All Eyes on Yield Monitors

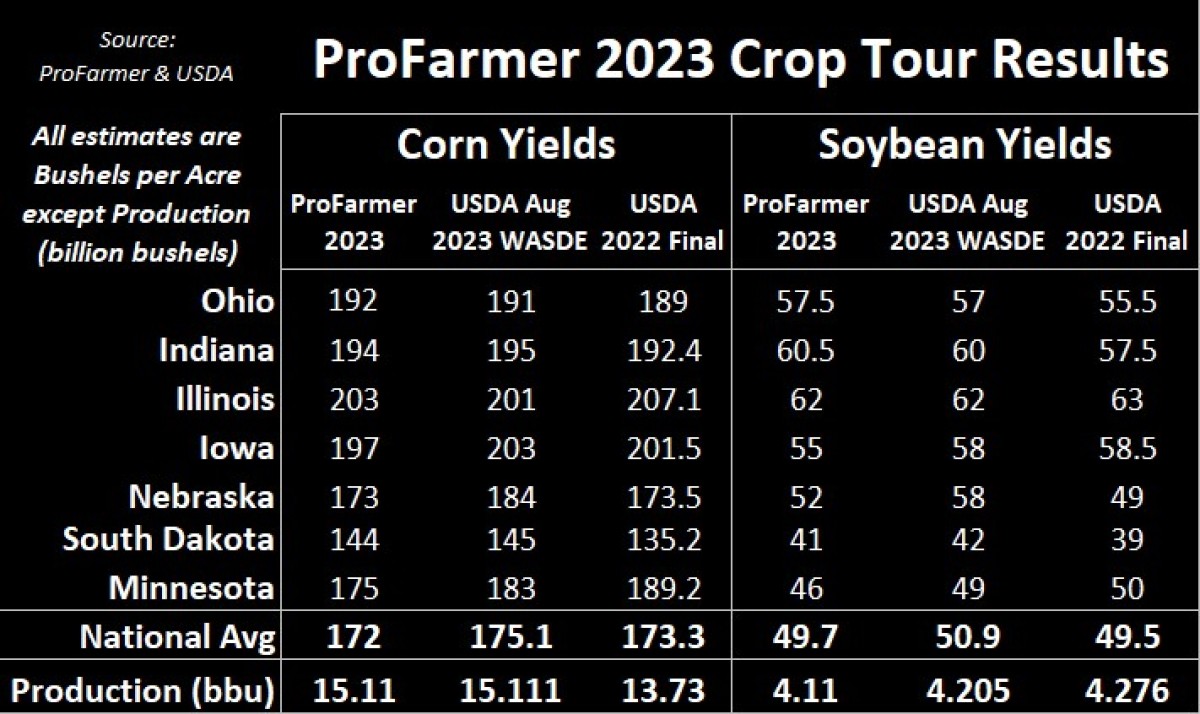

Grain markets were mixed this week with weather and the annual ProFarmer Crop Tour through the American Midwest dominating the headlines, with soybeans and oats being the big winners, while wheat mostly followed corn. Thanks to the hot, dry weather this summer that most of the region received, the tour results suggested smaller yields and production than the USDA’s August WASDE estimates. The wheat complex ended the week mostly on a high note, following corn with a stronger Friday close, but was also weighed on by harvest deliveries and a second ship successfully leaving a Ukrainian port and sailing through the Black Sea without being attacked by the Russian navy. The European Commission continues to reduce its wheat harvest estimate, this month by 300,000 MT down to 126.1 MMT, with consistent precipitation impacting harvest progress and reduced quality. Finally, canola found some strength to end the week after Statistics Canada suggested that crushers used a record 962,000 MT in July (plus 25 per cent year-over-year) and a total of nearly 10 MMT for the 2022/23 crop year (plus 16 per cent year-over-year).

Coming back to last week’s crop tour, the theme of participants seemed to be “variability” with most noting the recent heat is going to pressure final corn and soybean yield tallies. As scouts headed further west and north, heat damage continued to be a consistent term used to describe both corn and soybeans. Specific to beans though, the weather leading into finishing the crop will be the wildcard as to what direction prices may go and if fields receive more stress over the next few weeks, prices will certainly head higher as traders are cognizant of the existing tight carryout scenario. It’s a bit of a similar dynamic in corn if national yield averages fall by another few bushels, carryout is likely to fall below two billion bushels and the technical line of resistance around $5 bushel won’t be hard to push past like it has been this month (seven times this month we’ve seen corn prices get up here but then pulled back). This is especially true considering managed money is holding a net-short position of more than 121,000 contracts that could catalyze a short-covering rally!

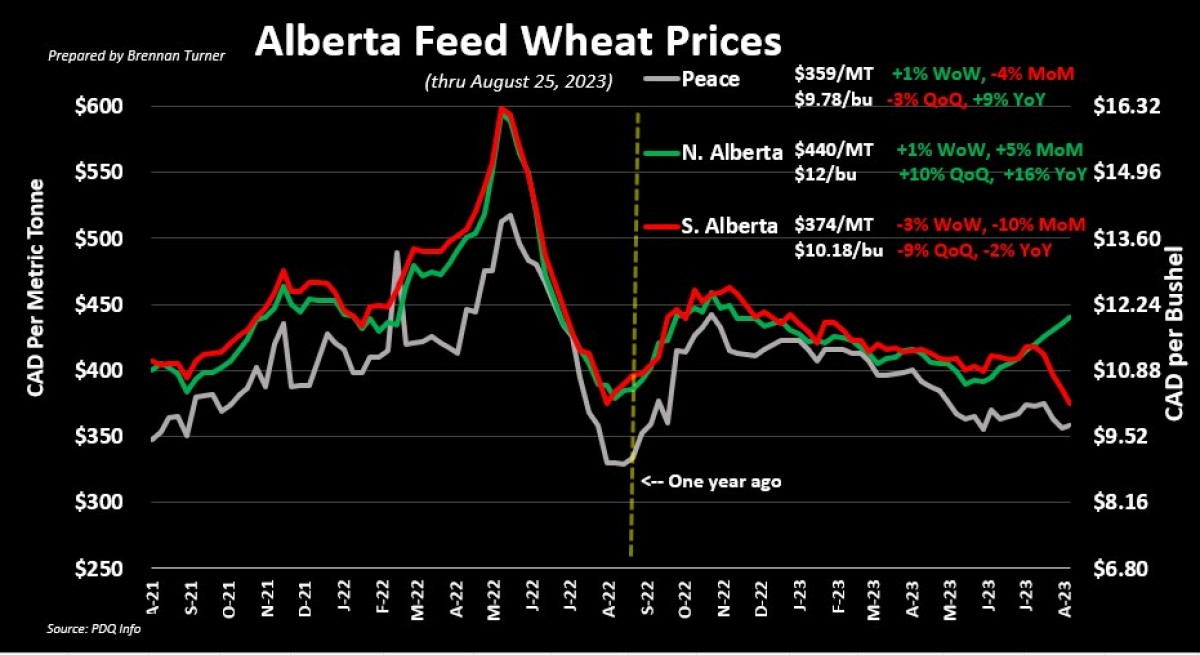

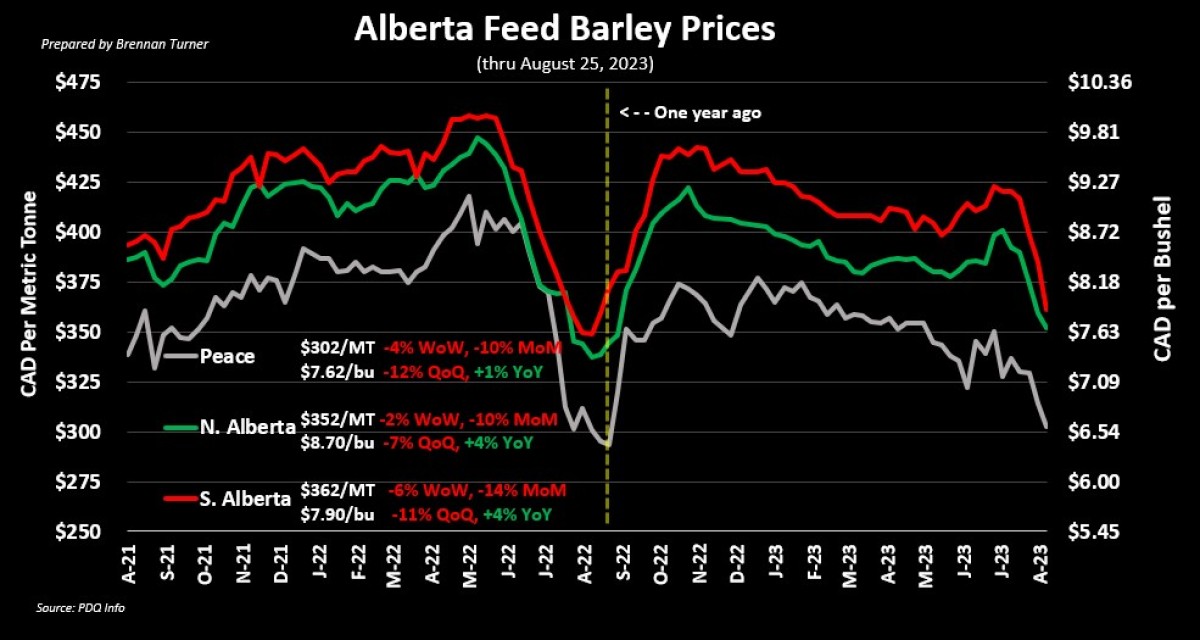

Now that the crop tour is out of the way, traders will look to the next USDA WASDE report, out on Tuesday, September 12 (two weeks from now), whose estimates will be based on 3,500+ USDA representatives’ in-field surveys. Therein, I expect to continue to see volatility in the market as the variability from the ProFarmer Crop Tour and the UDSA survey will likely be talked about a lot over this time frame. On that note, we continue to see more U.S. corn coming up to feedlot alley, which is certainly weighing on feed barley and wheat prices as harvest deliveries are ramping up. To be more precise, more corn has been booked for the 2023/24 crop year already for Canada than what was sold in all of 2022/23! That said, as you can tell from the charts below, we are possibly near the lows in feed wheat, with feed barley lows not far behind. The anomaly here is the Northern Alberta feed wheat prices, which have sprinted higher over the last few weeks as buyers secure coverage, given yields in the area haven’t been that great.

On that note, as of last week’s crop report, 11 per cent of Alberta’s spring wheat fields have been harvested and average yields predicted by the provincial Ministry of Agriculture are at 39.1 bushels per acre (unchanged from a month ago). At this time a year ago, the spring wheat yield estimate from the Alberta government was 53.2 bu/ac, and two years ago, in the 2021 drought, it was 30.2 bu/ac. Back in 2021 though at this time, 21 per cent of the spring wheat crop was rated good-to-excellent (G/E), whereas this year, Alberta spring wheat’s G/E sits at 44 per cent. Similarly, 32 per cent of Alberta’s durum is currently rated G/E, while in 2021, only 18 per cent made this grade. In Saskatchewan, 13 per cent of spring wheat and 26 per cent of durum fields had been harvested. Overall, with 21 per cent of all crops in the province taken off, that’s above last year’s pace of 16 per cent by this point, as well as the 5-year average of 14 per cent. In Manitoba, 23 per cent of the spring wheat crop had been harvested, and 13 per cent of the overall harvest is complete, both in line with the seasonal average. Quality ratings continue to be mostly fair to good with the best quality seen in the eastern and Interlake regions of the province.

Finally, the Ukrainian wheat harvest is unofficially complete, with nearly 22 MMT of wheat taken off this year, or an increase of 1.24 MMT year-over-year. Now the question is, how is this going to get to market? Local Danube river ports and the Romanian port of Constanta are seemingly the best options as of right now, but five EU countries have repeatedly asked for the ban on imports of Ukrainian grain to be extended beyond September 15 (NOTE: imports are different than grain transiting through the country to be exported; regardless grain in transit ties up infrastructure just the same as if it was being imported). In the meantime, Russia’s wheat exports continue to flow and this is probably the largest bearish variable hanging over the wheat market. Moreover, private analyst SovEcon just raised its estimate of this year’s Russian wheat harvest by 5 MMT to 92.1 MMT, whereas the USDA is currently predicting a harvest of 85 MMT.

At the end of the day, it’s harvest time and so with more supply coming to market, prices will be pressured. Therein, I’m not focusing on making new sales right now, but instead on a safe and efficient market, and delivering on the contracts that I’ve already signed. I’m also thinking about preparing good samples to ensure I know what quality of wheat I have to sell, so that when the seasonal highs approach again around late October and into November, I’m prepared to take advantage, regardless of what my yield monitor says today.

To growth,

Brennan Turner

Independent Grain Markets Analyst