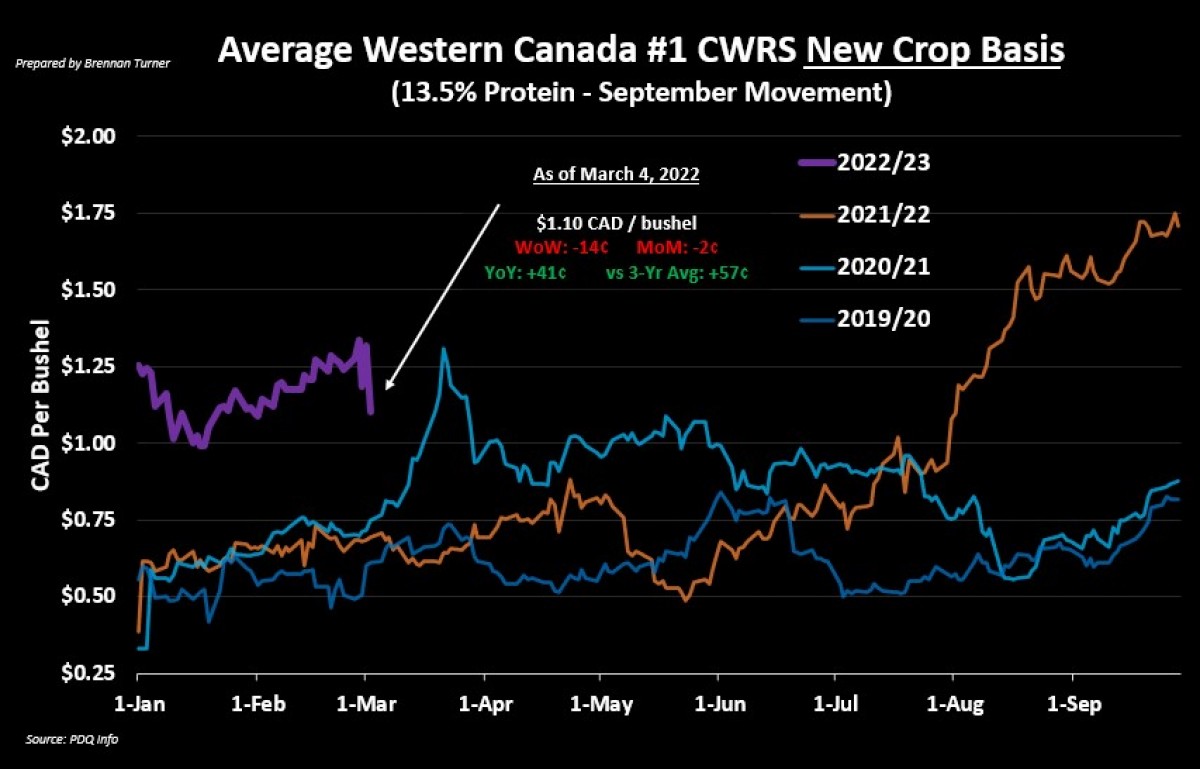

Front-month/old crop contracts aren’t the only ones trading higher as new crop futures have certainly made some big strides, and are looking very attractive since the beginning of 2022. In fact, both SRW and HRW wheat new crop contracts are up nearly 40%, while canola and HRS wheat are up about 16%. However, like old crop basis, new crop basis has fallen by a considerable amount, again led by CPS wheat (which is priced off Kansas City HRW wheat futures). Average new crop cash prices for September 2022 movement for CPS wheat in Western Canada are now sitting at $10.83 (nearly double the 3-year average), while it’s $11.60 CAD/bushel for HRS wheat (80% above its 3-year average). Meanwhile, new crop durum prices are being the stoic of the wheat complex, sitting at $11.68 CAD/bushel, basically unchanged since the beginning of 2022.

In the first Wheat Market Insider column of the 2022 calendar year, I suggested that new crop basis for both CPS and HRS wheat in Western Canada was historically high and so, locking in the basis and then pricing out the futures over the next 8 months could be a smart, risk-managed play. So far, that’s looking like a good marketing decision, but even today, net-cash new crop contracts are still sitting at their highest ever. Therefore, if you haven’t locked any new crop in yet, sometime in the next few weeks, getting a little coverage on the books (i.e. even 5% of expected production) would be healthy. This isn’t to say that wheat prices won’t continue to trek higher over the next few weeks, but daily limit-up rallies don’t last forever.

Unfortunately, there’s never been a situation where so much of the world’s exportable grain supplies are unavailable, so it’s hard to benchmark possible scenarios against previous timeframes that experienced daily limit-up trading sessions for multiple weeks. It’s more than likely there’s more speculative money (read: fund money) coming into grain markets, meaning that volatility will continue for the foreseeable future. Basically, the only major bearish factor in the wheat market today is the potential for said speculative money to start selling their (likely profitable) positions.

On the flip side, there are still some variables that could push wheat prices, incredibly, even higher. The first variable is the drought in the Southern Plains, something I’ve mentioned repeatedly over the last few months. While there’s still time for some moisture to help the crop jumpstart again out of dormancy, there’s nothing really in the forecast. Therein, if no good rains fall in the southern U.S. wheat belt, I think new crop Kansas City HRW wheat futures on the September 2022 contract could top $14 in the next 3 months, or another 25% higher than today’s prices. In fact, with new money adding to the volatility, $15 or $16 handles could theoretically also be seen. Bottom line, moisture in the Southern Plains is needed for any bulls to lay off the gas pedal they currently have pressed down.

On the other side of the world, the Chinese government admitted last week that the condition of its winter wheat crop could be the worst in history, thanks to heavy rains last fall that limited planting to about one-third of its normal area. At the start of dormancy, the portion of the crop rated good-to-excellent was down by about 20% year-over-year. Therein, we are starting to understand why the Chinese government hedged their bets by opening trade back up with Russia for wheat and barley. Incidentally, this was also right before Russia invaded Ukraine, which, as we now know, was followed by economic sanctions that basically stopped anyone not named China from buying Russian wheat! Arguably, this is bearish because China will minimize its purchase of low-protein wheat from any other country (but not stop completely as they will likely have blending needs).

Understanding the ripple effect of all these moving parts is complex, but I’ll try to simplify it. First, since 2 of the world’s largest wheat exporters are offline, demand will go to other major exporting sources such as the EU, Australia, U.S., and Canada. But all of these countries have relatively limited exportable supplies so traders might look to alternative sources like India, Romania, etc. However, these countries will start to get concerned with their own supplies and domestic prices and so could restrict exports, such as what Hungary did last week with their wheat, and what Bulgaria and Romania are considering as well. For Bulgaria alone, the government has already committed to buying about half of the country’s remaining wheat supplies so the next obvious step in trying to rein in domestic food price increases is to stop letting other countries drive your own domestic price up.

Put another way, the 21% increase year-over-year in the FAO’s food prices index seen in February will likely be small compared to what’s to come. While we might not see the impact today in the form of higher food prices here in North America, we are seeing it already in another market: energy. Record-high gasoline prices are now available to the consumer at pumps from California to Newfoundland, but the high cost of energy is on another level in Europe. For example, wholesale natural gas prices in the UK have increased 1,200% from a year ago. Twelve Hundred Percent! If you’re using natural gas or oil to do things like help manufacture a couple of consumer products or even heat your home, your expenses are going up, to the point where you can either (1) pull back on your production/heating your home or (2) pass these costs along to the consumer.

It’s obviously impossible to pass your home heating costs on to someone else (except in the case of renters), but the most likely thing business will do is pass the costs along to the consumer. This means higher costs for goods, which means that inflation continues to go up. When this inflation starts to be felt at places other than the pump, such as the grocery store, the very likely consequence, as per economic history, is a recession (AKA reduced demand as people pull back on their spending, given prices are too high). The aforementioned FAO food price index is actually now above what it was during the Arab Spring in 2010 / 2011, so the economic impact in developed countries could pale in comparison to the societal consequences in developing nations in Africa, the Middle East, and Asia, all of whom are incredibly food-price sensitive.

Overall, it’s easy for me to say that, with every passing limit up trading day, I think we’re getting closer and closer to the high. Given the moisture concerns in major wheat-producing areas in North America, the highs that were seen this month could be seen again in May / June, depending on how the Plant 2022 campaign goes. With that in mind, let’s not forget that with these higher prices, an acreage battle for the planting season is still ongoing, especially in the northern U.S. and parts of Canada where corn, soybeans, and spring wheat are all offering a great ROI. Finally, on Wednesday, March 9, the USDA will release its next WASDE report and while most traders are watching Europe, production downgrades in South America are expected once again.

To growth,

Brennan Turner

Founder | Combyne