Wheat 2023: Quality vs Quantity?

Grain markets saw significant selling to end the month of August. Going into the Labour Day long weekend, traders were re-positioning for Black Sea trade talks and another few days of triple-digit temperatures. In the southern hemisphere, Argentina’s freshly seeded wheat crop is looking for rain, albeit it is likely to come as Mother Nature swings back to an El Nino mode. In Australia, they just had one of their warmest winters on record and with below-average rainfall, so this year’s crop is unlikely to be another monster like the last three. In Europe, a quagmire of harvest-time rains across the region, and less fertilizer usage in Ukraine, is adding up to lower wheat protein levels, increasing the likelihood that Europe imports more high-quality wheat. For example, we already know that in the two months of July and August combined, the EU increased its purchases of Canadian wheat by 54 per cent year-over-year (YoY). Finally, Russian and Turkish Presidents, Putin and Erdogan, were set to talk this week about renewing the Black Sea Grain Deal, which weighed on the wheat complex.

While a cold front could show up later this week, the first week of September is likely to be one of the hottest for the Corn Belt in more than 30 years, and this after one of the driest Augusts over the same timeframe, according to WeatherTrends360. Agronomically, this could negatively impact test weight in corn and seed size for soybeans as the crop finishes out its development. This would be more bullish for soybeans than corn prices though as the American bean balance sheet is already pretty tight, and international demand for U.S. corn remains timid, especially relative to cheaper options from South America, Europe or the Black Sea. Adding onto expensive U.S. grain values are logistical costs, which are ticking higher on another season that starts with low water levels across the American river barge system.

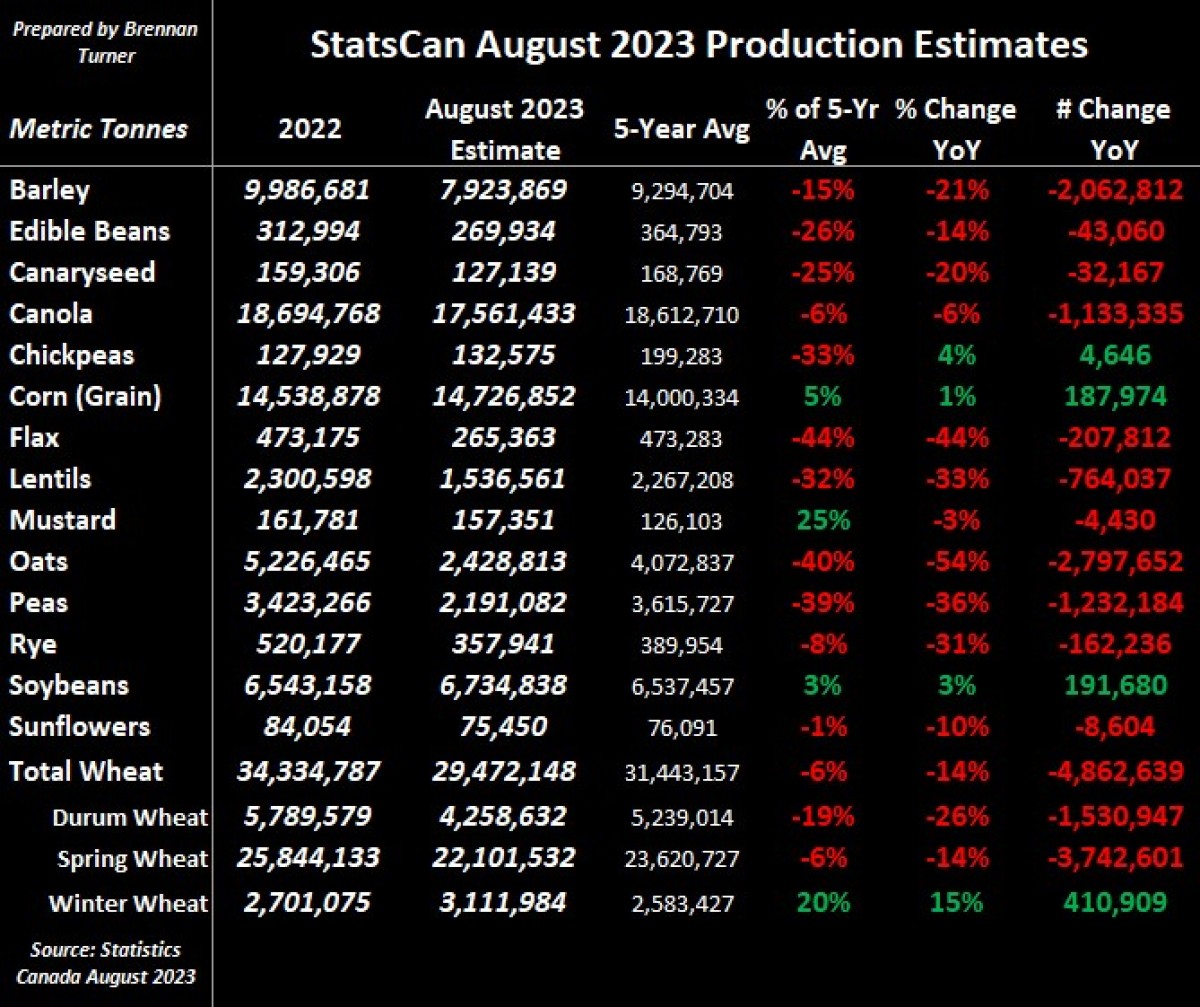

The big news for Canadian grain markets last week was Statistics Canada’s yield and production estimates, released on Tuesday, August 29, which is based on satellite imagery and agro-climatic data through to the end of July. Using their model, StatsCan is predicting that only corn and soybeans will see higher production than last year, largely because of decent growing conditions in Eastern Canada. Across the gamut of Western Canadian crops though, the total haul is looking closer to 2021 than that of last year.

For example, canola production is forecast at 17.6 MMT (minus six per cent YoY), minus six per cent from the five-year average), barley is pegged at just 7.9 MMT (minus 21 per cent YoY, minus 15 per cent from the five-year average), oats at 2.43 MMT (minus 54 per cent YoY, minus 40 per cent of the five-year average), 1.54 MMT of lentils (minus 33 per cent YoY, minus 32 per cent of the five-year average), and peas totalling just 2.2 MMT (minus 36 per cent YoY, minus 39 per cent of the five-year average). From an average yield standpoint, oats saw the biggest downgrade year-over-year of nearly 21 bushels to 86.4 bu/ac; barley wasn’t far behind (minus 15 to 55.3 bu/ac), as were peas (minus 10.7 to 27.1 bu/ac).

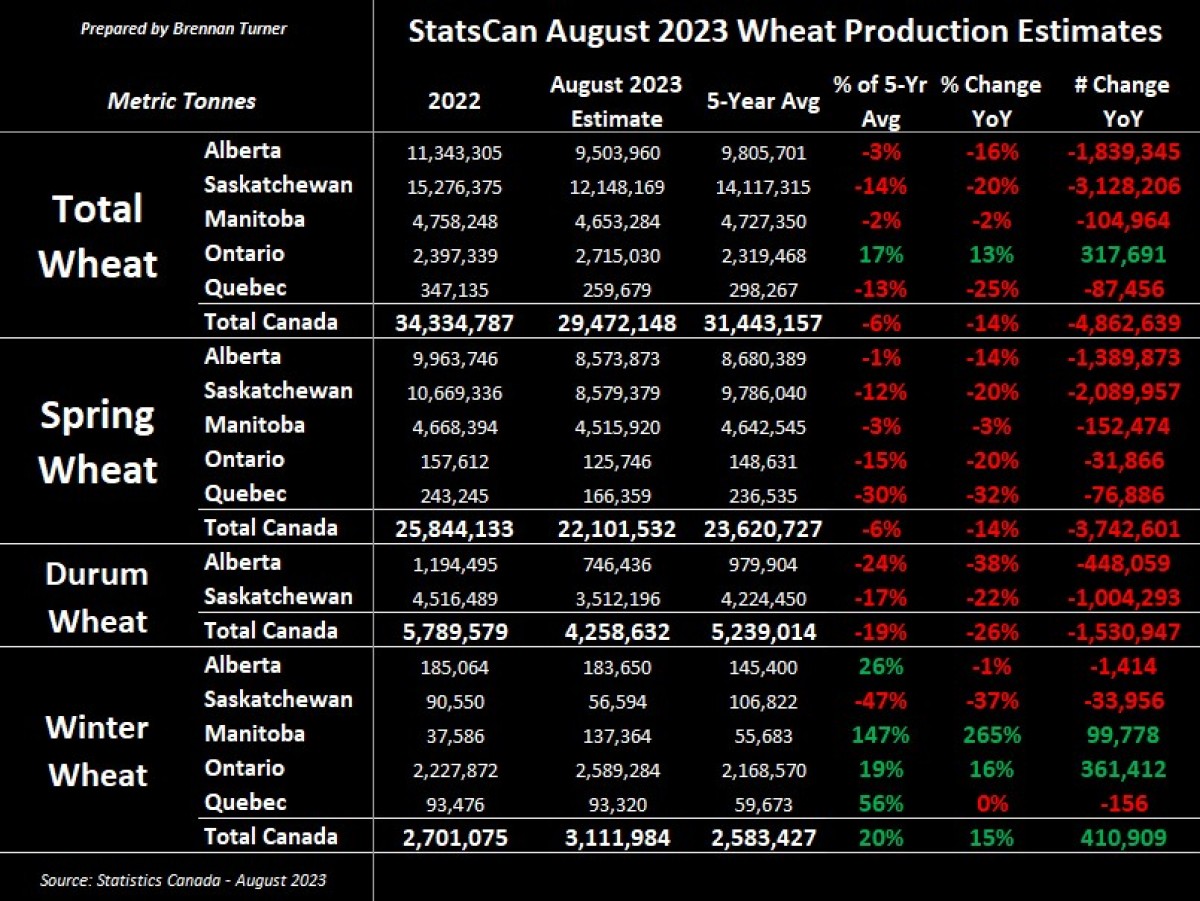

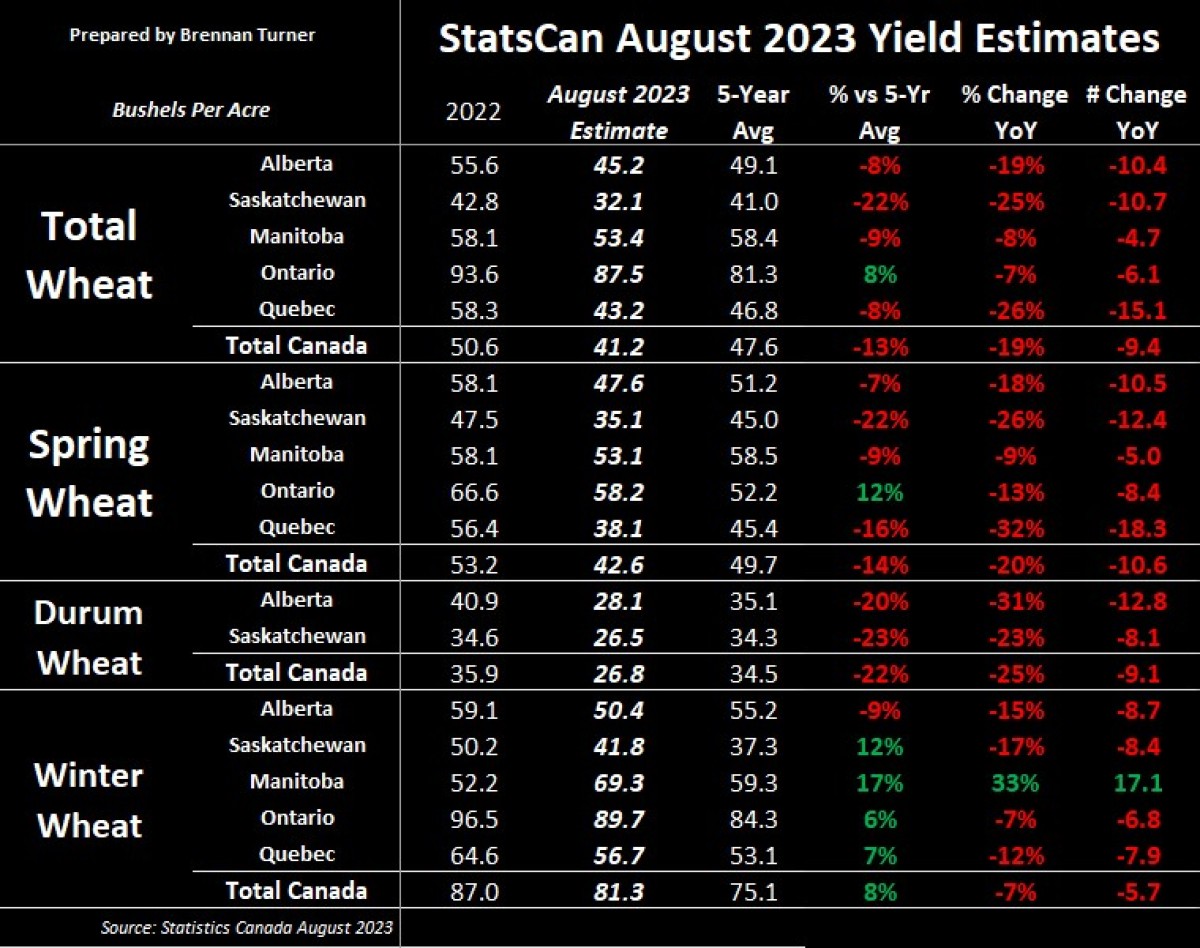

Specific to the wheat complex, total Canadian production will amount to just under 29.5 MMT, about 14 per cent below last year and six per cent below the five-year average. This includes 22.1 MMT of spring wheat, down 3.74 MMT or 14 per cent year-over-year, despite the fact that harvested acres are expected to increase seven per cent year-over-year to 19.1 million. Yield-wise, the average national durum yields are estimated at 26.8 bu/ac, down 25 per cent (or nine bushels) year-over-year and 22 per cent below the five-year average, while spring wheat’s forecasted average of 42.6 bu/ac is down 10.6 bushels year-over-year, and 14 per cent below the five-year average.

Total spring wheat production is set to fall most in Saskatchewan, minus 20 per cent or 2.1 MMT less than last year at just under 8.6 MMT, thanks mainly to average yields failing by 26 per cent year-over-year, or 12.4 bushels to 35.1 bu/ac. Alberta is not far behind with a spring wheat harvest forecasted also at 8.6 MMT, but with average yields only falling 10.5 bushels or 18 per cent, year-over-year to 47.6 bu/ac. Contrasting the two western Canadian Prairie provinces is the eastern one as Manitoba’s average spring wheat yields are forecasted to drop by only nine per cent, or five bushels, to 53.1 bu/ac, albeit this is still below the five-year average of 58.5 bu/ac.

Durum-wise, the balance sheet continues to look precariously tight as StatsCan is estimating just a 4.26 MMT harvest, which if not for 2021’s drought-riddled production of just 3.03 MMT, would be the smallest crop since 2011. With the bulk of Western Canada’s drought hitting the main durum growing regions in Alberta and Saskatchewan, it’s no surprise that average yields are expected to fall YoY by 31 per cent and 23 per cent, respectively. Overall, from the wheat complex, only winter wheat, is expected to see an increase in production year-over-year, thanks again to Eastern Canada.

The timestamp of when the data was collected (up to July 31) tells you a lot though about how accurate these estimates may be for today. This also may be why the market pulled back this week on what would normally be considered bullish wheat news, so watch for the basis to creep higher if wheat futures values remain suppressed. Therein, I’ll be putting more weight on the farmer survey-based estimates collected through August 31, which comes out next week on Thursday, September 14. Using the average of the last five years between their model and survey-based reports, StatsCan tends to increase their spring wheat production number by 0.6 per cent or roughly 200,000 MT, but drop durum output by 0.4 per cent or about 70,000 MT. It’s worth noting that in 2021, when we also experienced dry conditions, from the August to September report, Statistics Canada dropped spring wheat production by 781,000 MT (or almost five per cent), while durum production fell by more than 450,000 MT, or an 11.3 per cent drop from the August estimate. Are we in for a repeat next week?

The reality is that this year, Western Canadian crops reached peak health ahead of normal, and thereby, with the accelerated crop development, peak yields are inherently stunted. As were move through September, we’ll likely see a bottom form (if not already here), but again, I’m not focused on making sales right now, but instead on executing on a safe harvest and ensure I’m taking good samples and getting multiple assessments done.

To growth,

Brennan Turner

Independent Grain Market Analyst