A Review of 2023 Wheat Markets

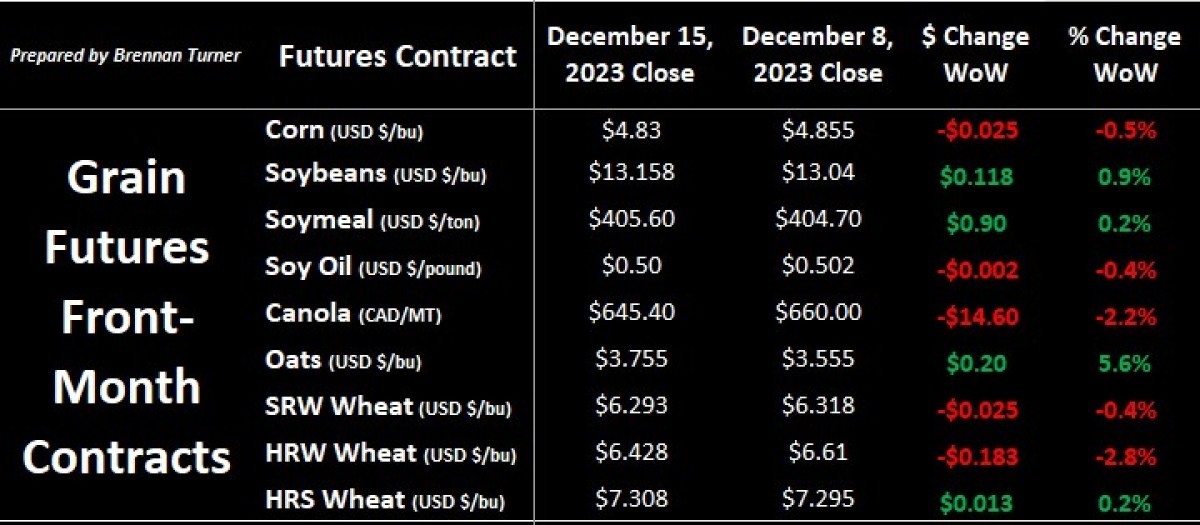

Grain markets saw mixed results throughout the middle of December. Ongoing focus on weather in South America was competing with healthy export demand. Corn did finish the week lower but traded up on Friday thanks to weekend forecasts showcasing hot and dry conditions in central and northern Brazil. U.S. soybean export sales ended the week with its eighth straight day of sale announcements, while November crush data topped pre-report estimates, coming in at its second-highest level for any month. The wheat complex saw some short covering in Chicago Soft Red Winter and Kansas City Hard Red Winter futures, thanks to another strong week of U.S. Wheat export sales at 1.49 MMT, the largest one-week commitment since September 2007! However, rain and snow falling in the U.S. southern plains pared down any bullish momentum.

This week’s column focuses on a recap of 2023 wheat markets. You’ll see a few more charts to help visualize what happened over the last year. After the holidays, we’ll begin the 2024 outlook for variables I think will impact wheat markets most and the timing of new crop and remaining old crop sales.

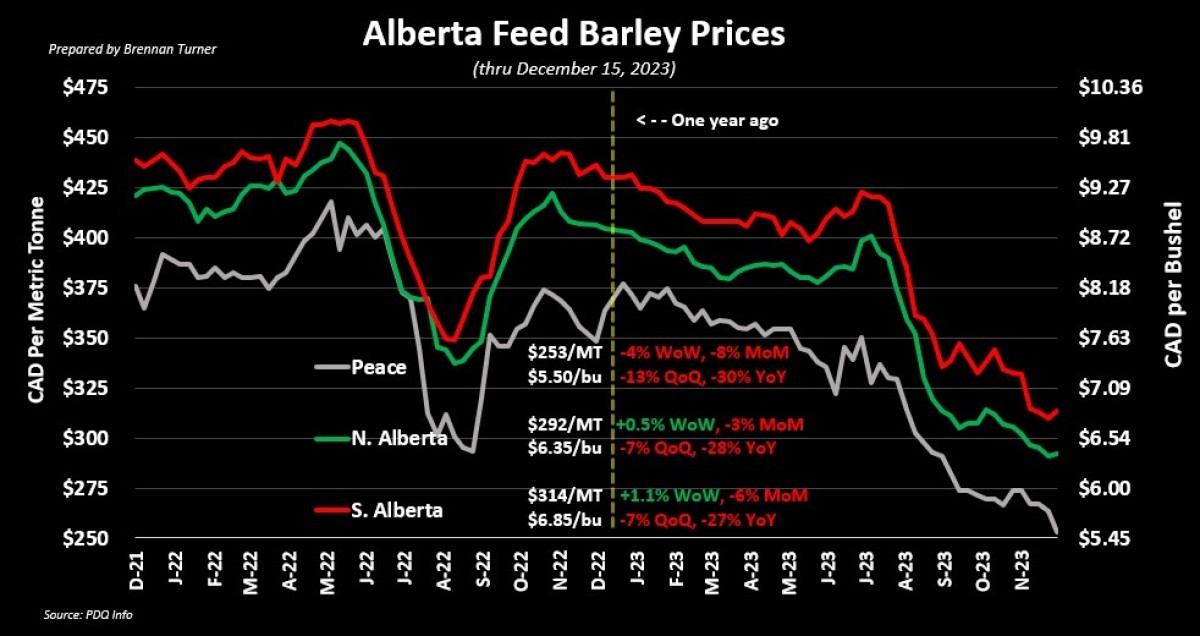

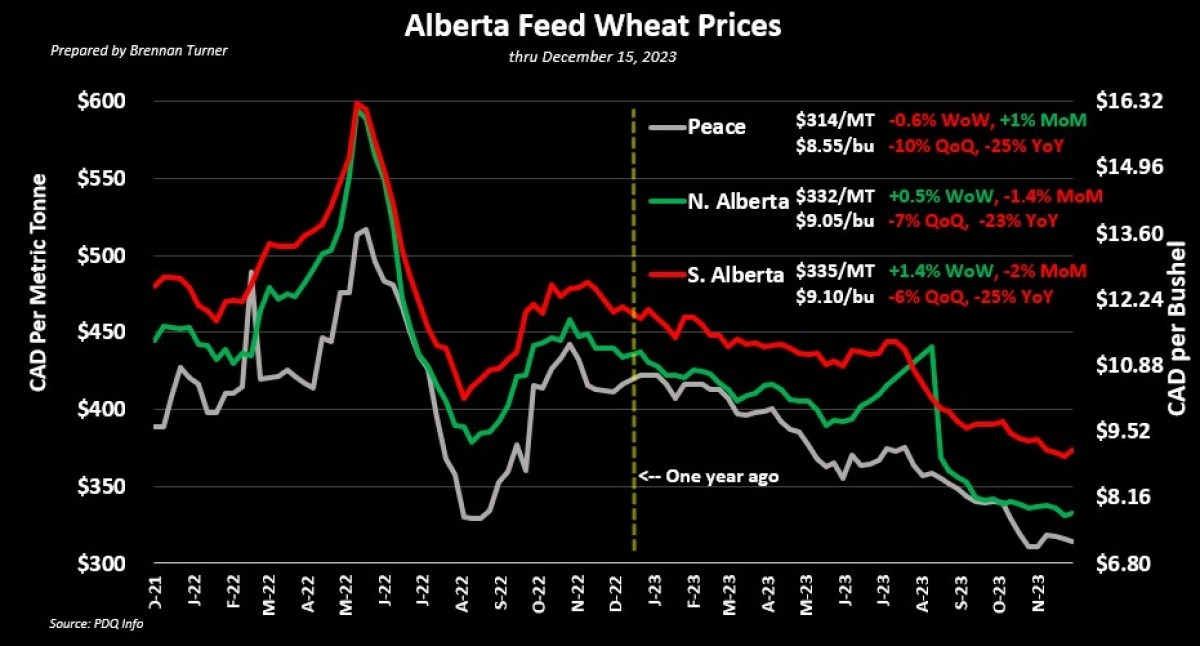

In feed markets, with winter coverage by buyers remaining relatively fulfilled and ongoing competition from imported U.S. Corn, we continue to see prices revert back to levels seen last at the end of the 2020/21 crop year. Of course, to start the 2021/22 crop year, prices eventually jumped to record highs thanks to the drought (as shown in the left-hand side of the two charts below). As I won’t be talking about feed markets in the 2024 outlook in a few weeks’ time, my perspective is that we’ll likely trade sideways, possibly slightly lower, over the next two months, so be aware of those delivery windows and the usual bump during the planting campaign.

We'll look at this class next as we sometimes see Canada Prairie Spring Wheat moving into the feed column. Compared to a year ago, Kansas City Wheat front-month futures have fallen by 24 per cent, while the basis has literally been halved. As a result, spot values today are trading nearly one third lower than this time in December 2022. The primary variable has been the decline of the paper trade, largely thanks to weaker American exports. However, this decline in basis also tells us the impact the Loonie has had, which has trended higher against the U.S. Greenback to sit at its highest level since August. It is worth noting that, technically, the basis has improved a bit since September, but the seasonal trend the last few years has been to the downside into the spring season.

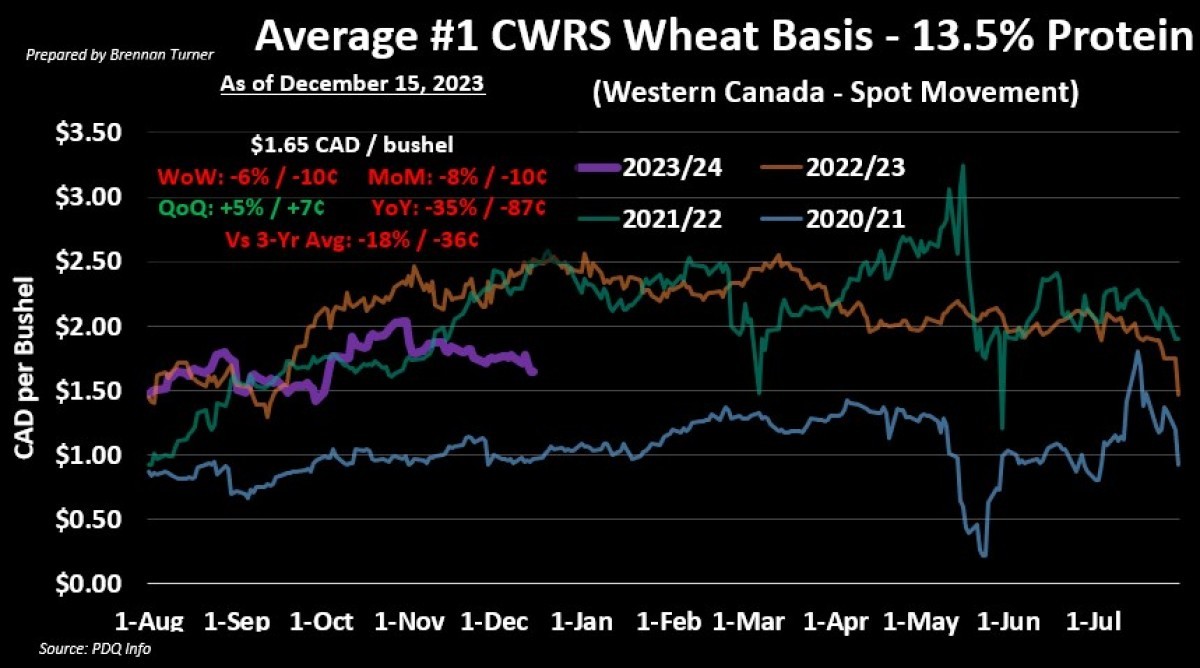

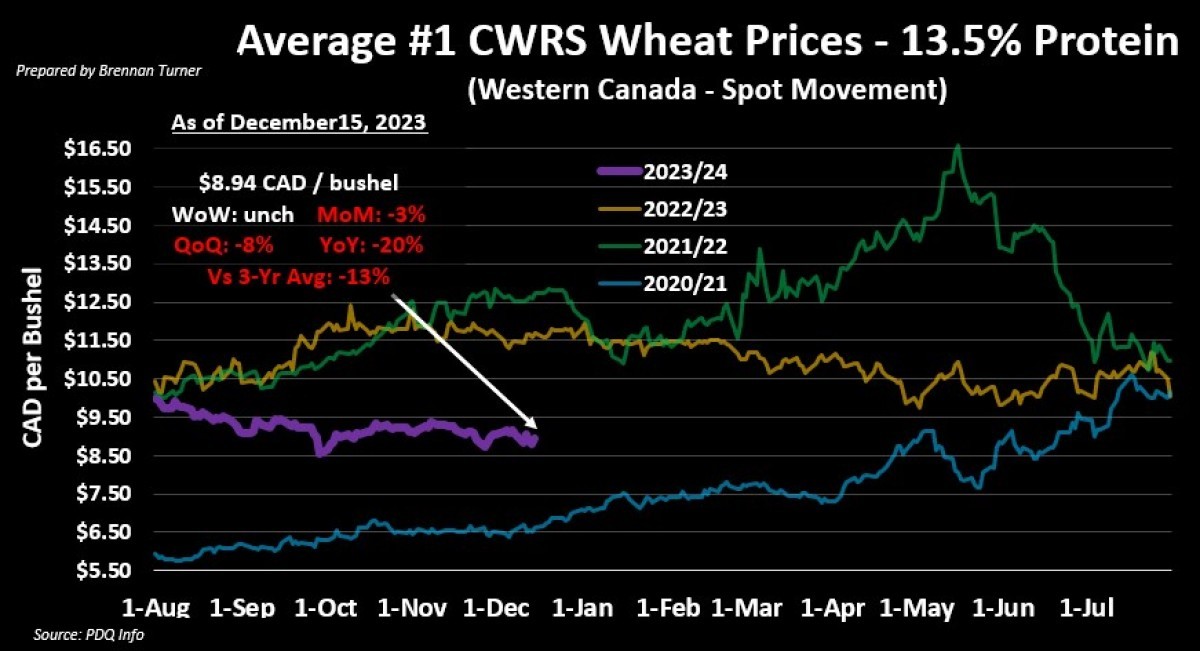

It’s a similar story for Hard Red Spring Wheat, as the basis has improved since September, but we’re still tracking 35 per cent, or nearly 90 cents per bushel lower than this time a year ago. Over the same time frame, front-month Minneapolis Spring Wheat futures have fallen by 24 per cent to now sit at an average of under $9 CAD/bushel for Western Canada. Frankly, I think we’re at a bit of a crossroads as to where spot Hard Red Spring Wheat prices on the cash markets will go, but there are quite a few variables that suggest we should trade sideways, with exports being the main factor to push them higher. We know that the quality of the European and Chinese wheat harvests was subpar so there’s an expectation that Canada will remain a primary supplier, but I think the strength of the Canadian Dollar recently may temper some forecasts a bit.

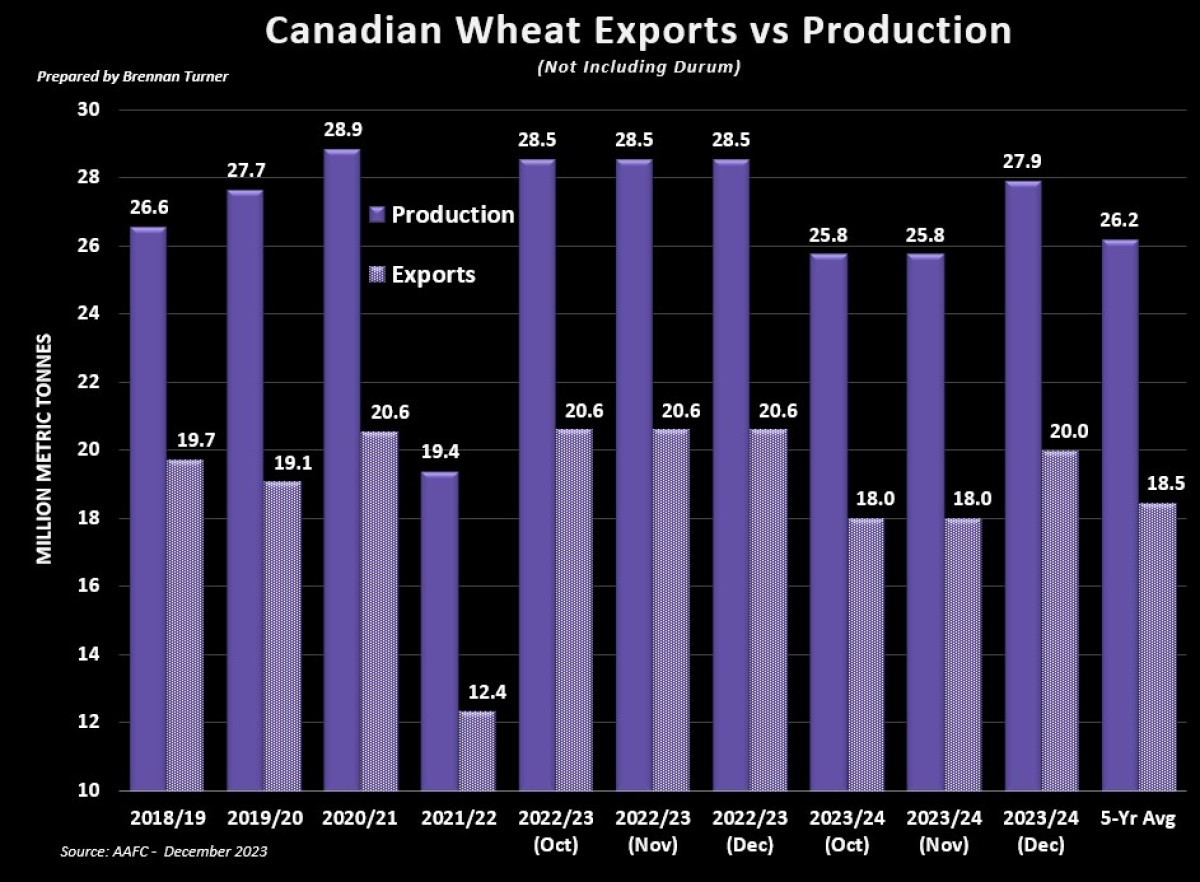

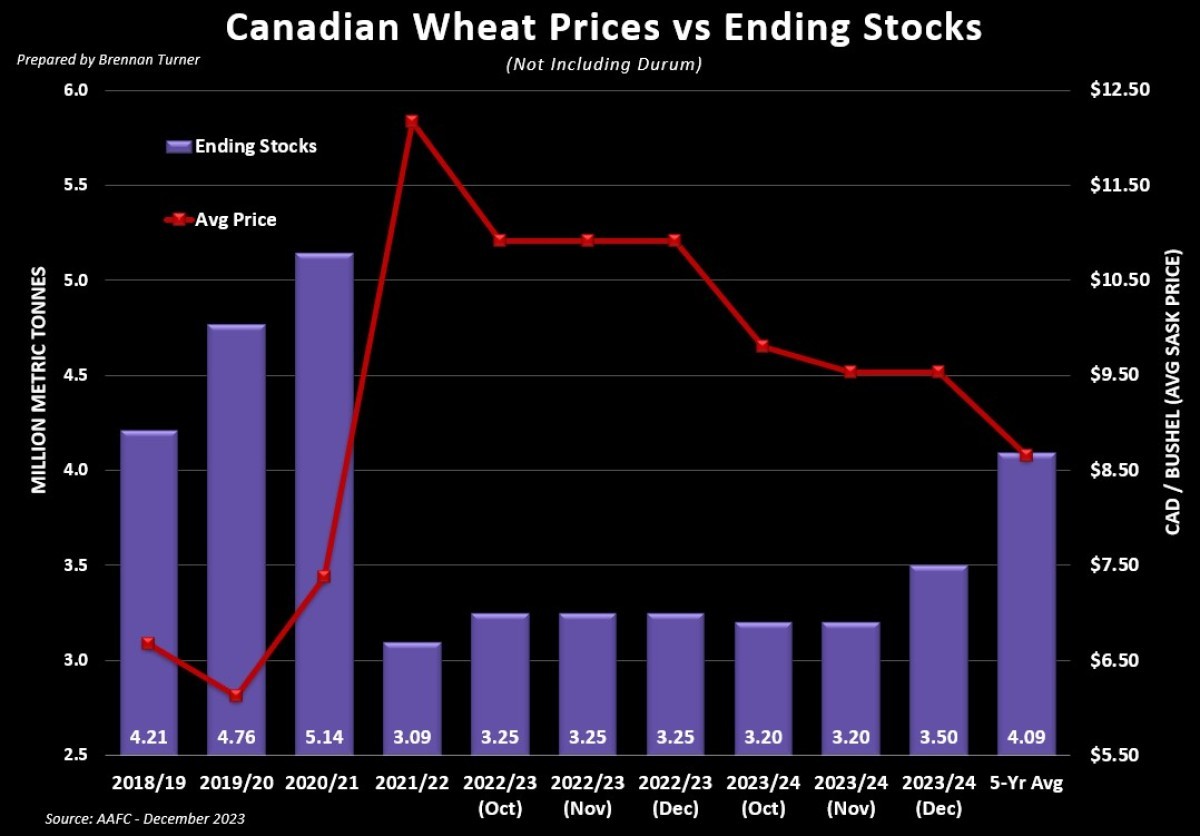

As mentioned in last week’s column, I expected Agriculture Canada to increase their export target by 800,000 MT or so, but I was wrong. Instead, they increased it by a full 2 MMT, or 11 per cent more than their November estimate. This was also mainly because of the 2.1 MMT increase in Non-Durum Wheat production that Statistics Canada announced a few weeks ago. Arguably, this large differential likely explains the general malaise in cash wheat markets in the last few months, especially when relativized against the seasonal uptick generally seen at year-end. That said, despite AAFC increasing ending stocks by 300,000 MT to now sit at 3.5 MMT, they didn’t change prices (hence my own sideways to possibly higher comment above).

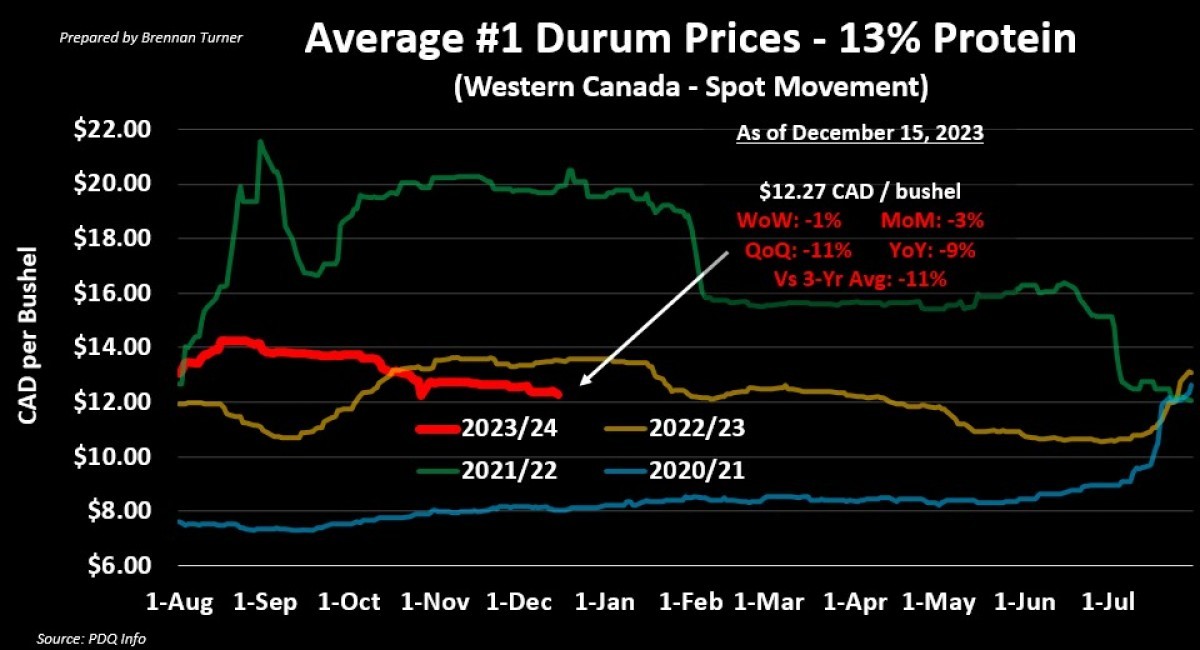

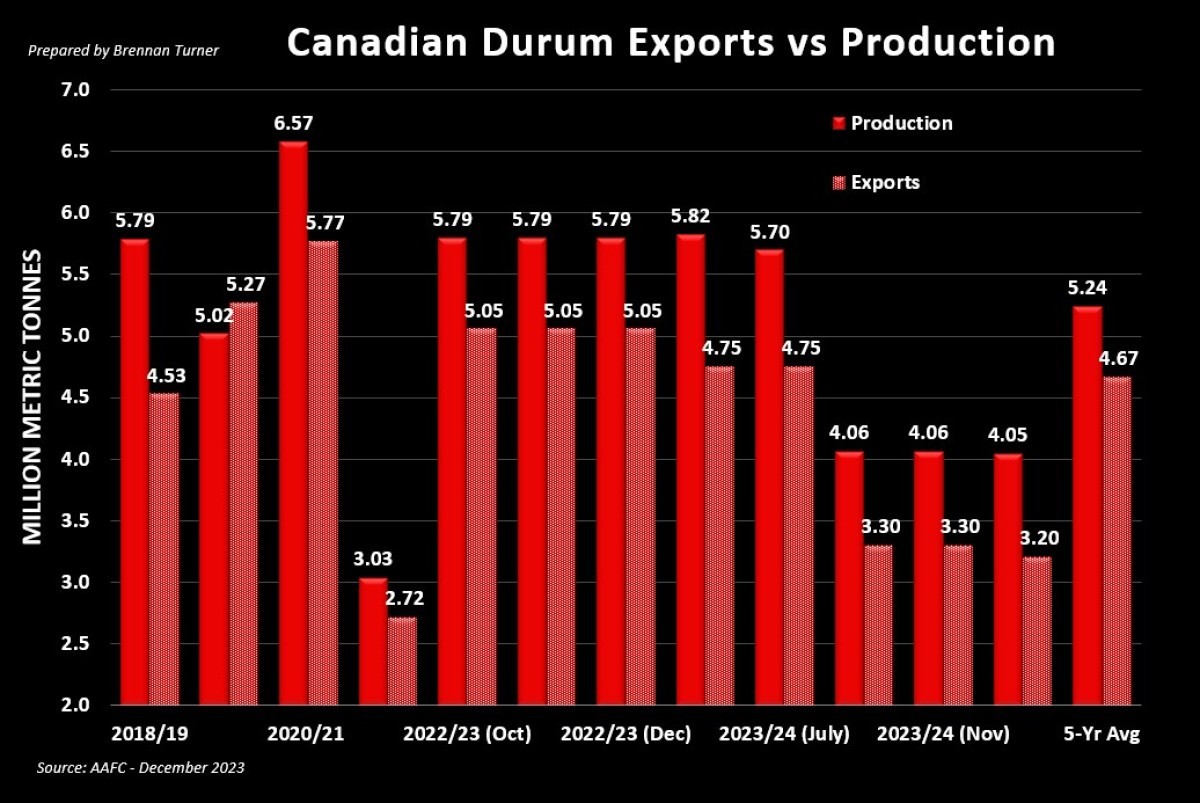

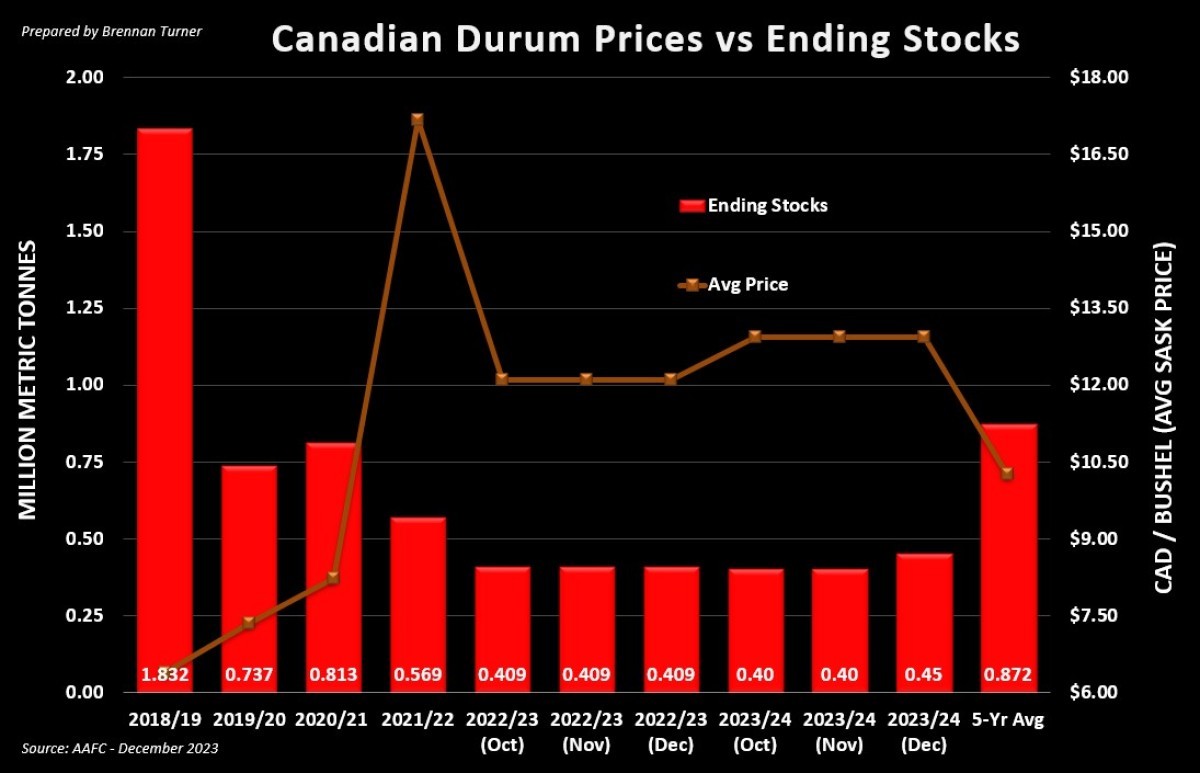

Rounding things out, durum exports and, thereby, cash prices have seen a disappointing performance so far in the 2023/24 marketing year. There are not a lot of market participants, including yours truly, who correctly called the impact that Turkish exports would have on the market, both in terms of volume and geographies that they shipped into. Therein, Agriculture Canada did lower their full-year target by 100,000 MT to 3.2 MMT, which pushed ending stocks up above the previous record low they were forecasting. That said, we have started to see a pickup in exports in the last few weeks (at least compared to the start of the year), but we certainly need to see the pace improve further to see that 3.2 MMT target achieved. As a result of the slow start, durum prices are marginally lower than both the end of harvest a year ago and the three-year average, ironically making them the best performer, year-over-year, of the Canadian Wheat market. With stronger exports likely in the pipe, though, and as the 2022/23 and 2020/21 crop years show, prices could trickle sideways to higher over the next six to eight weeks.

Ultimately, the world does have less wheat to go around, with the largest year-over-year decrease in world-ending stocks in over a decade and the lowest global total since 2015/16. That bodes relatively bullish for the Canadian wheat complex, but as always, the devil is in the details, some of which we’ll get into after the calendar flip.

Happy Holidays and Happy New Year!

Independent Grain Markets Analyst