Summer Bottoms

Grain markets continued to see selling through the middle of July as good growing conditions and higher yield expectations are driving values lower. The USDA’s July WASDE surprised the market with lower-than-expected ending stocks for both corn and soybeans, but wheat inventories continued to increase on better yield prospects. The new demand for corn and soybeans was welcomed but is unlikely to offset the reality that this year’s crop is looking pretty good, plus U.S. farmers are reportedly still holding onto around 3 billion bushels of last year’s crop (the largest volume since 1988)! As EU tariffs on Russian agricultural goods come into effect, the Kremlin is open to re-starting negotiations for a new Black Sea Grain Deal to help Ukraine grain move through the region more safely. More broadly, general market sentiment is that former President Trump looks more likely headed back to the Oval Office after surviving the assassination attempt this past weekend.

USDA Says Larger 2024 Wheat Crop

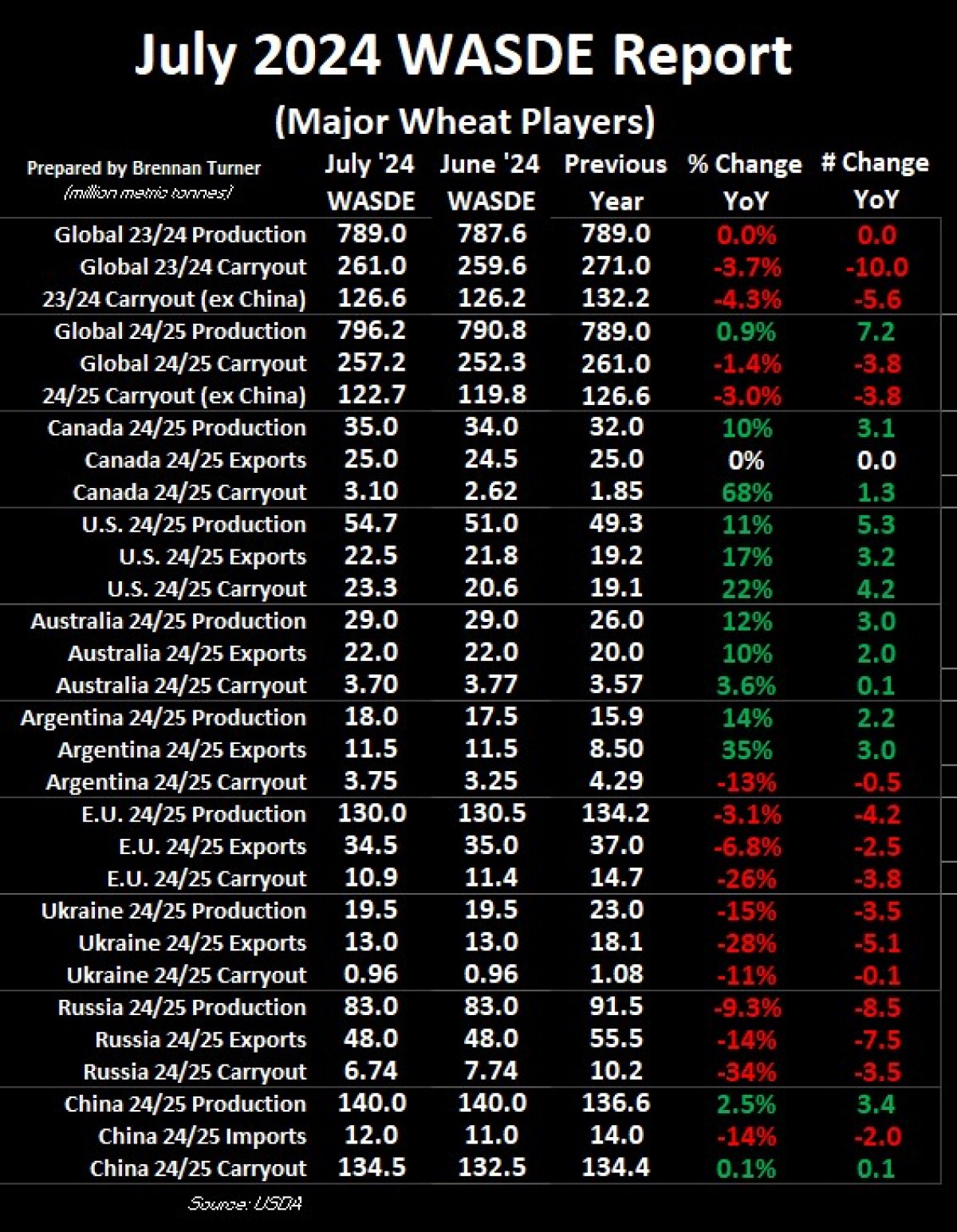

- July WASDE report on Friday, July 12th showed an increase in both production and ending stocks for the 2023/24 and 2024/25 crop years.

- Russia’s old crop 2023/24 wheat exports were raised by 1.5 MMT to 55.5 MMT

- China’s old crop wheat imports were raised by another 1 MMT to 14 MMT (this is an increase of 3 MMT in just the past 3 months)

- Global 2024/25 wheat production was raised by nearly 5.5 MMT, with ending stocks (excluding China) upped by almost 5 MMT.

- Canada’s wheat harvest was increased by 1 MMT to 35 MMT, with exports raised by 500,000 MT to 25 MMT.

- Average U.S. wheat yields were raised by 2.4 bushels per acre to 51.8, adding 3.64 MMT (or ~13M bushels) to the production column.

- Despite the Black Sea region still battling through hot, dry weather, the forecasts for Russia and Ukraine didn’t change.

- Private estimates for Russia’s wheat harvest range from 82 – 85 MMT

- EU’s wheat harvest was lowered by 500,000 MT but there may be more production cuts coming as the same day of the USDA’s WASDE, FranceAgriMer published its updated estimate for France’s soft wheat crop of 29.65 MMT, a 15% decline year-over-year.

- The drop is due to the wet conditions, with only 57% of the crop rated good-to-excellent (G/E), a large delta from the 80% rating a year ago.

- France’s wheat harvest has been slow too, with only 4% of the crop off, compared to more than ¼ of fields cut by now this time last year.

- The USDA raised U.S. wheat production estimates on generally good growing conditions, namely more moisture in the Northern Plains, albeit the Southern Plains remain dry.

- American hard red spring wheat production of 532M bushels (or about 14.5 MMT) would be a 14% jump year-over-year, despite only 70,000 more acres getting seeded than last year

- With the higher production, HRS wheat imports are forecasted at 50M bushels, down about 21% year-over-year (most U.S. HRS wheat imports come from Canada).

- Despite HRS wheat exports increasing by 11% to 260M bushels (or ~7 MMT), ending stocks should climb by 21% to 230M bushels (or 5.26 MMT).

- U.S. durum production is estimated to climb by more than 50% from last year to over 2.4 MMT, which was also about 20% higher than what the market was expecting to see.

- Some private estimates have put the U.S. durum crop as high as 3.5 MMT (the record is a 3.76 MMT harvest in 1998/99.

- Even with 11% more exports at 30M bushels (or ~816,000 MT), U.S. durum ending stocks are estimated at a 5-year high of 36M bushels (or nearly 1.1 MMT).

- American hard red spring wheat production of 532M bushels (or about 14.5 MMT) would be a 14% jump year-over-year, despite only 70,000 more acres getting seeded than last year

More Moisture = More Canadian Wheat

- Combination of cool and wet conditions in Western Canada contributed to most of the Prairies’ drought conditions being alleviated (save for a few pockets, namely Alberta’s peace region and some parts of southern Saskatchewan).

- 78% of Alberta’s spring wheat crop is rated G/E, up from 46% a year ago.

- 90% of Saskatchewan’s spring wheat crop is rated G/E, the best July measurement for the province’s crop since 2016!

- Manitoba’s spring wheat crop ratings are the worst out of the three Prairie provinces with roughly 65% of field rated G/E.

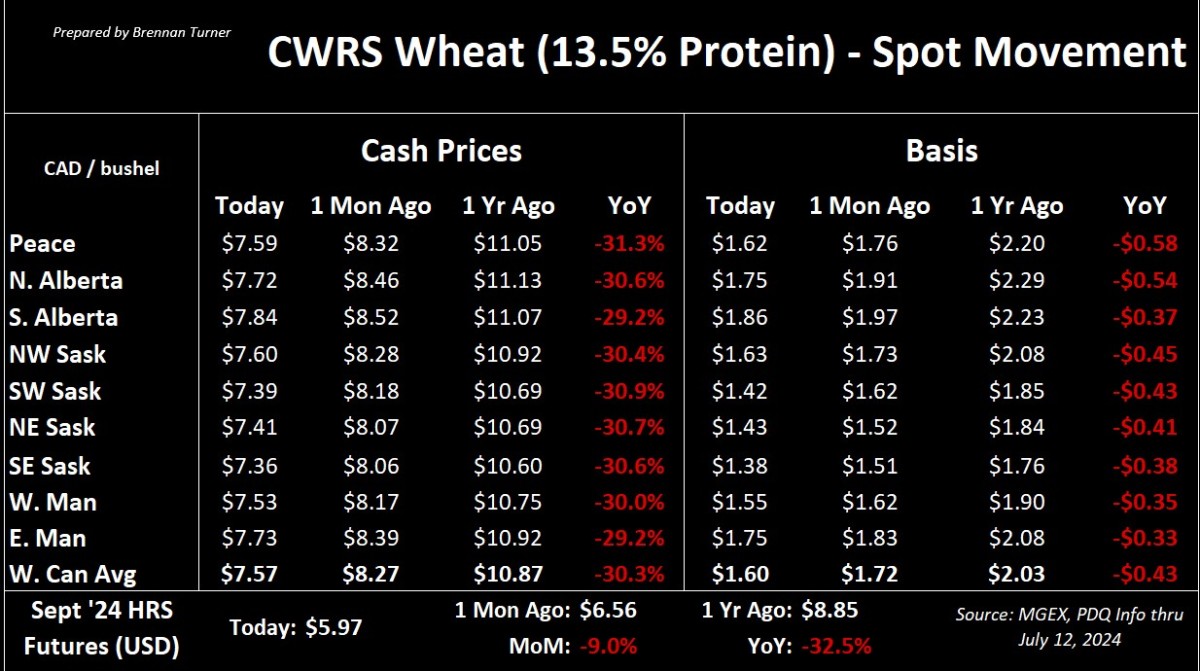

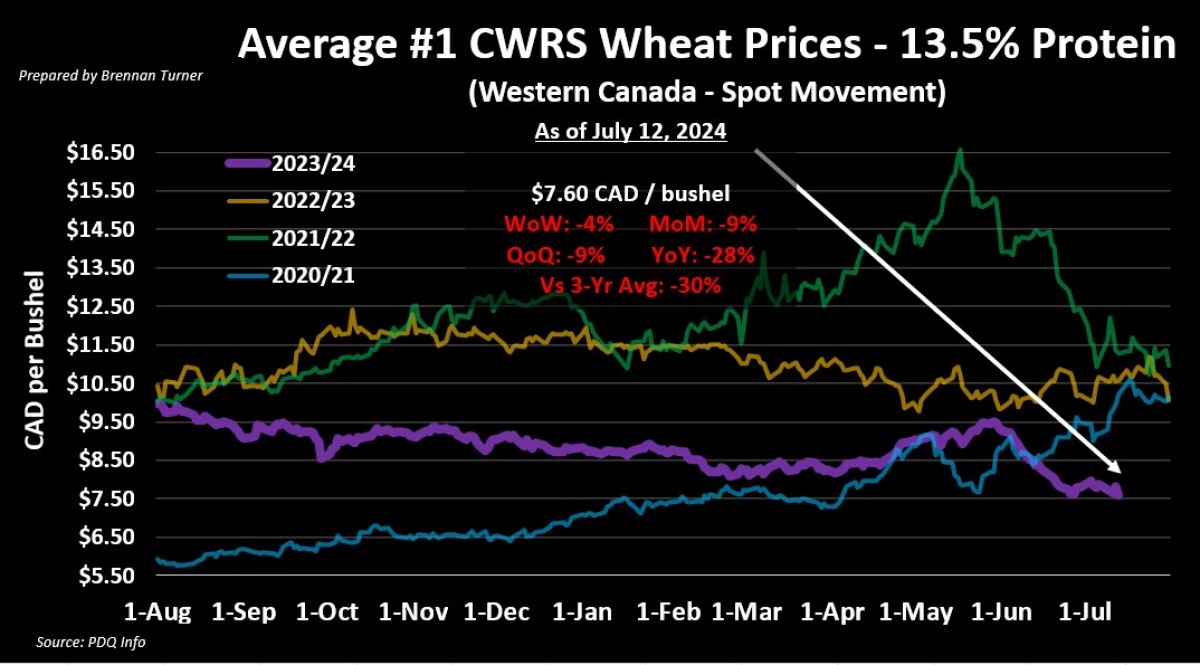

- The better growing conditions are being reflected in both old and new crop HRS wheat prices, which are down about 10%, with a trend that looks closer to the 2021/22 crop year finish and 2022/23 crop year start (green and orange lines respectively, in the chart below).

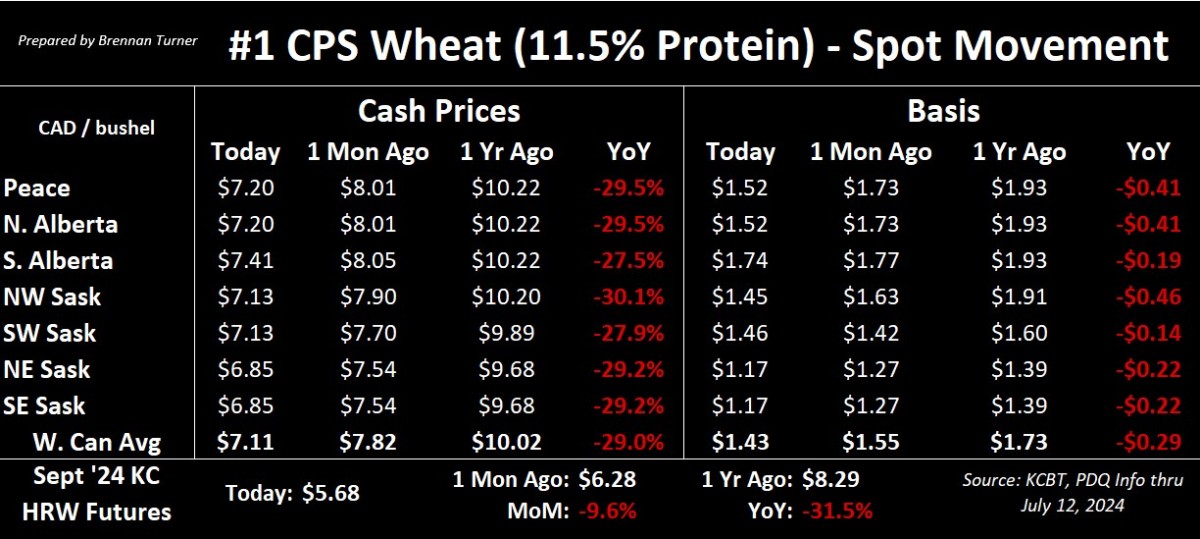

- CPS wheat values have dropped by a similar amount, and are also mirroring the finish the 2021/22 crop year.

- As the growing season moves along, and the potential size of the crop is better understood, we’ll start to see a bottom for prices, and usually for spring wheat, it’s around the end of July (or the switch of the crop year calendar).

- This would suggest that our next sale point will likely come in late September or October.

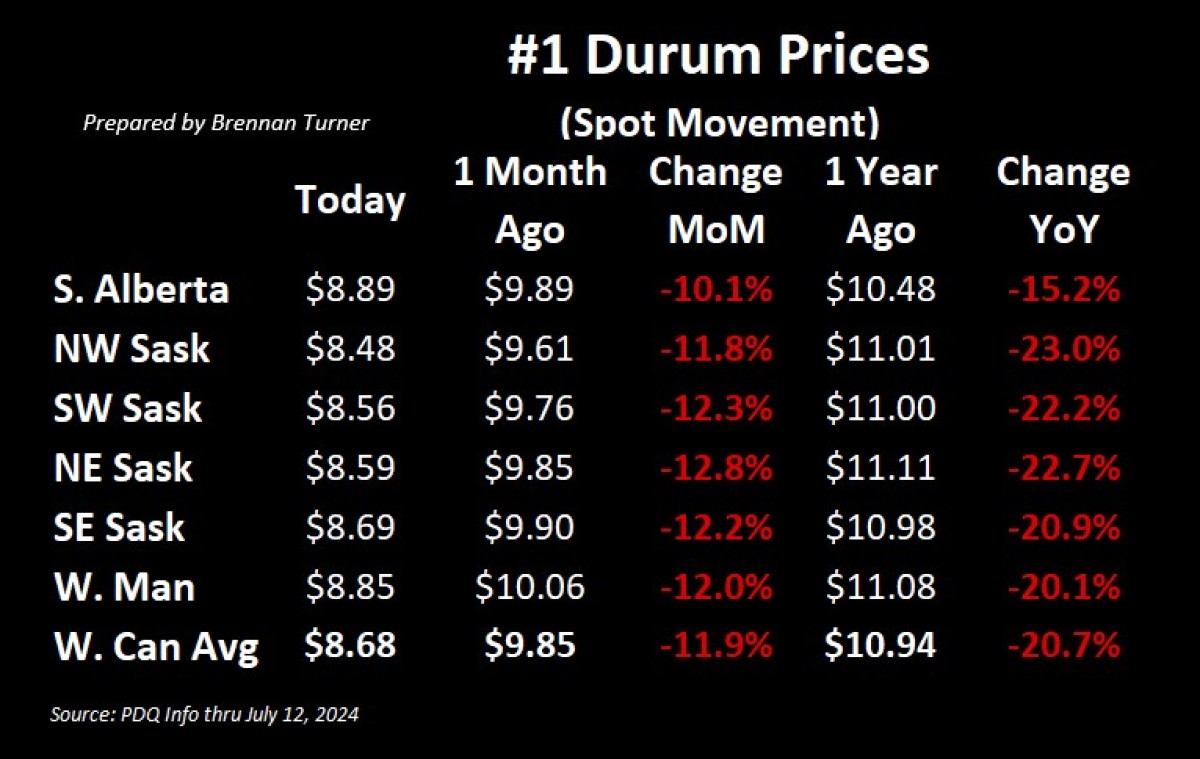

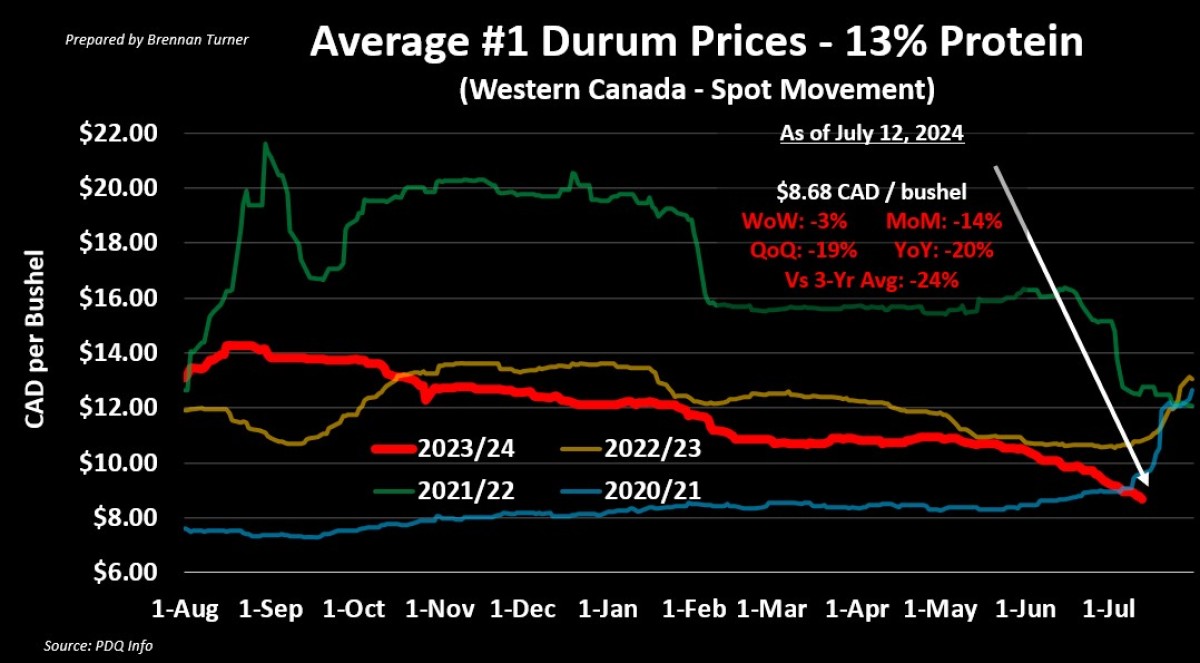

A Record Durum Crop?

- Like spring wheat, durum yield prospects across the Canadian Prairies look very promising, thanks to better growing conditions (read: not hot and dry and missing basically every beer cloud, which has been the case the last couple years).

- Alberta’s durum crop was last rated as 79% G/E, which would be the best in four years.

- Saskatchewan’s durum G/E rating is at 93%, and like the province’s spring wheat crop, the best in eight years.

- Some private estimates for Canada’s durum harvest are as high as 7.5 MMT, which would be second to only 2016/17’s 7.76 MMT record haul (note: crop ratings are currently the best since that same year).

- In Europe, COCERAL’s last durum production estimate was 7.27 MMT, with better yields in Spain offsetting a smaller harvest in Italy.

- This basically matches last year’s durum harvest in the EU, which also means Italy will be looking to import a healthy amount in 2024/25.

- French durum crop’s ratings remain weak, with just 64% rated G/E.

- With more competition globally (looking at your Turkey and Russia), Canadian durum prices have been on a steady decline since the start of the 2023/24 crop year.

- With $8 CAD/bushel handles for spot movement now the standard across Western Canada, this year’s larger yields are likely been priced in, but we could see even more downside into September.

- Looking at the orange line of the 2022/23 crop year in the chart below, our next sale could very well be at the current levels, but in 3 months, around the end of October or start of November.

- Translation: if you’re looking to secure some cashflow before harvest, now may be the time to pull the trigger on old crop.

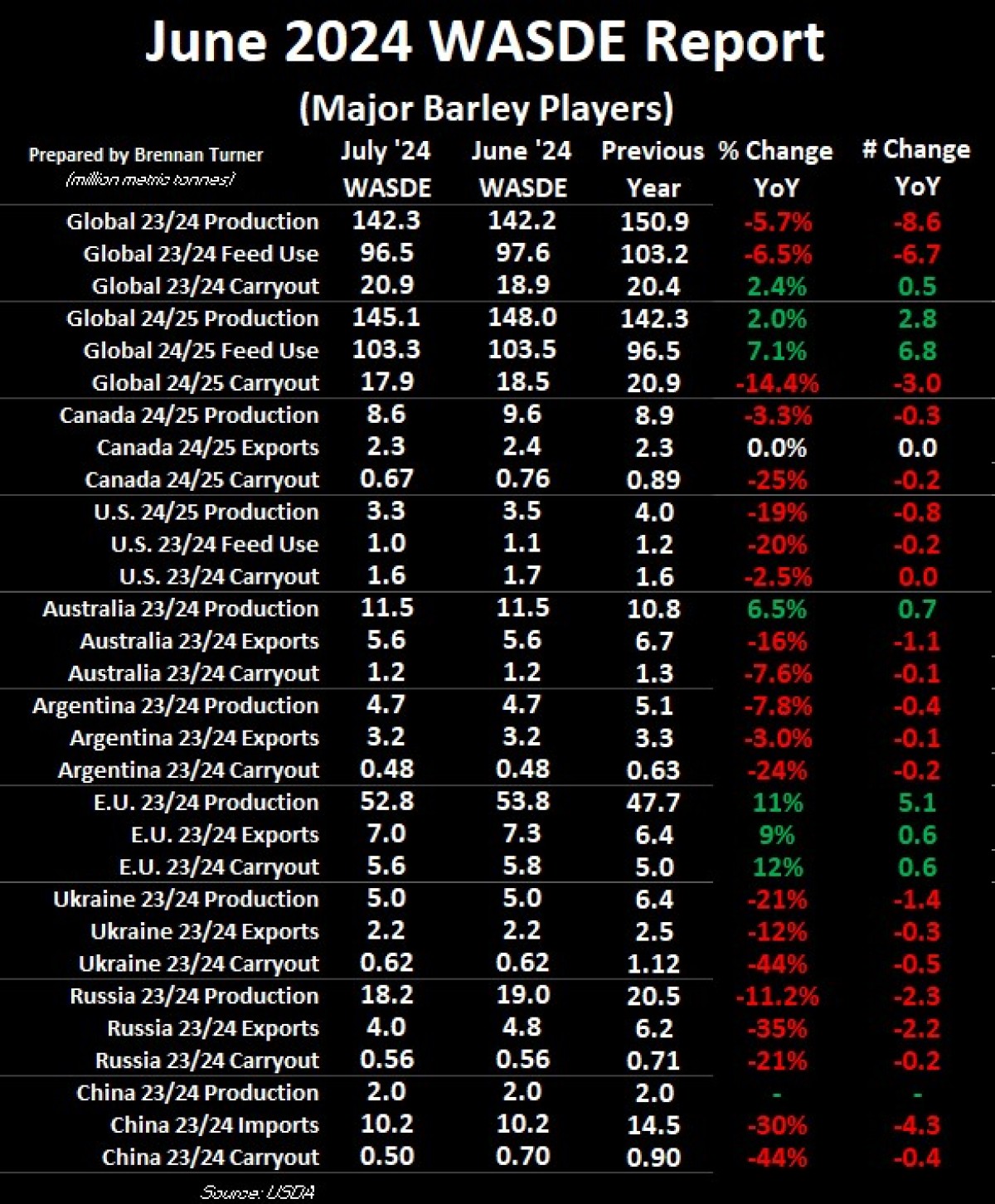

Smaller Global Barley Harvest?

- The USDA’s July WASDE showed a nearly 3 MMT decline the global barley harvest from the June report, largely because of smaller prospects in the EU, Russia, and Canada.

- The EU barley harvest was cut by 1 MMT to 52.8 MMT, while Russia’s barley harvest was lowered by 800,000 MT to 18.2 MMT.

- Strategie Grains thinks Europe’s barley crop could be even smaller, dropping their estimate last week by 900,000 MT to 51.3 MMT.

- About half of France’s barley fields have now been combined, at consultant group Agritel is estimating the country’s harvest at just 7 MMT, or a 28% decline from last year’s 9.66 MMT harvest.

- The EU barley harvest was cut by 1 MMT to 52.8 MMT, while Russia’s barley harvest was lowered by 800,000 MT to 18.2 MMT.

- The USDA surprisingly reduced Canadian barley prospects by 1 MMT, largely reflecting the updated planted acreage estimates from Statistics Canada in June of 6.4M acres, down about 750,000 acres from their March survey.

- This sort of downgrade seems surprising though, as better yield prospects will certainly make up for some of the last acres.

- In Alberta, 77% of the 3.5M acres planted to barley is rated G/E, nearly double the rating at this time a year ago and the best since 2020.

- Saskatchewan, 90% of the 2.3M acres of barley are rated G/E, and like spring wheat and durum, the best conditions since 2016.

- For reference, Canada’s average barley yield in 2016 is still the record, with 72.5 bushels on every acre nationwide.

To growth,

Brennan Turner

Independent Grain Market Analyst