What 2021 Will Bring for Wheat Markets

A reflection on the past year can be a guide as to where we go next and that’s certainly something to consider right now as it relates to grain markets. The end of 2020 came with some relief but we woke up the next day with the reality that we’re still dealing with the COVID-19 pandemic. And this pandemic, coupled with some trade restrictions and drought concerns in South America, has fueled a rally in grain markets that has rarely been matched. As the table below illustrates, the performance on the futures board alone in the last quarter of 2020 shows the impact of these 3 factors on grain markets.

But flipping the calendar into 2021 paints a much different picture of what the market is expecting once combines start to roll again in the fall. 2021 new crop contracts are well-below what spot movement is trading for as it relates to corn (50¢/bu), oats (50¢/bu), and especially soybeans ($2/bu) and canola ($96/MT or $2.20/bu). However, wheat is the only grain where 2021 new crop prices are higher than what you can sell old crop for today, save for Chicago SRW wheat.

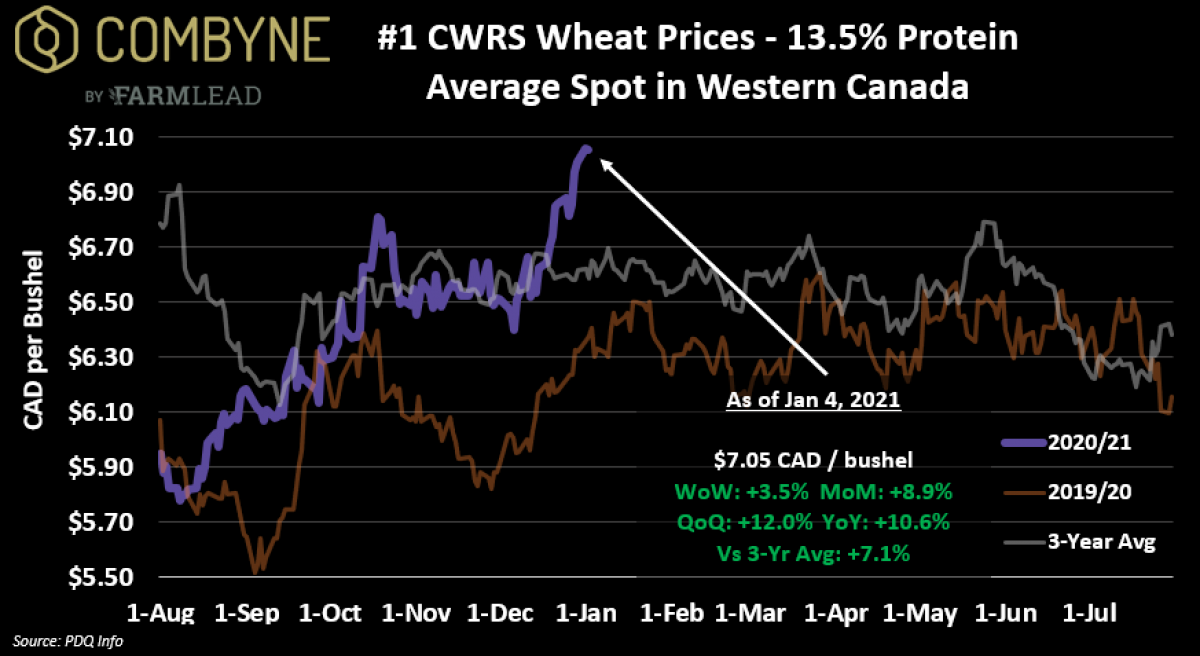

On the cash markets in Western Canada, new crop HRS wheat prices for September 2021 movement are virtually the same as what they are for today’s spot price for immediate movement. Compared to a year ago though, new crop cash HRS wheat prices are actually sitting about 70 – 90¢ CAD/bushel higher (about 20 cents of this is attributed to better basis and the rest to new crop futures values being higher today than they were a year ago). Looking at the spot price chart, the current rally in cash HRS wheat markets could start to fade in the coming weeks, unless weather concerns in South America continue to drive the broader complex higher.

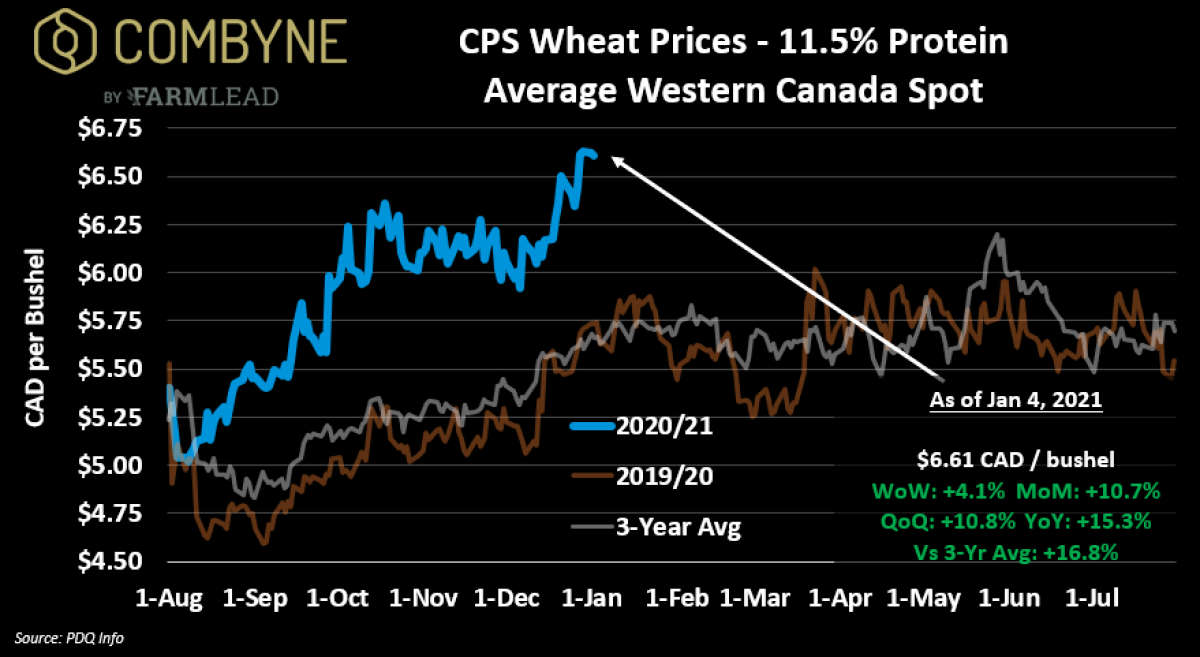

Comparably, CPS wheat prices are full $1.00/bu higher than where they were a year ago, but this is almost wholly because hard red winter wheat values on the futures board in Kansas City are nearly a dollar higher as well! If dryness concerns in the U.S. Northern Plains continue, then KC futures could continue to go higher, and so will low-protein wheat prices in Western Canada.

That said, whether it’s for new or old crop opportunities, said low-protein wheat prices in Canada continue to be one of the profit darlings of the crop rotation. For this reason, I expect to see a lot more SWS, CPS, and GP-type wheat seeded this year and eventually, this will put pressure on the cash price, but it will largely be reflected in the basis. Thus, locking in some new crop low-protein wheat contracts in the next couple of weeks is a smart move to guarantee some profits. However, if said dryness persists in American Southern Plains or in other winter wheat-growing areas, we might see values maintained, if not inch up a bit because of futures continuing to go higher.

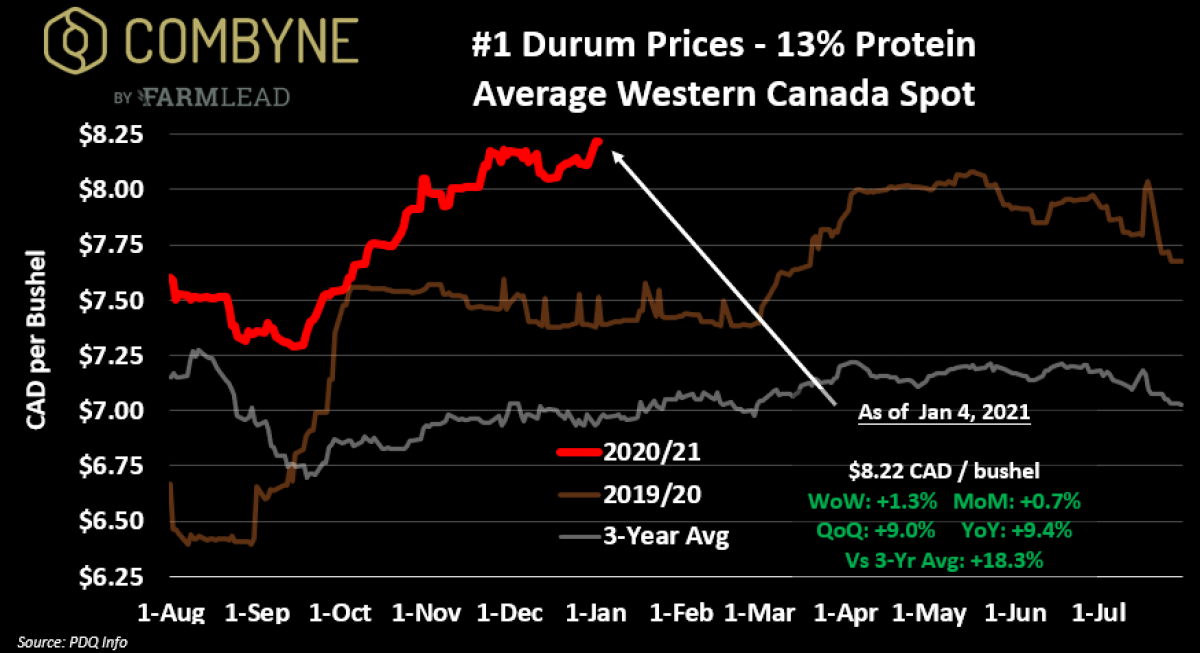

Finally, in durum, I’m expecting to see some sideways trading for the foreseeable future, for both spot and new crop prices. Even accounting for Agriculture Canada increasing durum carryout by 300,000 MT to 1.1 MMT (which is 22% below the five-year average), where durum prices will go will largely be a function of how the European and North African durum harvests perform. I’m mindful, however that some recent sales into these markets suggests the current $8.25 average spot price in Western Canada could move up by about 50 cents.

Overall, compared to the rallies seen in corn, oats, canola, and soybeans, wheat looks like that old, ugly piece of equipment in the yard that you hate to look at but have to remind yourself that it still runs fine! Nonetheless, there have been some great opportunities that we’ve seen this past year, and it’s worth taking an hour or two to reflect on them and use the charts above as references but just keep in mind that the charts are all spot prices. To help ascertain best new-crop pricing opportunities though, in next week’s column, you’ll see some new crop pricing perspectives in chart form!

To growth,

Brennan Turner

President & CEO | FarmLead.com