Promising Hiccups

Promising Hiccups

Grain markets see-sawed towards the end of July (and the 2023/24 crop year) as a small rally gave way to profit-taking last week in the complex. Both winter wheat exchanges hit contract lows while spring wheat wasn’t far behind. Corn and soybeans were able to squeak out a positive gain on the heels of dryness concerns in the U.S. but the selling is likely to continue since more rains are forecasted for the Midwest and other key production regions. Arguably, with the selling we’ve seen by farmers this month, the market has likely found a bottom for the next few weeks, or at least until some major crop tours roll out and early yield monitor results start coming in.

More broadly, the Bank of Canada cut their interest rate again, this time by 0.25% (with more cuts likely), and we’re expecting an update from the Canadian Industrial Relations Board on or before August 9th about the looming CP and CN rail strike. Given the potential of this year’s crop, more producer organizations are reminding their government that with global grain stocks at a 10-year low, the world needs Canadian grain more than ever and with no rail movement, it would be a major hiccup for the balance sheet of both the Canadian farmer and the government. As a heads up, this column will also have a new look as we flip the calendar to the 2024/25 crop year!

Trade Issues to the East?

- France’s soft wheat and durum crops continue to deteriorate, with the latest crop ratings at 50% and 58% good-to-excellent (G/E) respectively; this is the worst since 2016 and about one-third below the conditions a year ago.

- If France can’t supply what’s needed, international buyers may look to Russia who’s still expecting to harvest over 84 MMT of wheat, but their Rostov region – which accounts for ~11% of the country’s grain production – is likely to see a 38% decline in the harvest this year, due to early frosts in May and recent temperatures topping 50 degrees Celsius!

- With a smaller crop, more trade sanctions, and high state spending, Russia’s inflation of 8.6% is likely to continue to climb.

- Nearly 2 months into their 2024/25 crop year, Ukraine’s wheat exports are tracking 68% higher year-over-year at 1.3 MMT.

- Kazakhstan is banning the import of any wheat until the end of the 2024 calendar year after increased Russian imports in the first 6 months of the year has contributed to lower domestic prices and higher inventories.

- Turkey is also banning wheat imports until mid-October, due to heavy Russian and Ukrainian imports to date, but they’ll also be dealing with a smaller harvest, which the USDA’s office in the country just estimated at 18.85 MMT, down from last year’s 21 MMT haul.

Large 2024/25 Harvest Potential

- Argentina’s wheat crop is virtually all planted on the 15.6M acres, and the USDA’s attaché down there is forecasting a 18.6 MMT crop in 2024/25, slightly more than the official USDA estimate of 18 MMT.

- Brazil relies on Argentina for about 80% of its 3 – 4 MMT of annual wheat imports but is looking to be more self-sufficient and are investing in new tropical wheat varieties that can grow in their Cerrado region, which accounts for 22% of the country’s arable land but has more humid and hot weather.

- North Dakota’s spring wheat crop could see a record yield of 54.5 bu/ac this year, according to the Wheat Quality Council’s tour last week. This is well above the 5-year average of 42 bu/ac but still below the USDA’s current estimate of 56 bu/ac (and again, this would be a new record).

- The USDA’s Ottawa office pegged Canada’s total wheat crop at 35.5 MMT, in line with Agriculture Canada’s estimate this month of 35.4 MMT.

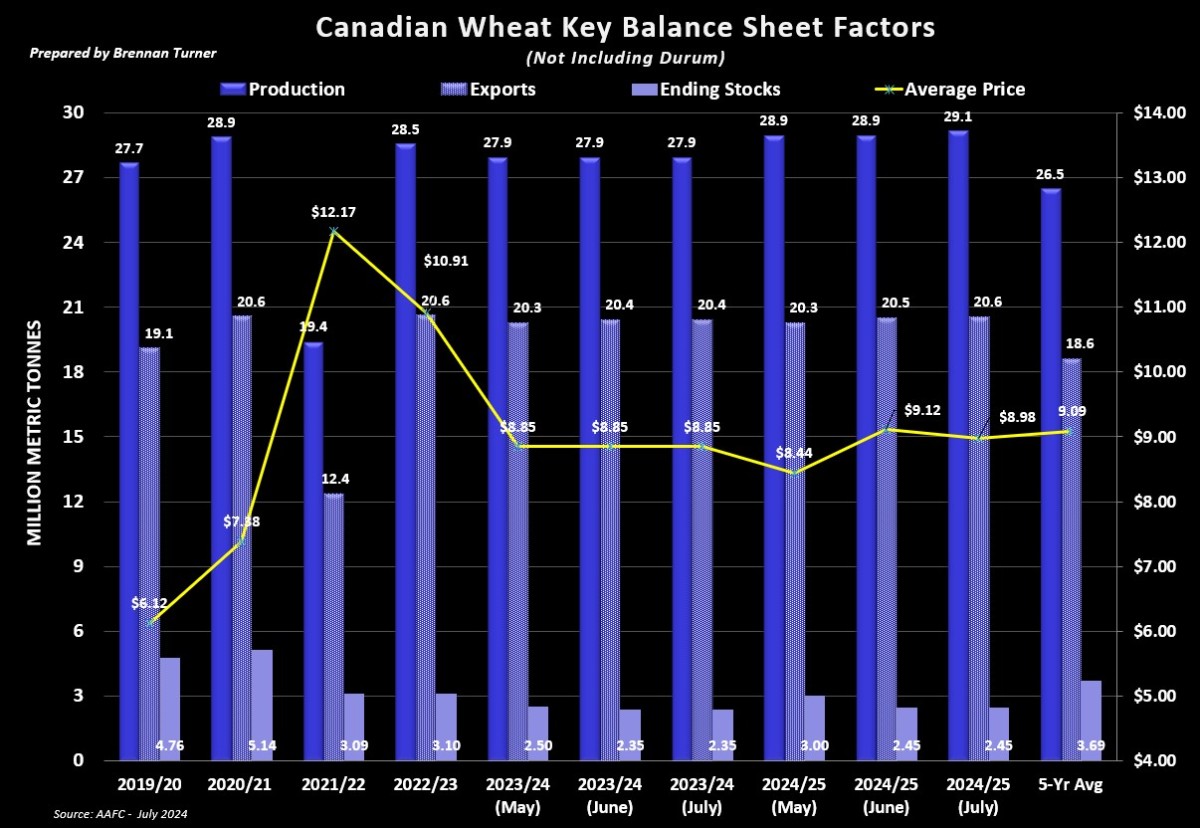

- Despite a 1.4% reduction in planted acres to 20.4M, AAFC is estimating total non-durum wheat output at 29.13 MMT, a jump of 4.4% year-over-year and 10% of the 5-year average.

- AAFC slightly raised 2024/25 domestic use and exports to keep projected new crop ending stocks at 2.45 MMT (would be the 2nd-tighest carryout, with the current 2023/24 crop year’s 2.35 MMT being the record)

- The recent heat to hit the Prairies have lowered some yield though: In Saskatchewan, spring wheat G/E ratings are down 13 points in the last 2 weeks to 76% G/E and in Alberta, spring wheat has dropped 18 points to 60% G/E. Conversely, Manitoba’s spring wheat crop ratings have improved slightly to about 74% G/E.

- While yield outlook may have dropped a bit, I’m reminded of the last few dry years still producing a yield (and without the heavy spring rains!)

- Despite a 1.4% reduction in planted acres to 20.4M, AAFC is estimating total non-durum wheat output at 29.13 MMT, a jump of 4.4% year-over-year and 10% of the 5-year average.

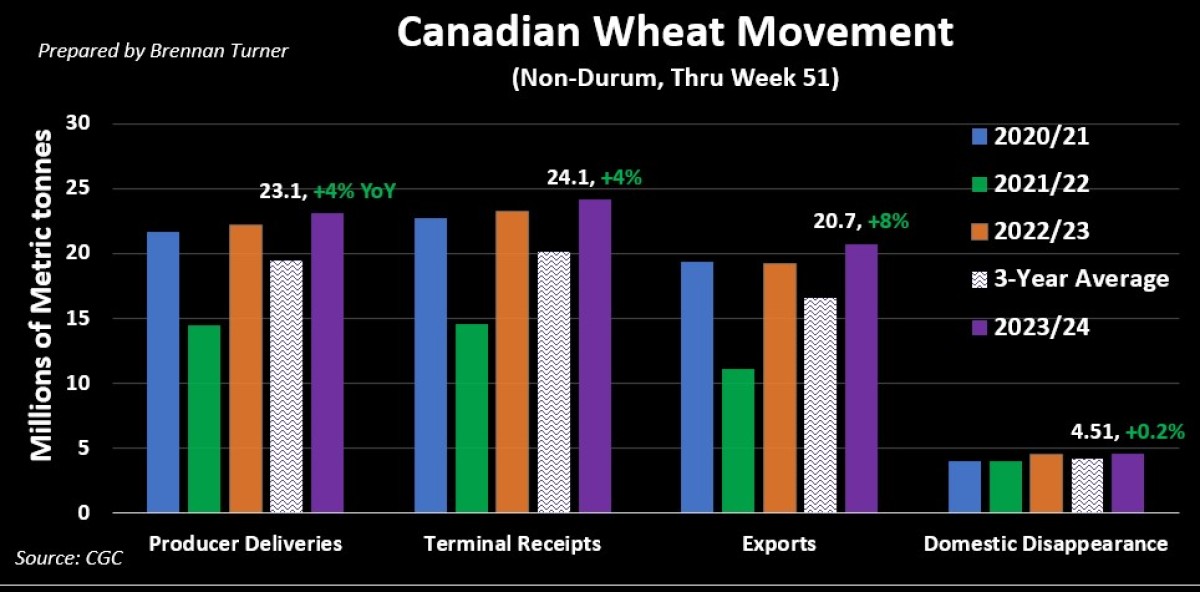

- Canadian wheat deliveries have slowed a bit, but exports and domestic use movement remains robust to end the crop year (a likely trend that will continue into the 2024/25 crop year).

Big Durum Harvest Too

- The Wheat Quality Council’s North Dakota crop tour pegged durum yields at 45.3 bu/ac, up from 43.9 a year ago, but also below the USDA’s official forecast of 46 bu/ac (which would also be a record).

- MarketFarms is pegging the average Canadian durum yield at 44 bu/ac, well above Ag Canada’s July estimate of 37.2, which was a 3.5 bu/ac jump from their June estimate.

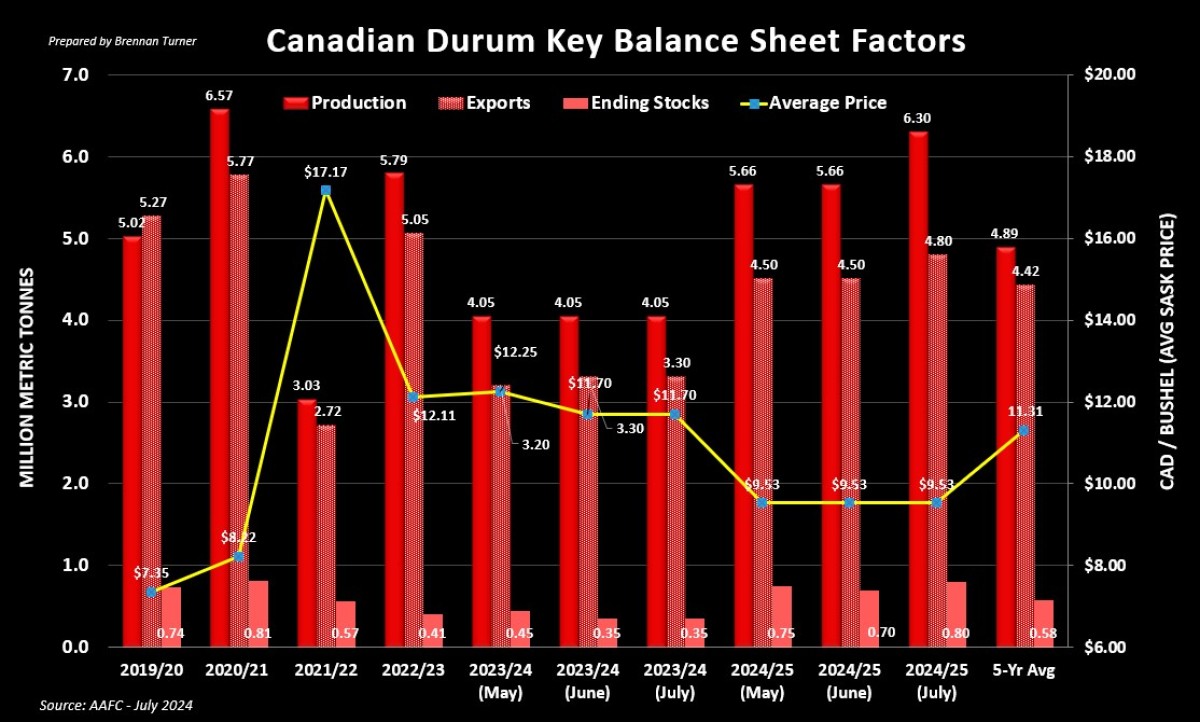

- The extra 645,000 MT in production that AAFC is now suggesting is mostly going to be taken by:

- More exports: +300,000 MT from last month’s estimate to 4.8 MMT (which would be +46% year-over-year with more shipments expected for Morocco and Tunisia), and

- Domestic use: +245,000 MT more for feed for a total domestic use of 1.075 MMT, which would be the largest since 2016/17 when 27%, or 2.1 MMT of the record 7.76 MMT harvest went into the feed category.

- Ag Canada’s yield estimate may be more realistic as Saskatchewan’s durum G/E ratings dropped from 83% to 55% in the last weeks of July!

- The extra 645,000 MT in production that AAFC is now suggesting is mostly going to be taken by:

- It’s likely that AAFC will raise old crop durum exports as we’ve already surpassed their forecast of 3.3 MMT, which should reduce ending stocks further below the record-low 350,000 MT currently forecasted.

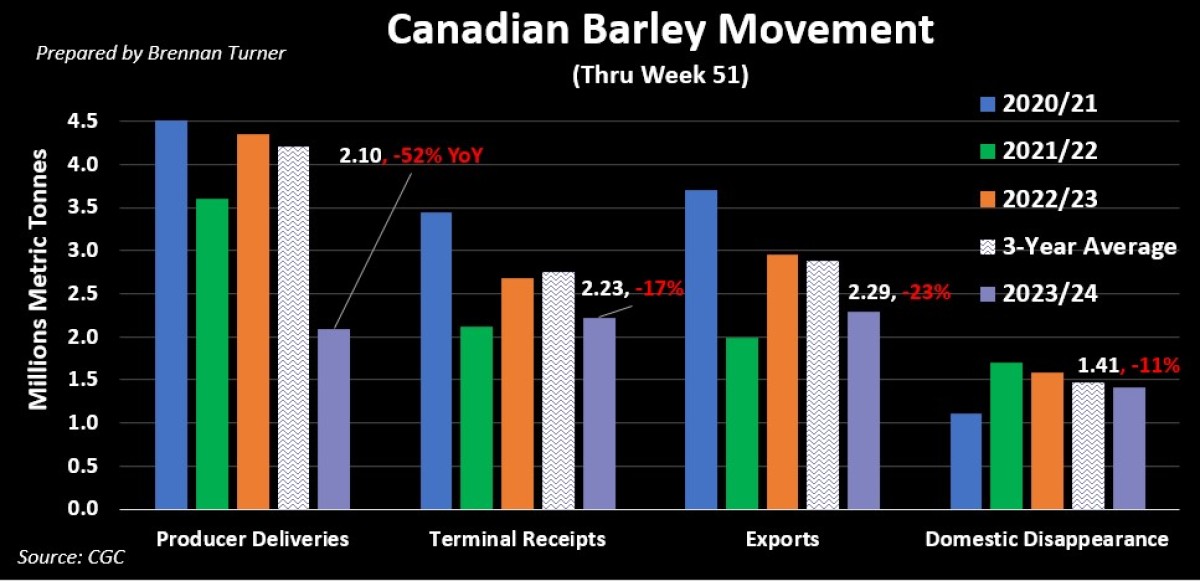

Surprising Barley Exports?

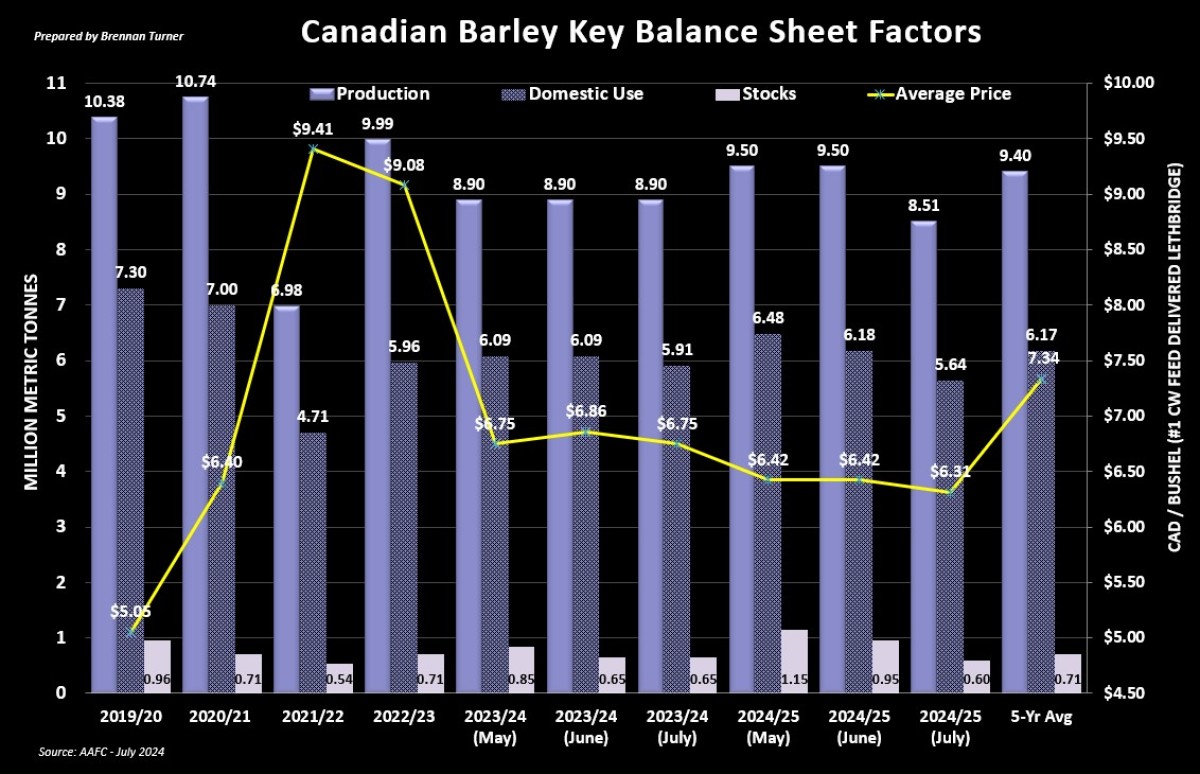

- Strong Canadian barley exports in June raised Agriculture Canada’s full 2023/24 crop year forecast to 3.13 MMT, with 2.35 MMT for grain and 780,000 attributed to product exports.

- For barley grain, China remains the #1 destination (84% of exports), with the U.S. (10%), and Japan (7%) distant secondary and tertiary markets.

- For malt, the U.S. is the primary market, owning 57% in 203/24, followed by Japan (22%), Mexico (14%), and South Korea (4%).

- Despite the surprising stronger international demand, weaker domestic use, namely feed demand, kept ending stocks at 650,000 MT, which is currently the second-tightest ever.

- For Ag Canada’s 2024/25 barley balance sheet up date, their estimating average yields at 67.3 bu/ac, up 10% year-over-year (MarketFarms is at 74 bu/ac).

- AAFC is forecasting 8.5 MMT in production (MarketsFarm is at 8.1 MMT).

- Despite a tight carryover of barley from 2023/24, 2024/25 exports are projected to still be around 3 MMT, while feed use is expected to fall by over 500,000 MT, or nearly 10%, year-over-year.

- At a project 600,000 MT carryout, it’s still looking like a tight balance sheet for Canadian barley again, but nonetheless, feed barley prices are forecast at the lowest in 5 years.

- Globally, it’s worth the reminder that barley stocks are set to fall to a record low of 18 MMT, with key exporters holding inventories well below their five-year averages.

To growth,

Brennan Turner

Independent Grain Market Analyst