China-Russia Wheat Trade Impact on Canada

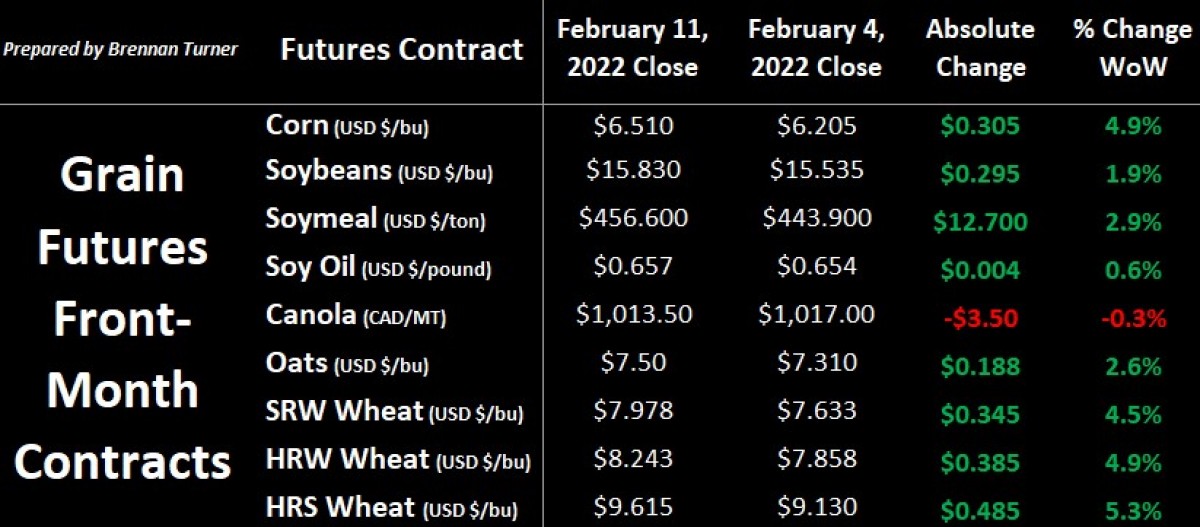

Grain futures ended the second week of February in the green as renewed and increasing speculation over a Russian invasion into Ukraine, as well as continuous lower production estimates in South America, helped fuel a lot of buying on Friday. I and many others continue to sit in the 5%-10% likelihood of a Russian military invasion. However, given these 2 countries are the #1 and #3 wheat exporters in the world, I’m aware that if it did happen, wheat prices would very quickly jump 20-30%. Therein, this week’s buying might be signaling another wave to capitalize on in terms of “sell the rumour, profit on the fact.”

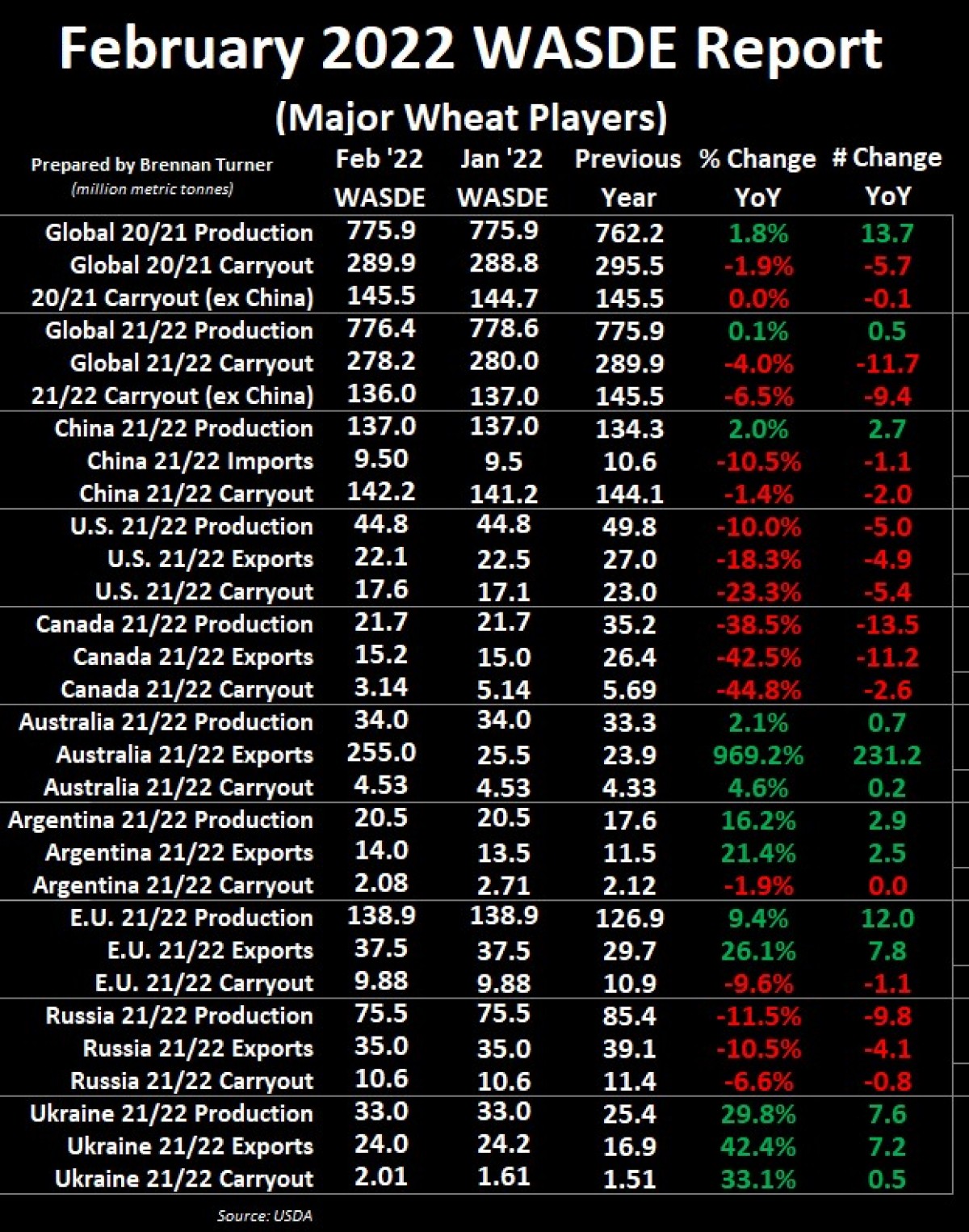

Also, this week, we got the USDA’s February WASDE report, and the biggest changes were actually seen on Canada’s wheat balance sheet. The USDA increased Canadian total wheat domestic feed use by 1.7 MMT to 4.5 MMT, and exports by 200,000 MT to 15.2 MMT. As a result, Canadian total wheat ending stocks were reduced by 2 MMT to 3.14 MMT, below Agriculture Canada’s current estimate of 3.45 MMT. Worth also mentioning is that Argentine wheat exports were raised by 500,000 MT, while U.S. wheat stocks were raised in every class except SRW, by a total of 20M bushels or 540,000 MT, because of slowing exports.

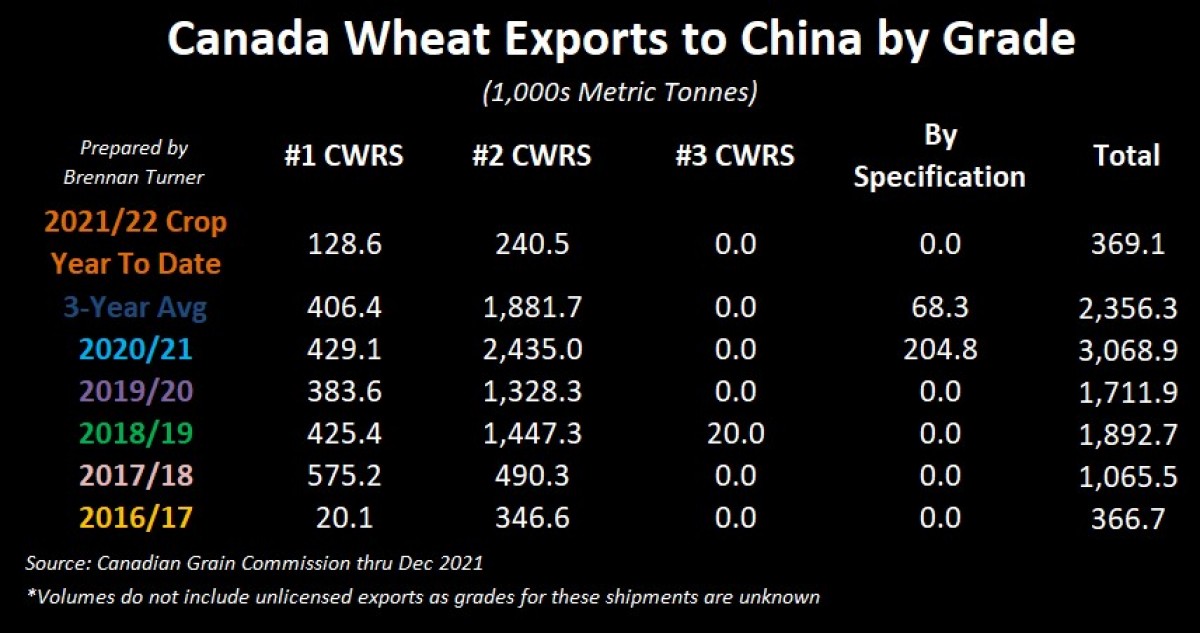

There’s a lot of buzz in the global wheat export market these days, especially with the news that China is opening up its border to Russian wheat and barley. As I promised last week, I dug into how this might impact Canadian shipments to the People’s Republic. First things first, Russian wheat and barley are usually of lower quality than what China tends to import from Canada. Frankly, I doubt Russia can replace a lot of Canadian #1 CWRS wheat, but probably could do so for some of the #2 CWRS. For barley, it’s hard to say exactly how much “By Specification” trade Russian barley could take from Canadian exporters, but I don’t think it would be a huge amount as I understand a fair amount is for malt production.

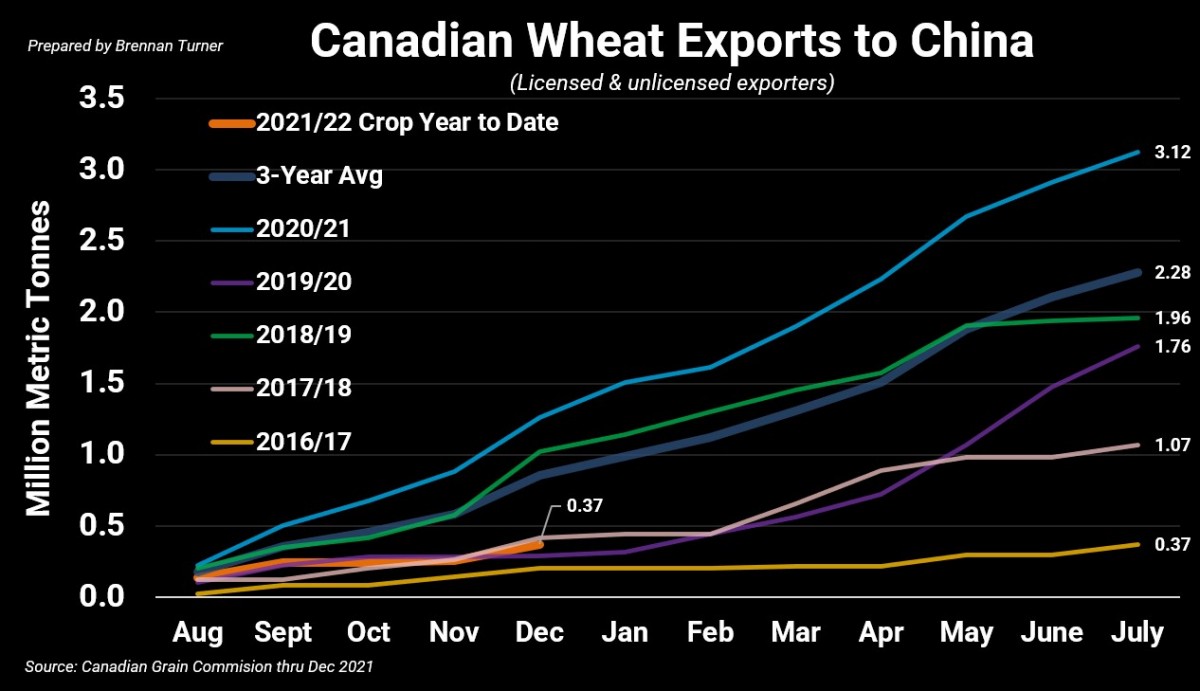

Stepping back and looking at the volume data, through December of the 2021/22 crop year (the first 5 months of the crop year), Canadian non-durum wheat exports to China are down 70% year-over-year, with 369,000 MT shipped, versus 1.24 MMT a year ago. I’m not sure this is a political thing though; we know that Canadian non-durum wheat exports through Week 27 are tracking 43% lower year-over-year with 6.07 MMT sailed, largely a function of this year’s much smaller harvest. We also know that, because of record-high domestic corn prices, China has basically exhausted its “usable” wheat reserves and is now looking to ensure the country does have supply going forward, so maybe they’re just looking to diversify their origins?

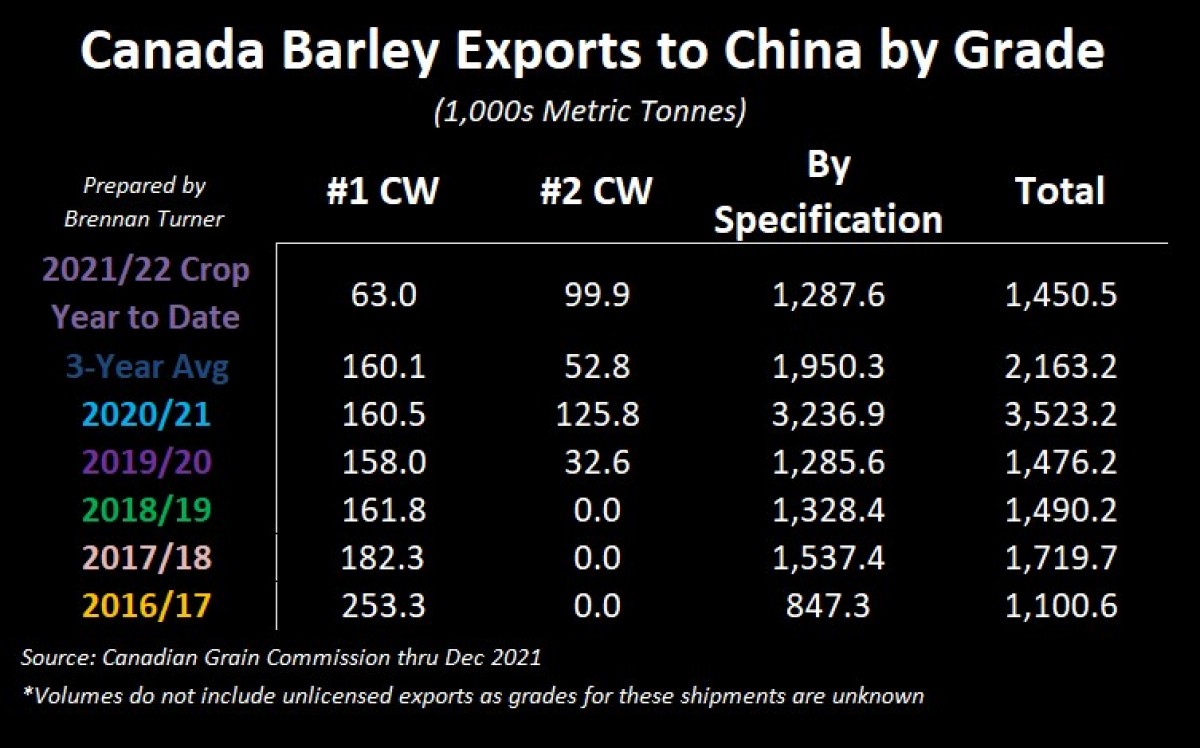

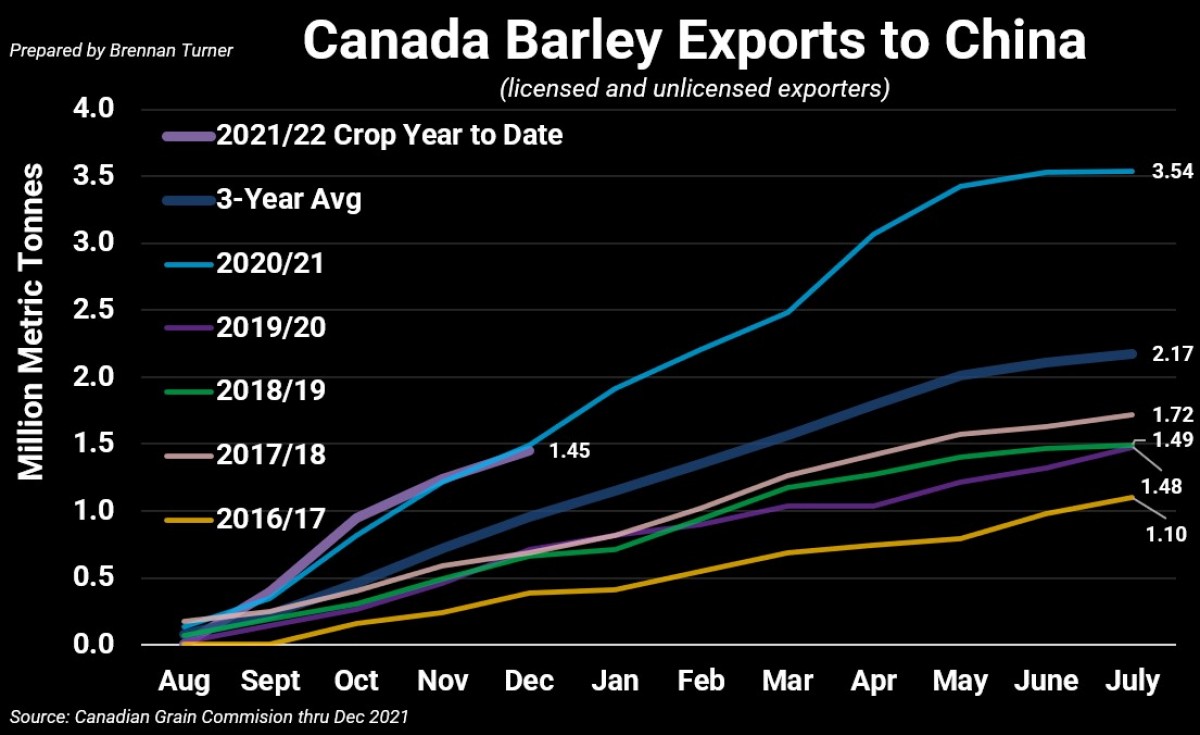

That said, on the barley side of things, I think Russia getting its barley into China could be more impactful on Canadian markets. Through the first 5 months of the 2021/22 crop year (December 2021), China has imported 1.45 MMT of Canadian barley, only 2% behind the 1.48 MMT that sailed by the same period in 2020/21. Perhaps China is starting to feel the impact of their 80% tariff on Australian barley and again, are just looking to diversify its supply origins?

What’s obviously known is that China, with its political and commodity consumption weight, tends to play the long game and this strategy of potentially importing more Russian wheat and barley shouldn’t be all that surprising. Russia, in the meantime, continues to deal with its own food price inflation issues, and accordingly, plan to keep their wheat, barley, and corn export taxes in place until June 1, 2022. Thus, I highly doubt there’ll be much impact on Canadian wheat and barley exports to China this year, but we could expect to see some relatively small reductions once we shift into the 2022/23 crop year.

To growth,

Brennan Turner

Founder | Combyne Ag