Premium Erosion

Premium Erosion

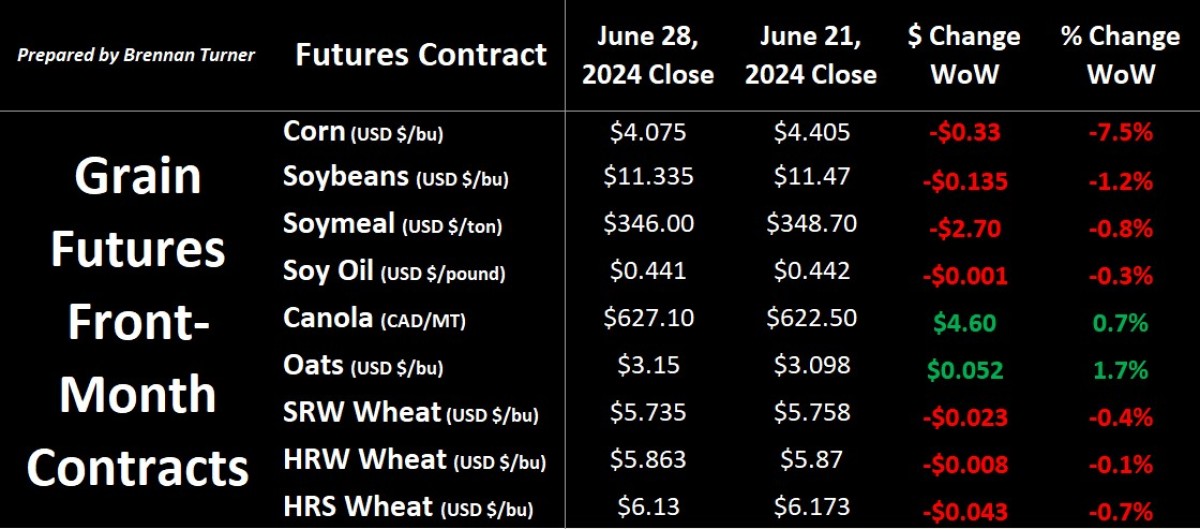

We continued to see heavy selling in the grain markets in the second half of June to amount to the worst monthly performance for the complex in two years. This week it was let by corn, as new crop contracts dropped nearly 33¢ USD/bushel last week, and 17¢ the week before that. The wheat complex and oats led the way in the 3rd week of June, with Chicago SRW wheat new crop futures down nearly 53¢ USD/bushel, Kansas City HRW wheat new crop down over 49¢ USD/bushel, and Minneapolis HRS wheat new crop losing 48 cents. On average though, the three wheat exchanges lost nearly 20% in June and so the market is telling us that what’s done is done and there’s a base yield potential priced in, meaning the focus will now be on week-to-week weather and any other geopolitical flare-ups. Specific to Western Canada, eastern Saskatchewan and Manitoba have had plenty of rain, while everyone I talk to say they could use some more sunshine and heat!

Leaning in though, the reason for the big decline in the last few weeks has been because of a few items converging on one another. First, concerns over Plant 2024 came and went, and the weather premium that was built up to a peak in late May has now been erased. Second, the Black Sea production concerns, due to a deadly combo of heat and frost, were fully priced in. And third, the USDA shared its updated estimates of acres planted in the U.S., as well as grain stocks as of June 1 and it was pretty bearish across the board, especially for corn. Unsurprisingly, we’re a far cry from where those new crop contracts started the 2024 calendar year, six months ago. Finally, there’s the usual fund positioning, and with the expiration of July options happening the 3rd week of June, we saw some massive selling from the managed money players.

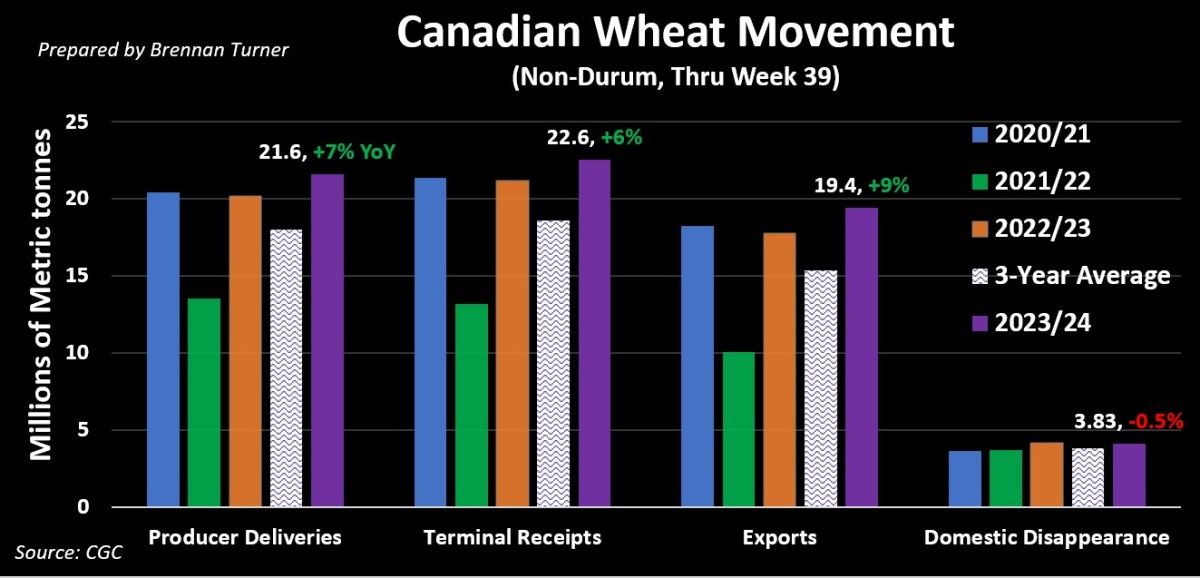

With seeding completed, we’ve seen more producer deliveries in the last few weeks, with farmers emptying bins and securing cashflow. Wheat and durum remain on pace to hit the full crop-year targets that Agriculture Canada has set out but there are certainly question marks as to how the 2024/25 crop year will start. The Canadian government is in the midst of determining how best to manage the proposed strike of the Rail workers Teamsters, namely if the movement of Canadian food and feed supply is considered essential. Pointing to the COVID-19 pandemic and how the movement of Canadian foodstuffs was essential, the grain industry is asking what’s the difference now. The railways agree, in that, they can’t just split up their networks to essential and non-essential corridors, and without grain movement deemed essential, its movement could come to a halt.

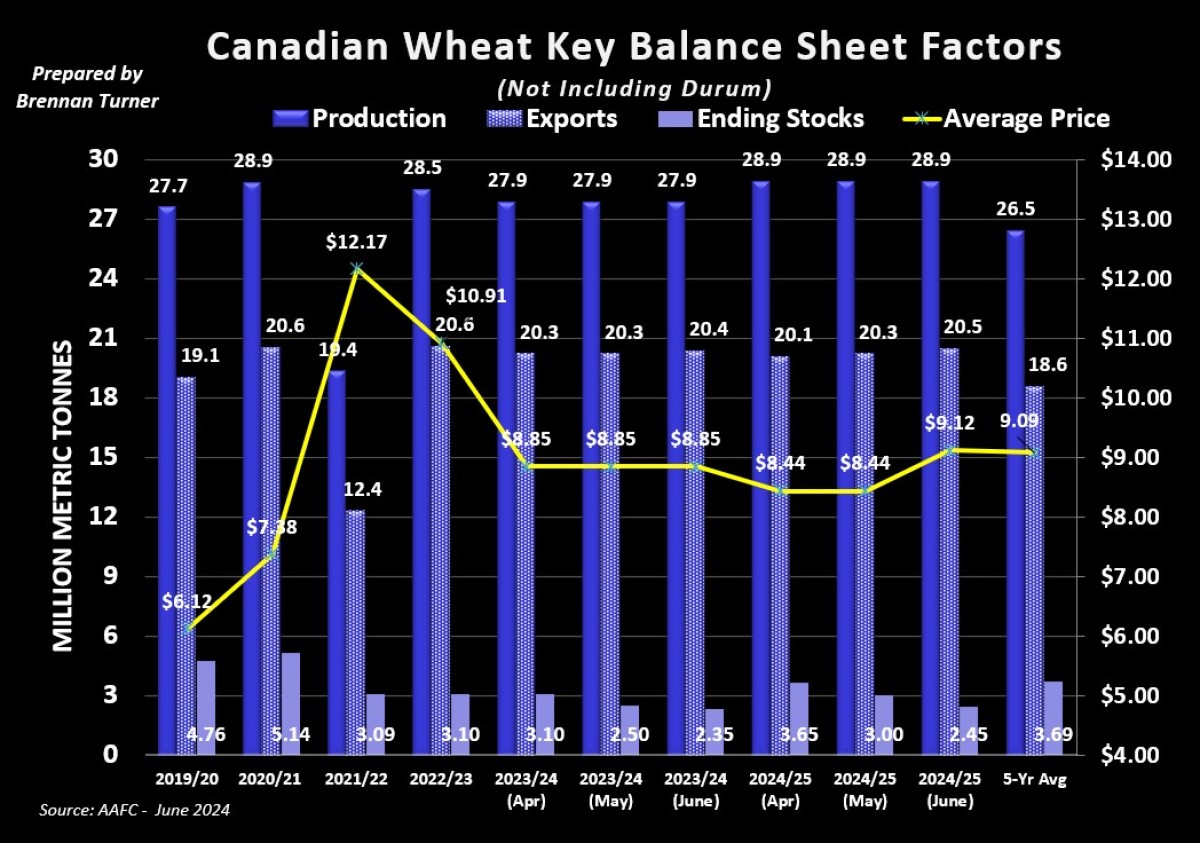

AAFC Raises Wheat Exports (Again)

- In their June report, AAFC also raised non-durum wheat exports by 150,000 MT to 20.4 MMT, which is about 200,000 MT short of the record volume shipped in the 2022/23 crop year.

- To achieve this, we only need to average less than 200,000 MT per week for the last 5 weeks of the crop year.

- 2024/25 exports were also raised by 250,000 MT to 20.5 MMT.

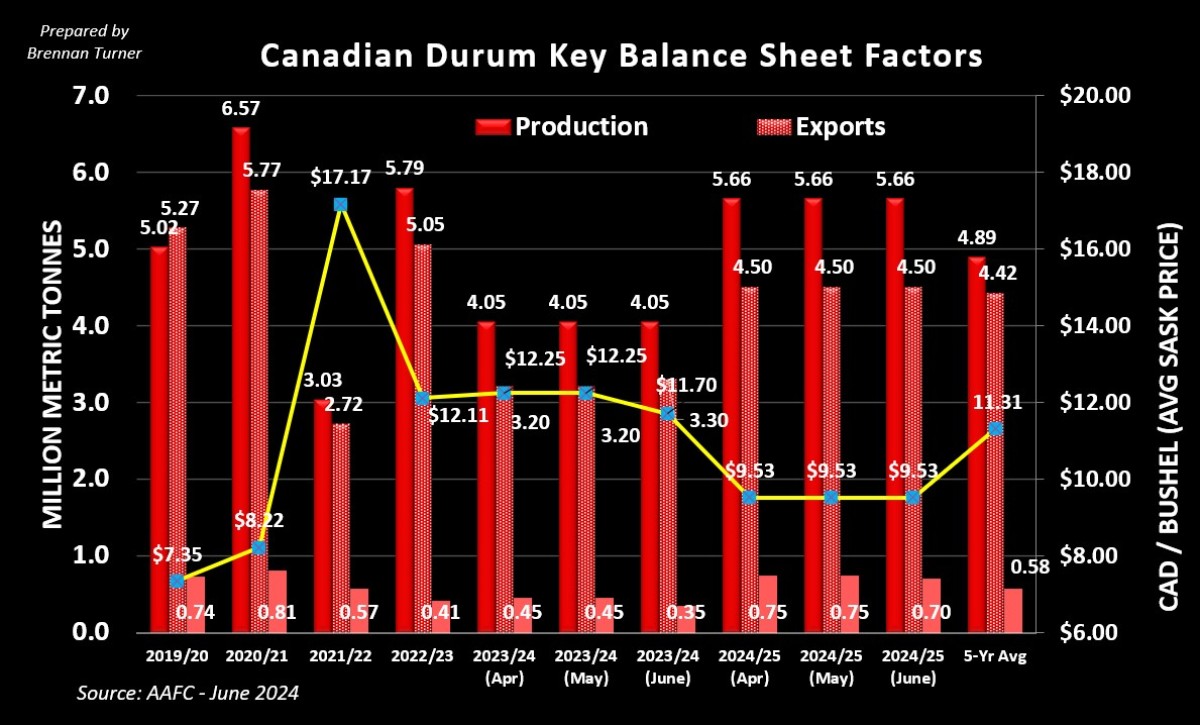

- Agriculture Canada raised old-crop durum exports by another 100,000 MT to 3.3 MMT, pushing ending stocks lower by the same amount to 350,000 MT (a record low).

- COCERAL is estimating the EU will harvest 7.27 MMT of durum, with Italy’s weaker yields being offset by better numbers in Spain.

- There’s also quality concerns of France’s durum crop after getting hit with a lot of rain.

- The USDA is now estimating that Turkey will produce 4.4 MMT of durum (out of 20 MMT total wheat production) and export 2 MMT of pasta-making cereal.

- The export number is the same for the Turkish Pasta Industrialists Association, but they think the harvest will top 4.9 MMT.

- Russia’s Ministry of Ag continues to suggest a durum harvest this new 2024/25 crop year of 2 MMT a relatively large crop for them.

- With the new EU tariffs on any Russian agricultural goods, one theory being thrown around is Turkey could import Russian durum and increase its own exports.

- After another dry year, Morocco and Algeria could also be a new customer for Russia, pending approval internally as this hasn’t been done before.

- Conversely, Algeria has leaned on Russia for the last few years for much of its bread wheat, but importing durum would a net new trade item for them.

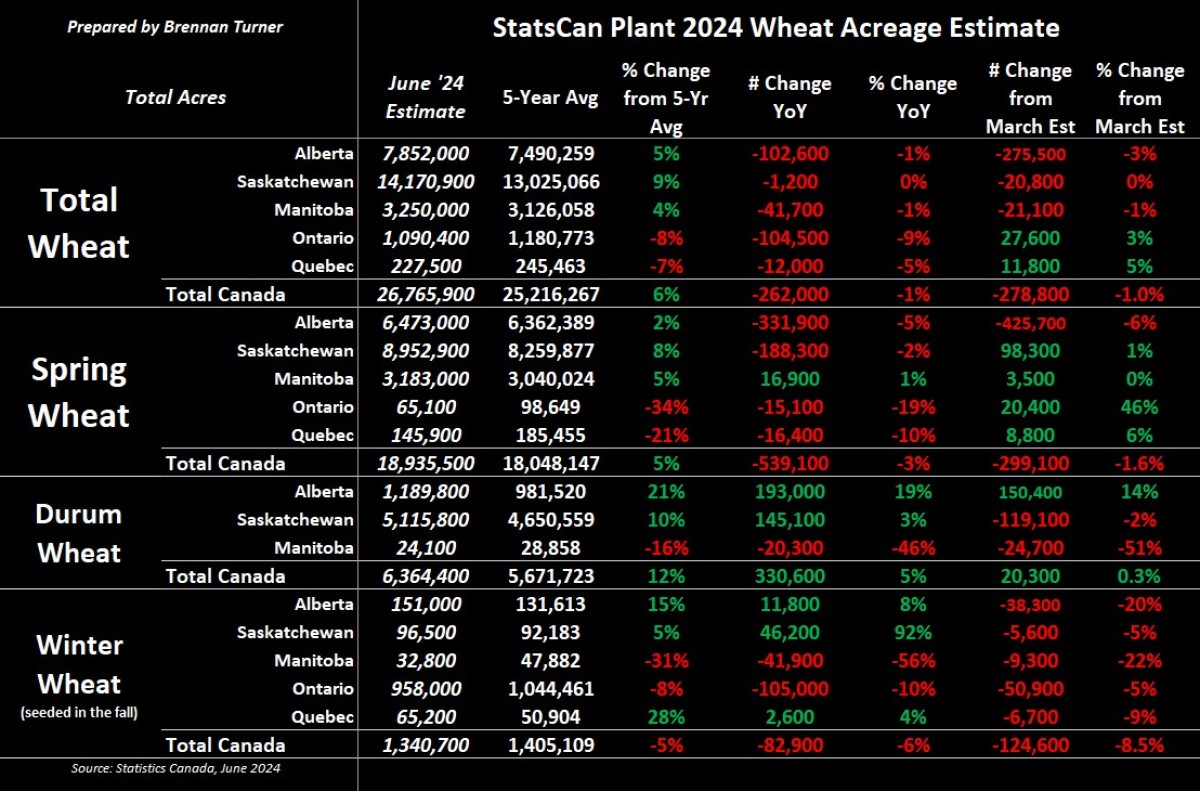

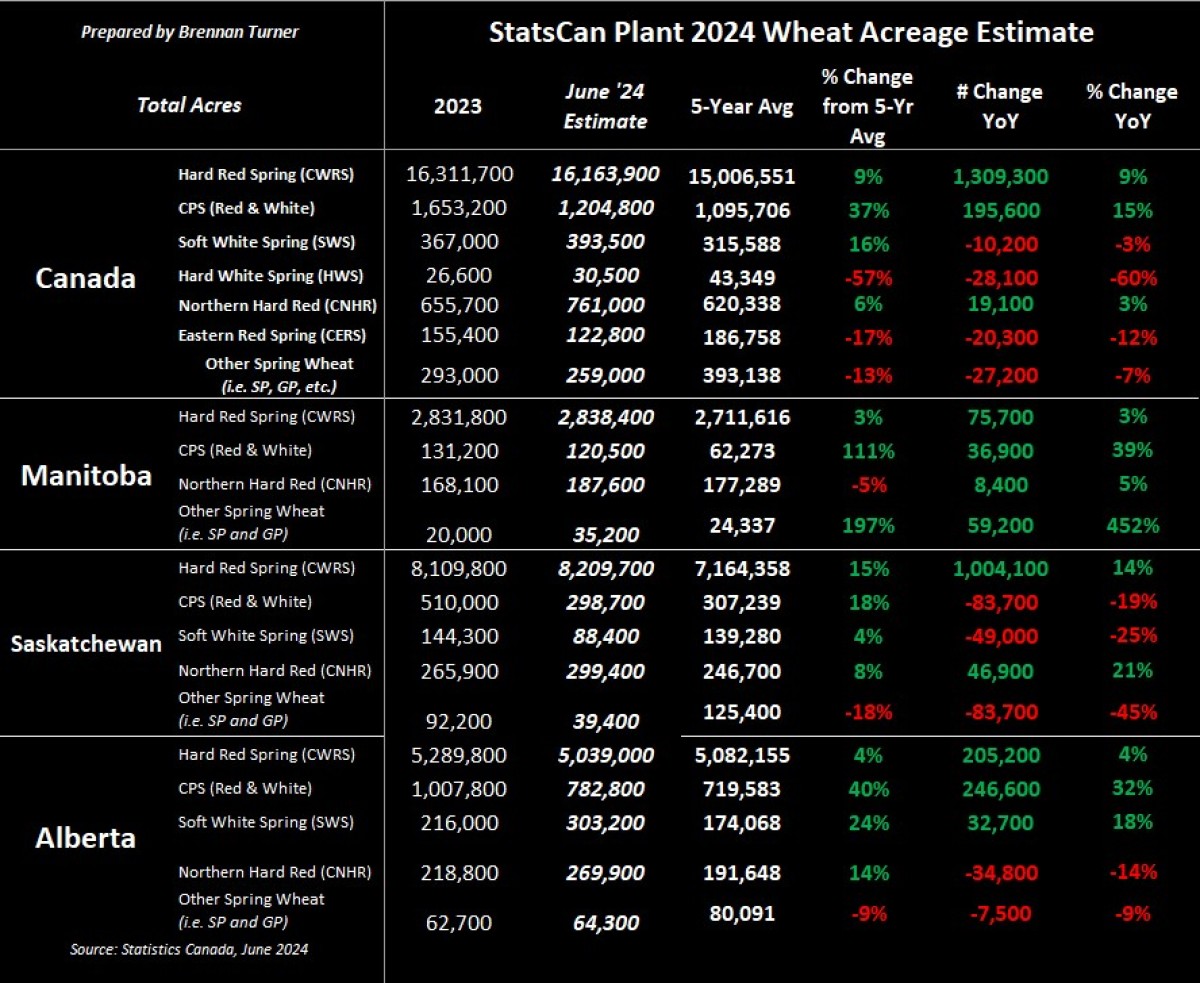

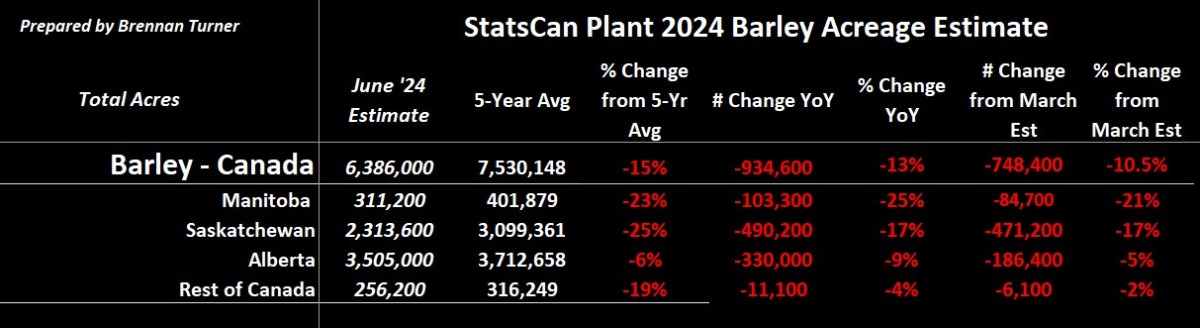

StatsCan Lowers Wheat, Barley Area

- On Thursday, June 27, Statistics Canada shared its updated estimates of what happened in Plant 2024, showing a lot less barley, oats, and spring wheat (at least in Alberta), but way more canola and lentils.

- About 125,000 acres of winter wheat were lost between the March estimate and now (AKA it didn’t make it!), with Ontario losing about 60,000 and Alberta dropping nearly 40,000 acres.

- Spring wheat acres were lowered by nearly 300,000 from the March estimate, with Alberta dropping by over 425,000 acres, but the other provinces making up the difference.

- At a total wheat area of just under 26.8M acres, this is down about 1% year-over-year but still more than 1.5M higher than the 5-year average.

- As is usually the case, hard red spring and CPS wheat (both red and white) account for nearly 90% of all spring wheat acres.

- Instead, there was more durum seeded in Alberta (to the tune of 150,000 acres more), whereas Saskatchewan and Manitoba farmers planted less for a slight overall increase.

- The reduction in barley production is notable though as, at just under 6.9M acres, it’d be the smallest area planted with the cereal in Canada since the 5.77M acres in 2017.

- Saskatchewan saw the largest reduction, down nearly 500,000 acres from the March estimate!

- Expectations are, however, that based on the start the crop is getting, bigger yields could easily offset this sizeable reduction in acres.

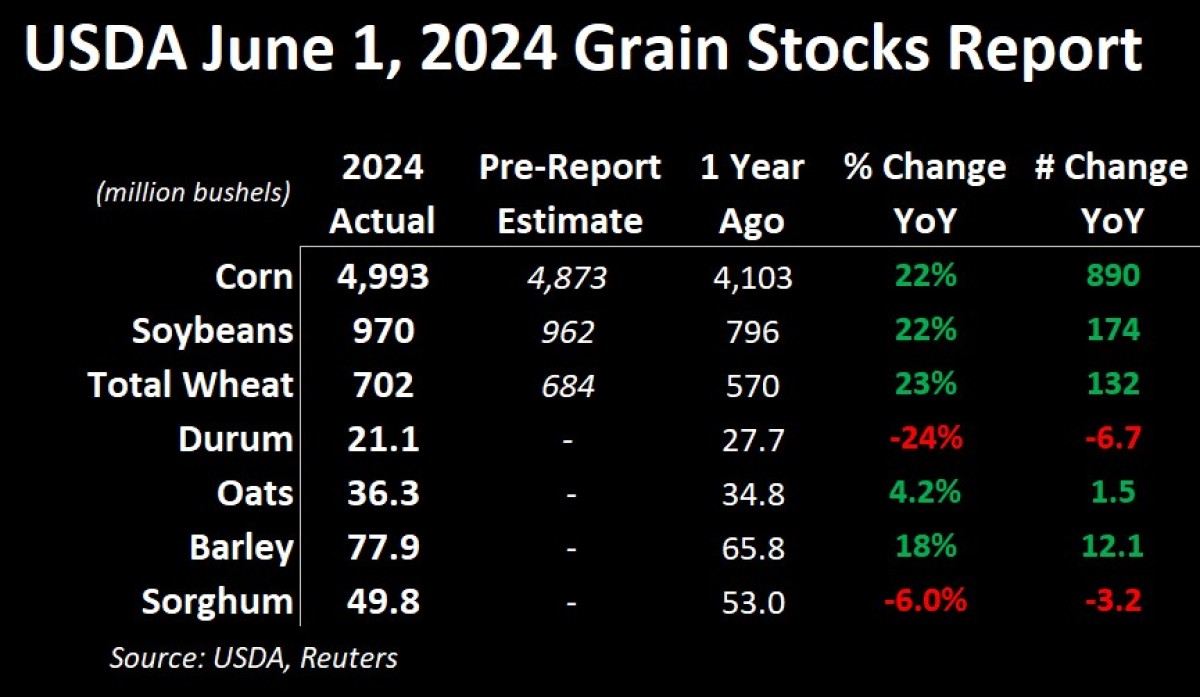

USDA Acreage + Stocks Reports

- U.S. corn area came in more than 1 million acres than what the market was expecting, and nearly 1.5M more than the March report.

- This extra production, combined with the USDA’s current average yield forecast of 181 bushels per acre won’t ease the supply burden.

- If realized, this would be a new record and nearly 4 bushels higher than last year’s / current record of 177.3 bu/ac.

- While demand has improved for corn, it’s not nearly enough to offset this increased production, meaning the balance sheet remains oversupplied (and we’ll likely continue to see U.S. corn coming into Canada).

- This extra production, combined with the USDA’s current average yield forecast of 181 bushels per acre won’t ease the supply burden.

- U.S. soybeans lost more than 400,000 acres from the March estimate to now sit at 86.1M acres.

- Worth noting that the average trade pre-report guess has been too high for each June acreage report for the last 10 years!

- U.S. winter wheat area dropped by 330,000 acres to 33.8M while spring wheat area inched lower by about 65,000 acres, whereas durum pushed up by 137,000 acres.

- The extra acreage for durum seems to be an attempt by farmers to play catch-up, as durum stocks as of June 1st dropped by 245% to 21.1M bushels (or a little under 574,000 MT).

- Durum stocks in North Dakota fell heavily by 42% to 6.3M bushels (or ~183,000 MT), while Montana dropped by half that, down 21% to ~172,000 MT).

- Given how lackluster U.S. wheat demand has been, expectations were pretty low going into the report and the USDA delivered, with stocks up 23% year-over-year.

- Barley stocks grew by 18%, with Idaho was the only state with a decline as North Dakota and Montana saw large increases, at nearly 20% and 75% (you read that right) respectively!

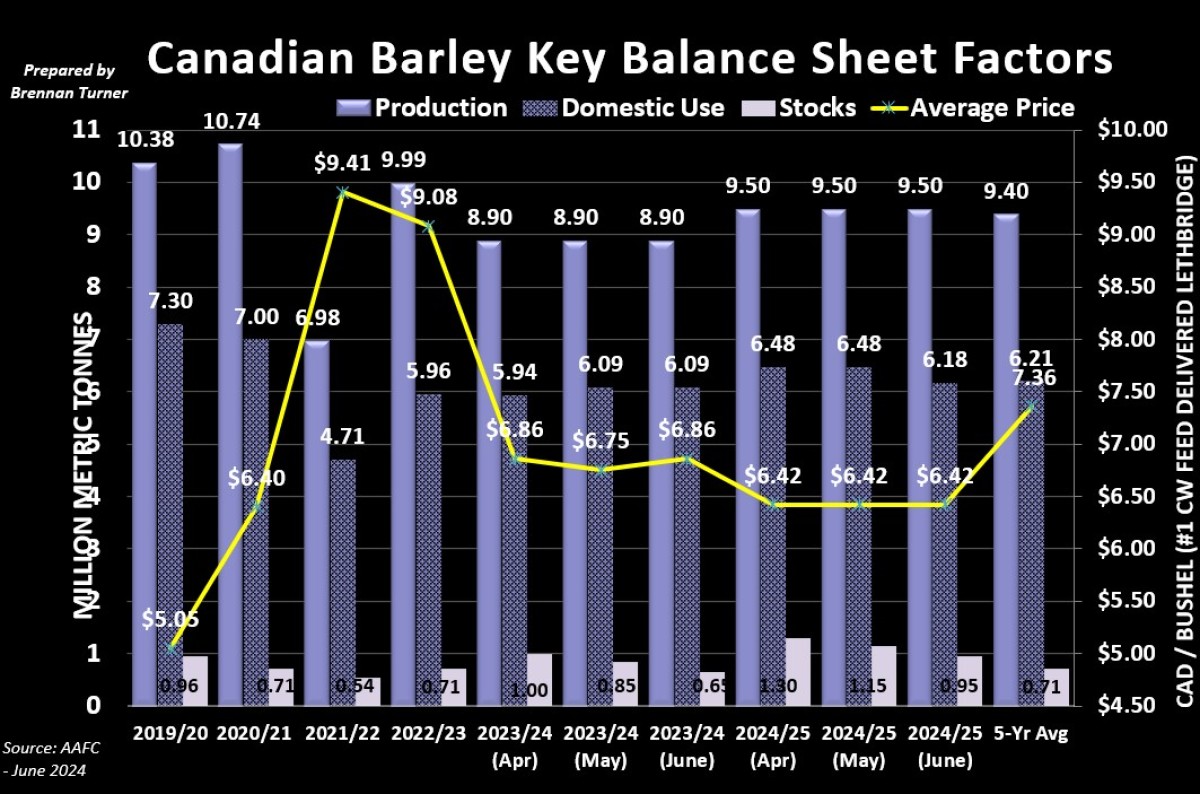

More Competition for Barley?

- There could be more opportunity to export barley into China as Australia, who has usually supplied the People’s Republic up to 1/3 of its barley needs, has tight inventories and total shipments in 2024/25 are forecasted to drop to five-year lows.

- The EU looks like it could prize to win the market, thanks to production of 53.89 MMT expected to hit a four-year high.

- With the bigger crop, the USDA is forecasting 7.3 MMT, which would be a 12% jump year-over-year, and if realized, would make them the world’s largest barley exporter!

- Canada would rank fifth at 2.4 MMT (USDA’s estimate), with the top 3 rounded out by Australia and Russia.

- For reference, Canada’s barley shipments to China in the first 3/4s of 2023/24 crop year are 36% lower year-over-year, with just 1.45 MMT sailed across the Pacific.

- Agriculture Canada raised old crop barley exports by 200,000 MT, reducing ending stocks by the same amount to now sit at 650,000 MT (less than 100,000 MT from the record low set in 2021/22 of 543,000 MT.

- They also raised new crop exports by 300,000 MT to 3.05 MMT, reflecting some of the new opportunities because of Australia’s smaller supplies.

To growth,

Brennan Turner

Independent Grain Market Analyst