More Missiles Pressure Grain Trade Risk

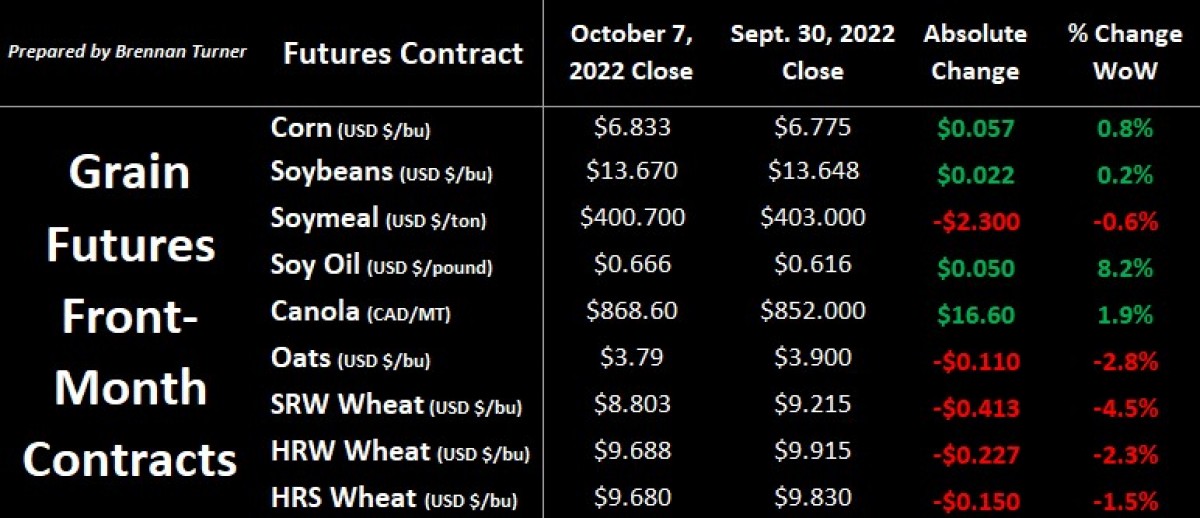

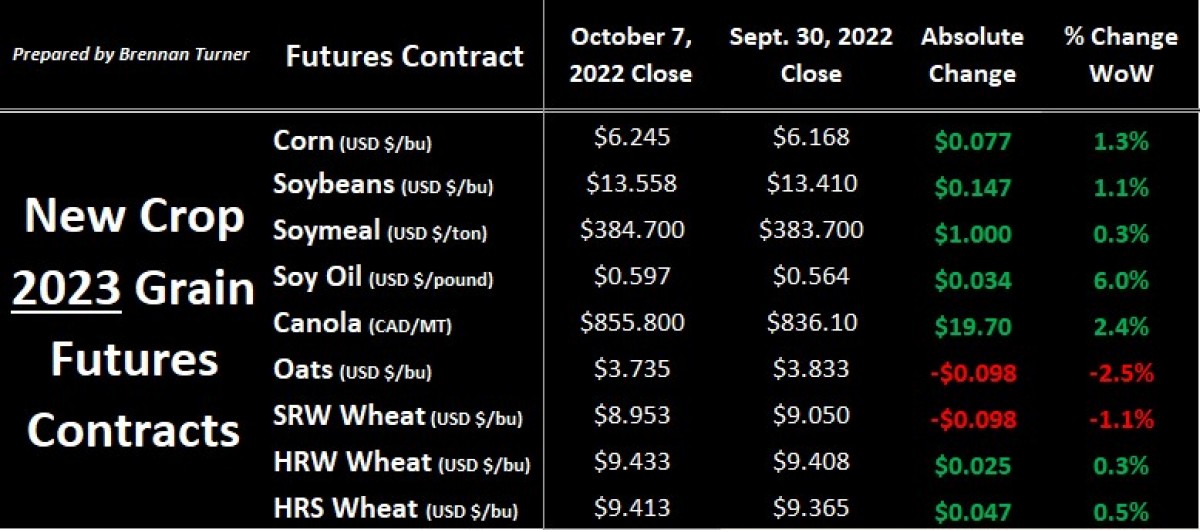

Grain markets ended the first week of October mixed as accelerating harvest activity In the U.S. was offset on Friday by a 5% jump in oil prices and money flows generally directed towards commodities. While bullish traders are conscious of a third straight year of La Nina weather, also weighing on the grains complex this week was CONAB, Brazil’s version of the USDA, suggesting a record harvest for both corn and soybeans of 126.9 MMT (+12% YoY) and 152.4 MMT (+21% YoY), respectively. In the upcoming holiday-shortened trading week, market participants will be watching the fallout of new levels of military aggression in Ukraine, and the USDA’s October WASDE report on Wednesday, October 12, 2022. On the flip side, almost all 2023 new crop futures contracts climbed for the week (worth noting the spread between these front months and new crop contracts).

Before digging into some of those WASDE expectations, over the weekend, on Saturday, Ukraine blew up the Crimean Bridge, which connects Russia to Ukraine, via the annexed Crimea Peninsula, and thereby, a military supply route. In retaliation, on Monday morning Ukrainian time, Russia targeted vital energy and transportation hubs in the capital city of Kyiv and 8 other cities. The actions come about six weeks before the “grain corridor” deal to help ship out idled Ukrainian grain exports is set to expire. Most analysts had suggested that the decision to extend the deal for the safe passage of Ukrainian grain was going to be a political one for Vladimir Putin. Still, with increased military tension, a military escalation may make the decision easy to not extend as port infrastructure is in the bullseye. This comes as ship tracking data going into the weekend suggested about 65 boats were waiting in the Black Sea to be loaded with Ukrainian grain – the most in 18 months – and the pace of grain exports is nearing the 4 MMT-per-month levels.

It makes sense then why many traders are even more skeptical today about locking in any movement in the second half of November and are just hoping that whatever’s been booked to sail between now and then actually materializes. According to the Ministry of Agriculture, 19.2 MMT of wheat and 5.5 MMT of barley have been harvested by Ukrainian farmers this year, down 40% and 41%, respectively, compared to Harvest 2021. In the meantime, with the country’s corn harvest starting up, and lots of Harvest 2021’s grain still in the bin because of limited exports, storage is a big issue with Yale’s Humanitarian Research Lab suggesting just over 5% (or 3.07 MMT) of the country’s 58 MMT bin space out of commission, with another 11% (or 6.24 MMT) under Russian control. Finally, as I’ve suggested for a few months now, Ukraine’s winter seeding campaign is under duress, with expectations from AgResource Company that the country’s winter wheat acres will be down 40% year-over-year.

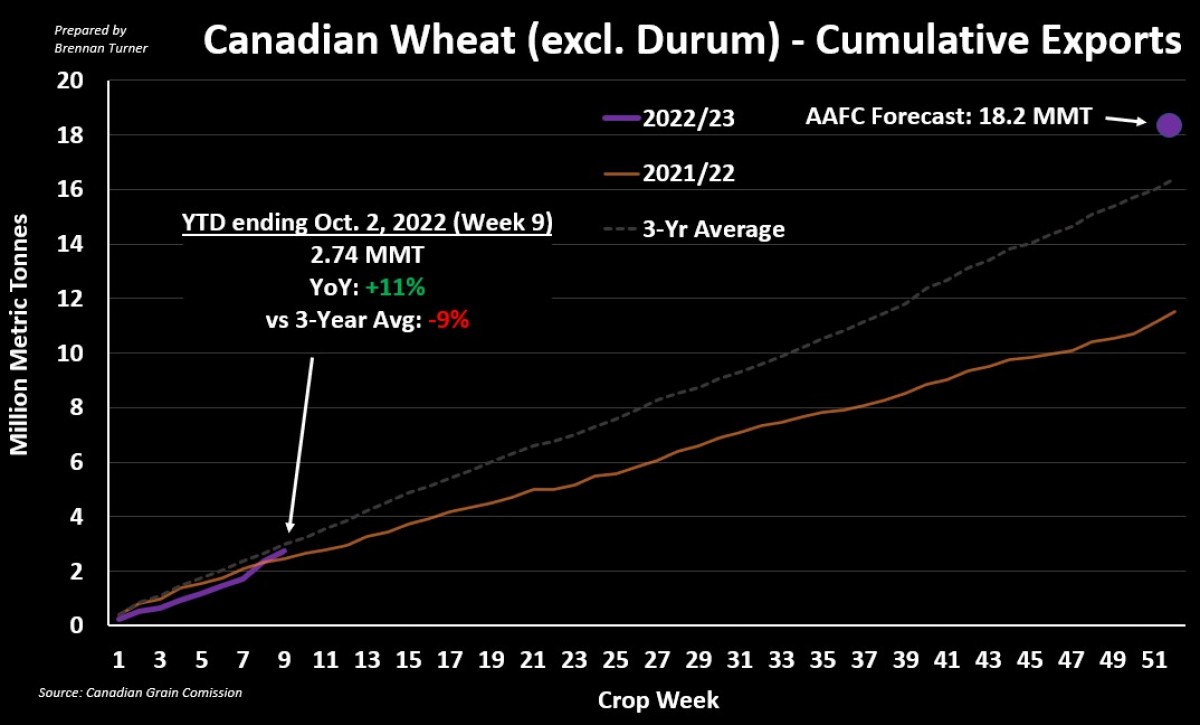

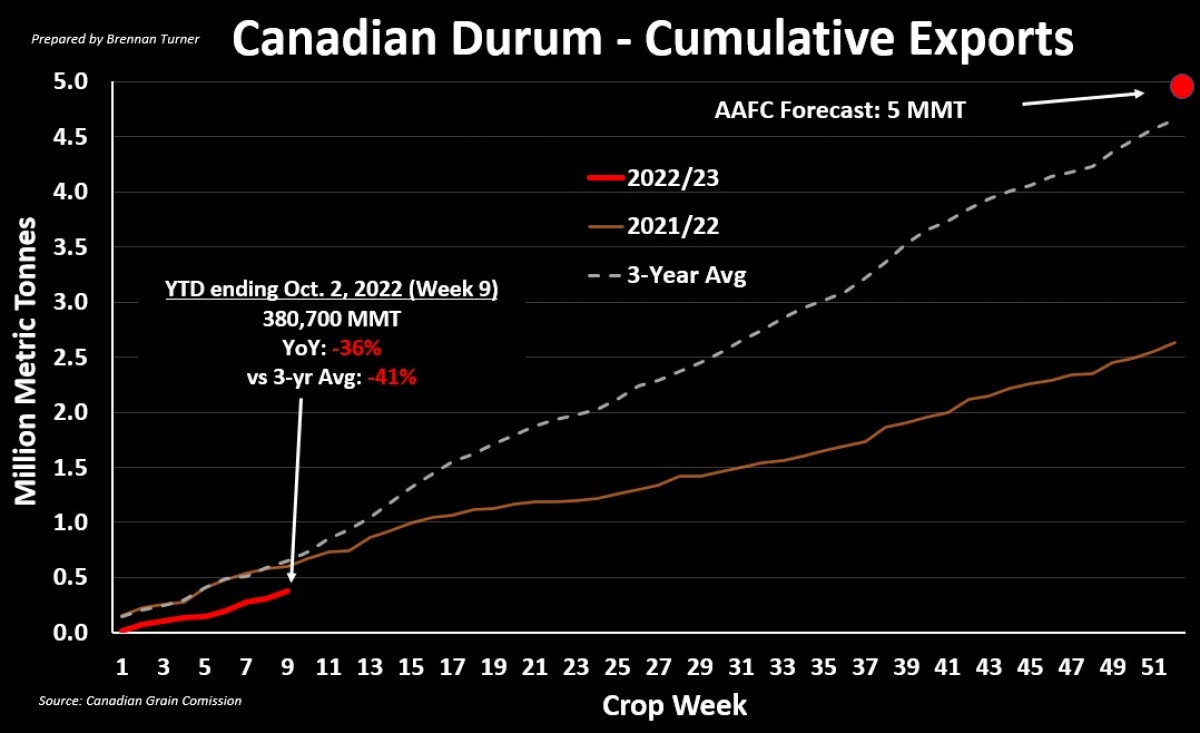

At the same time, Russian farmers are taking off a record wheat crop, currently estimated by private firms over 100 MMT (the previous record was 88 MMT). FastMarkets is reporting though that Russia’s two most significant shipping months, August and September, saw total volumes 30% lower than last year because of the expensive export tax and domestic inflation pushing farmers to hold out. There’s also the issue of some importing countries' inability to (read: refusing to) deal with Russian banks. Ironically, U.S. shipments aren’t faring much better, with August wheat shipments at a four-year low, and total sales commitments to date of 11 MMT tracking behind the average buying pace by about 10%. In Canada, shipping non-durum wheat has been the high-priority item so far in the 2022/23 crop year, with volumes up 11% year-over-year and just over 2.7 MMT shipped out. For durum, exports of just under 381,000 MT are more than a third behind the nearly 600,000 MT exported by Week 9 of the 2021/22 crop year.

Overall, Canadian grain exports are tracking 2% behind last year’s pace, with 5.26 MMT sailing. Still, most companies and traders expect this to accelerate over the winter months, a scenario that’s more likely given the heightened trade risk out of Ukraine after this weekend. Also supporting this thesis is the reality that, with rains negatively impacting the quality of Europe’s late-harvested cereal, more EU wheat and barley could find their way into feed markets. Furthermore, it’s a similar dynamic in Australia as there are heavy rains in the long-term forecast for eastern regions, where higher-protein wheat is produced. Finally, there’s also some local buzz in Argentina that the USDA’s current wheat production forecast of 19 MMT is too high, given some of the dry weather they’ve been experiencing.

I, and many others, doubt that any of these quality or production variables will be reflected in the USDA’s October WASDE report this week. Instead, U.S. corn and soybean yields will get most of the attention. Despite September 30, 2022, quarterly stocks report showing more corn and soybeans, both balance sheets continue to sit in a relatively tight scenario. Given that nearly 322M acres of U.S. crops are facing some level of drought, and ongoing recessionary risk, dropping yields might be offset by lower demand. Put simply, if U.S. corn and soybean ending stocks are raised in Wednesday’s reports, this will likely push the broader grain complex lower, as there’ll be a lower need for higher prices. Unless, of course, even more missiles fly in Ukraine, which could ultimately take precedence over any USDA data.

To growth,

Brennan Turner

Founder | Combyne Ag