A Balancing Act

A Balancing Act

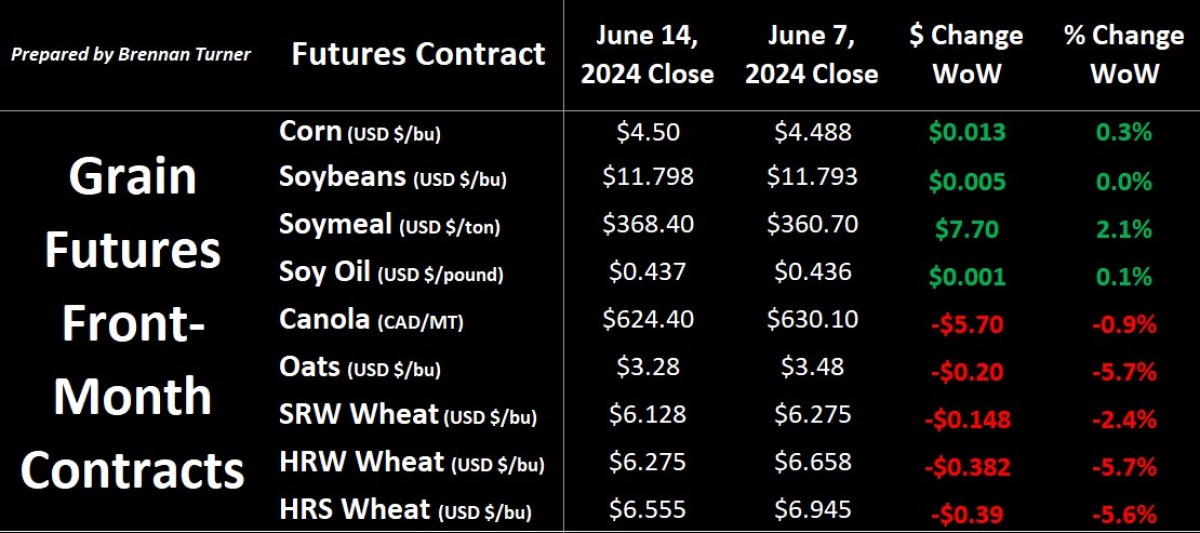

Grain markets continue their seasonal slide through the middle of June as weather premiums are fading on the anchor of a relatively good start to Plant 2024, and thereby, optimism for the yield monitor in a few months time. Last week’s WASDE report provided a few changes but, for the most part, the market is now focusing its attention on the planted acreage estimates, out the last few days of June from Statistics Canada and the USDA. Elsewhere, increased Houthi rebel missile and drone strikes in the Red Sea and skirmishes continuing in the Ukraine-Russia war aren’t going away, which lends a favorable hand to some level of geopolitical risk staying in the grain markets. That said, the EU is playing a little more hardball with Russia and Belarus, (finally) enacting new tariffs on agricultural exports from the two countries.

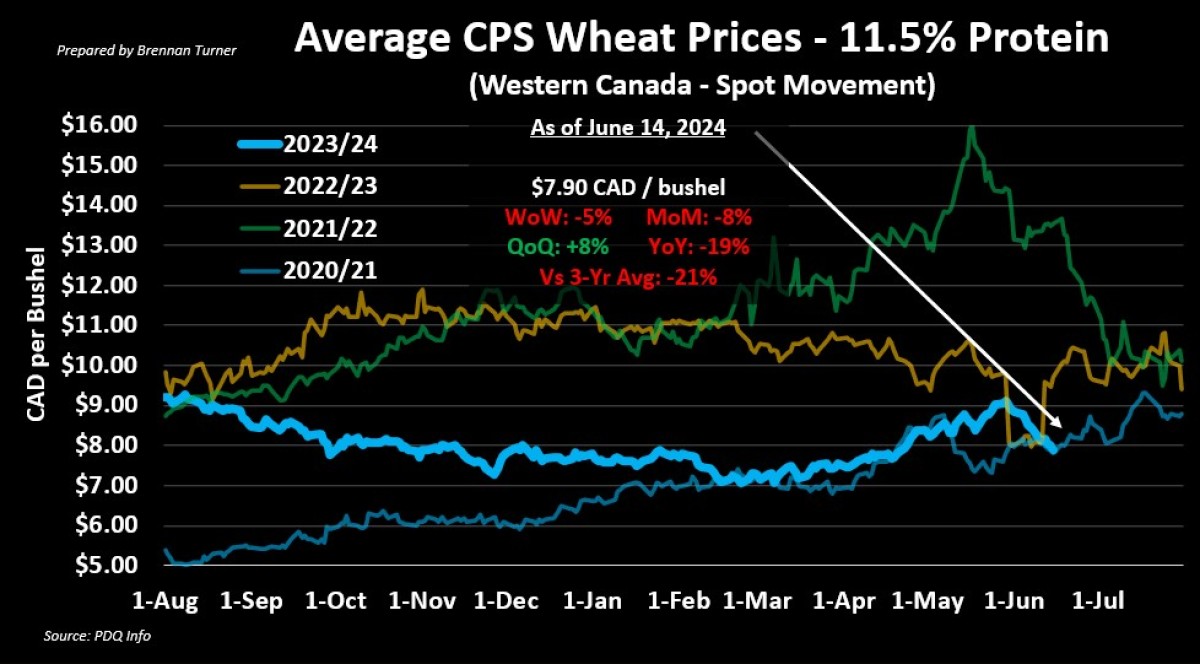

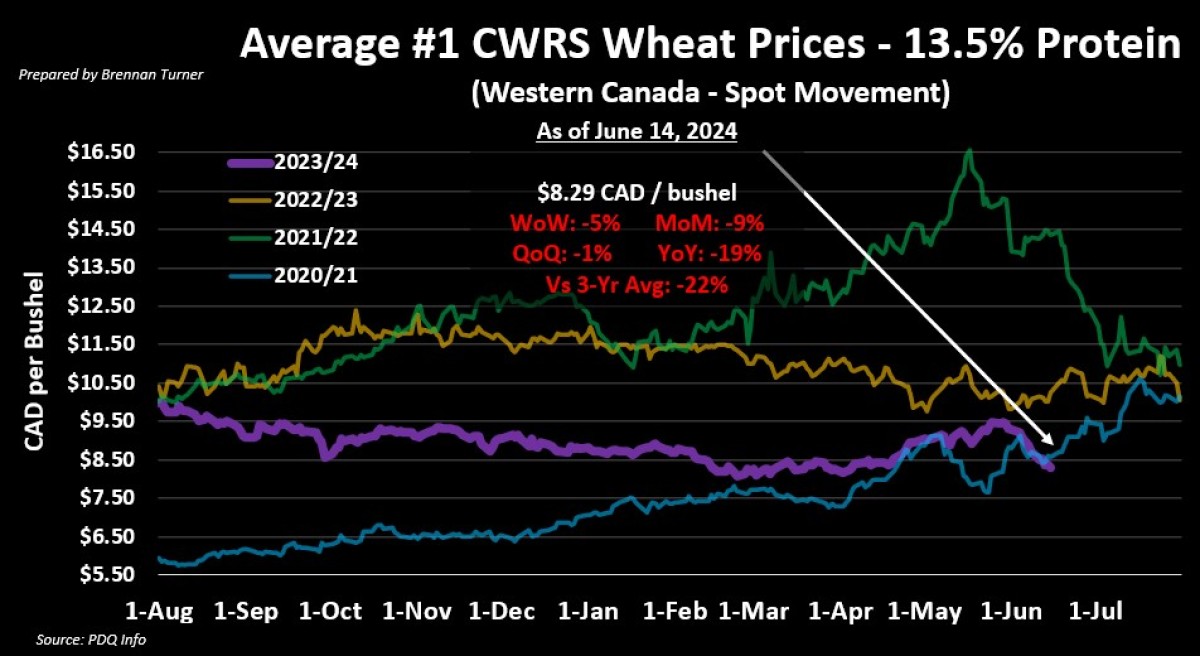

The wheat complex continues to tumble though as growing conditions remain reasonably benign, and the concerns over Black Sea and European production potential has now been priced in. With managed money bears re-accumulating their short positions, front-month hard red spring wheat futures in Minneapolis dropped last week to its lowest level since mid-May. Similarly, Kansas City hard red winter wheat (which CPS wheat here in Canada is pegged to) has closed lower in 11 of the last 13 trading days, and is now at its lowest since the beginning of May. The point here is that, while the complex is likely to level out a bit over the next month (read: further declines are possible), now is probably not the best time to be making old or new crop grain sales. Instead, balance this point of the farming season out with a review of the books, scenario planning for different weather and crop input applications, conversations with bankers or accountants, and anything else to help you put a best financial foot forward.

EU Taxes Russian, Belarussian Grain

- New European Union tariffs are meant to stop any imports of Russian or Belarussian grain, oilseeds, or derived products.

- Oilseeds are taxed at an astounding 50%, while all cereal imports from the region will get slapped with an additional $102.76 USD / MT (regardless if its wheat, durum, barley, etc.).

- While Kazakhstan and Ukraine are the best logistical options for Europe to use, I believe this to be a net positive for Canadian grain exports as it could open up the door for more peas, flax, durum, and maybe even mustard to head across the Atlantic. For reference, in the 2022/23 crop year, Russia exported to EU.

- 892,500 MT of peas

- 400,670 MT of flax

- 352,900 MT of wheat

- 265,300 MT of durum

- 48,550 MT of mustard, and

- Just 5,200 MT of canola/rapeseed

- Add in that Turkey, in order to protect domestic producers and prices, has halted all wheat imports until at least the middle of October, Russia has lost two important markets for its grain exports for at least the next 4 months.

USDA: Less Russian Wheat Anyways

- In their June WASDE, the USDA lowered wheat production in Russia for the upcoming 2024/25 crop year by 5 MMT to 83 MMT, reflecting the combo of hot/dry weather, as well as the heavy frosts in May. The USDA also lowered Russia’s wheat exports by 4 MMT to 48 MMT.

- Most private estimates currently peg Russia’s wheat harvest number between 75 - 80 MMT.

- Those same weather conditions led the USDA to drop Ukrainian wheat production by 1.5 MMT to 19.5 MMT, and exports by 1 MMT to 13 MMT.

- Conversely, Ukraine’s Ag Ministry is predicting a 21 MMT wheat harvest, with 15 MMT of exports.

- The EU’s wheat output was lowered by 1.5 MMT to 130.5 MMT due to the wet spring weather.

- France’s Ag Ministry says the good-to-excellent (G/E) portion of their soft wheat crop is 62%, still the lowest in 4 years.

- Add in their 2023/24 ending stocks dropped by 1.5 MMT, thanks to 2 MMT increased in their 2023/24 exports, the wheat balance sheet in Europe is looking tighter and tighter.

- U.S. wheat production was raised by nearly 500,000 MT to 51 MMT, while exports were raised by nearly 700,000 MT to 21.8 MMT, as U.S. winter wheat prices are expected to be more competitive with Black Sea options.

- Also worth noting is that China’s 2023/24 wheat imports were raised by 1.5 MMT to 13 MMT.

Canada’s Record Tight Wheat Market

- The USDA has recognized Canada’s strong finish to the 2023/24 export campaign, raising total wheat shipments by 1 MMT to 25 MMT.

- This puts their 2023/24 ending stocks prediction at just 1.87 MMT, which would be the tightest ever (AAFC’s current estimate for 2023/24’s total wheat carryout is 2.95 MMT).

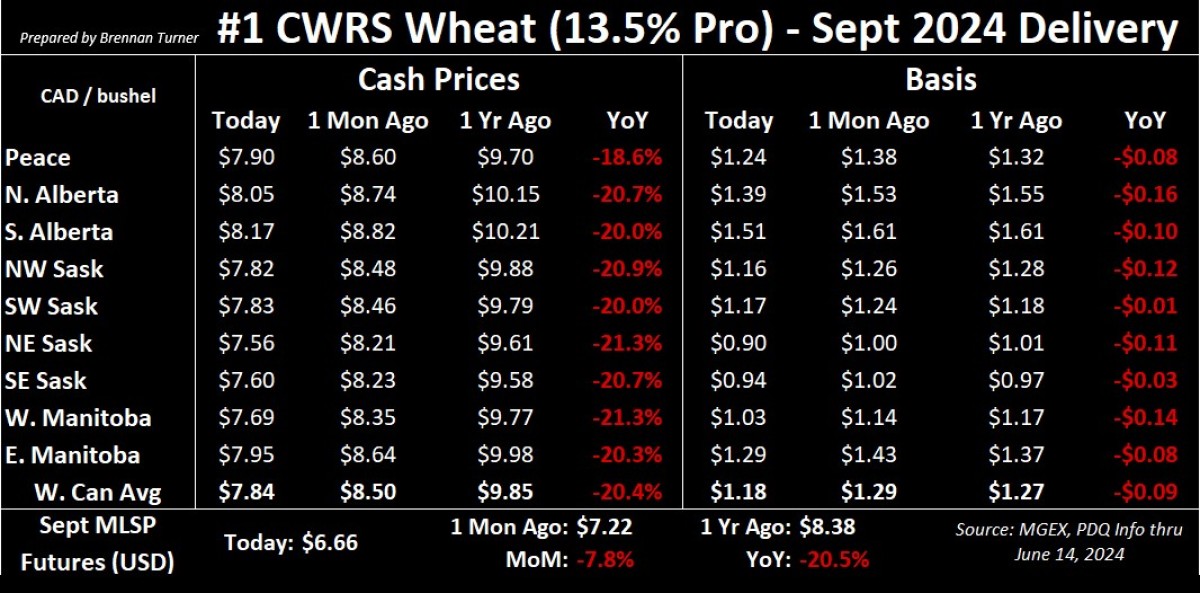

- Accordingly, the question I’ve been getting asked a lot lately, is if Canadian wheat prices are in such strong demand, and there’s less of it to go around, why aren’t our wheat prices higher?

- Short answer is that Canadian farmers have been willing sellers.

- Second answer is that there are other buying options out there like Australia (their exports were lowered by the USDA by 500,000 MT, largely reflecting competition with Canada).

- A tertiary component is that if the railroads stop moving, buyers will quickly seek out other options and once the buyers are gone, it’s not just a snap of the fingers to get them back.

- The rail workers union recently rejected CN Railway’s binding arbitration offer, suggesting we’re unfortunately not near a resolution.

- A fourth factor is that this year’s crop is looking pretty good and grain buyers are also aware of this, so with the 2023/24 shipping season likely now baked in, a lot more attention is being given to Harvest 2024 options.

- For example, in the last Saskatchewan crop report, 87% of both its winter and spring wheat crops are rated in G/E shape, which is much better than a year ago when drought conditions were starting.

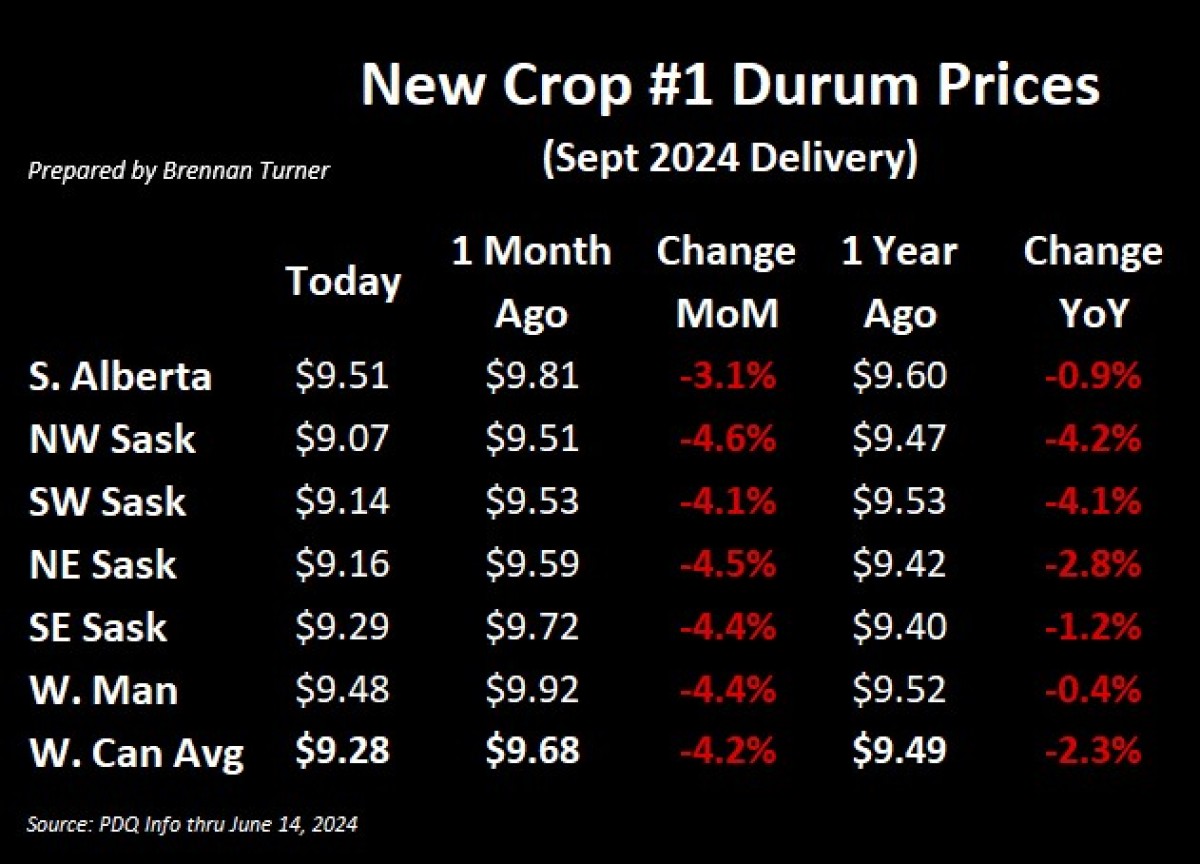

- This validates why new crop wheat prices also declining, now sitting about 70¢ CAD/bushel lower than a month ago, and nearly $2/bushel below what we saw at this time a year ago (Again, last year’s values were drought-driven).

- Canadian feed wheat prices are also following this pattern of focusing on new crop supplies with lower values.

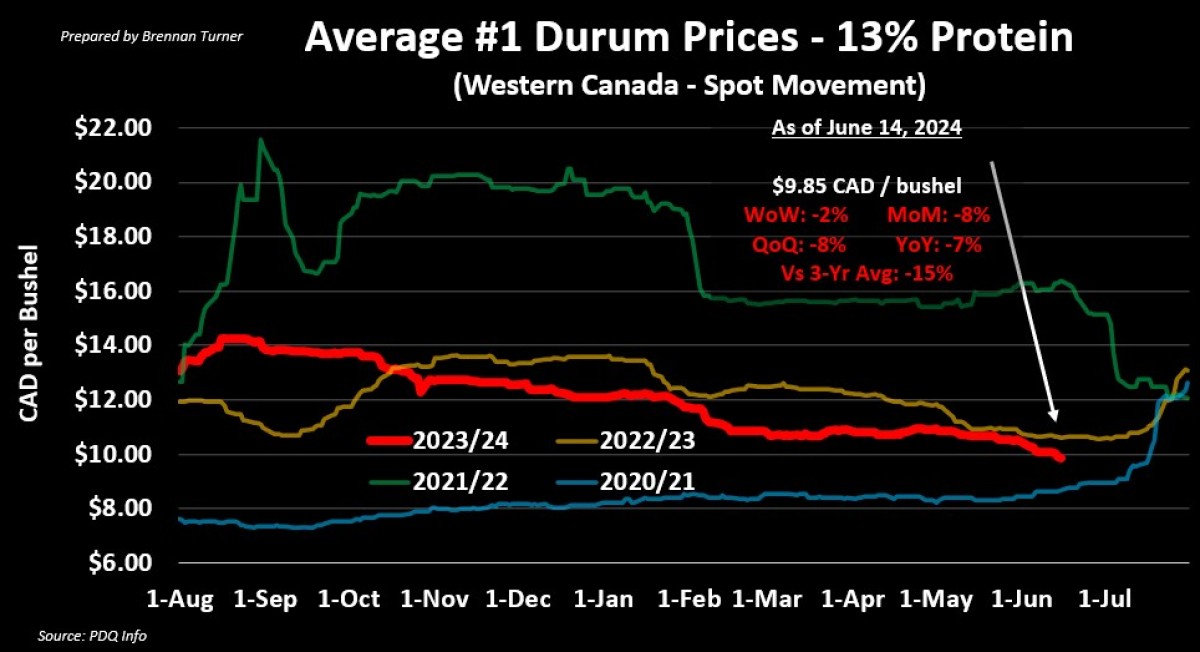

A Good Start for Durum

- Much like wheat crop, 93% of Saskatchewan’s durum fields are rated G/E, a big jump over last year’s rating through mid-June of 78%.

- Considering only 22% of the province’s durum crop last year finished the growing season with a G/E rating, the market is already pricing in better yields for this year’s crop.

- On the trade front, we continue to monitor further trade rules out of Turkey, as well as the needs from Europe and North Africa, but most of the focus is on finishing the 2023/24 export season

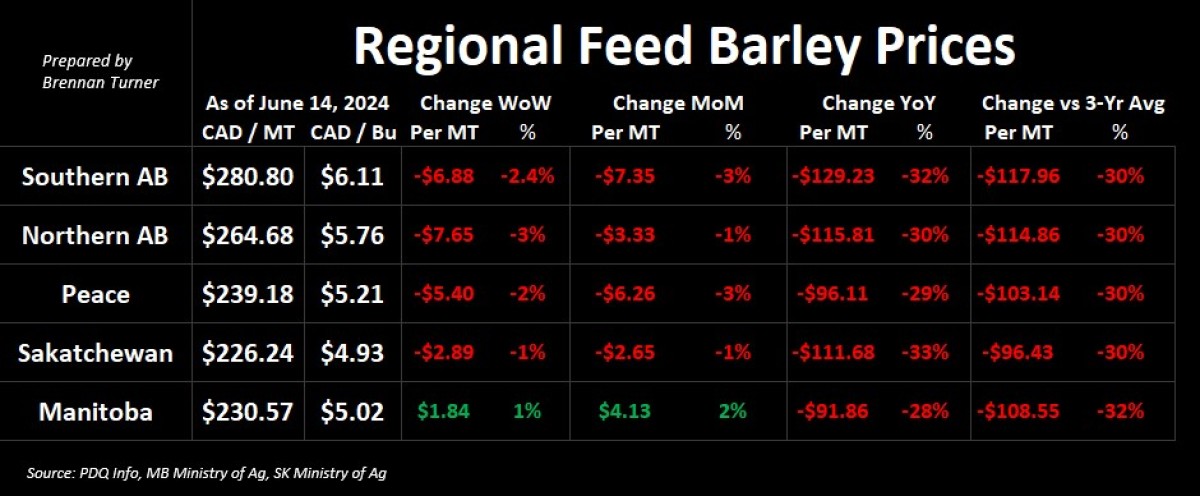

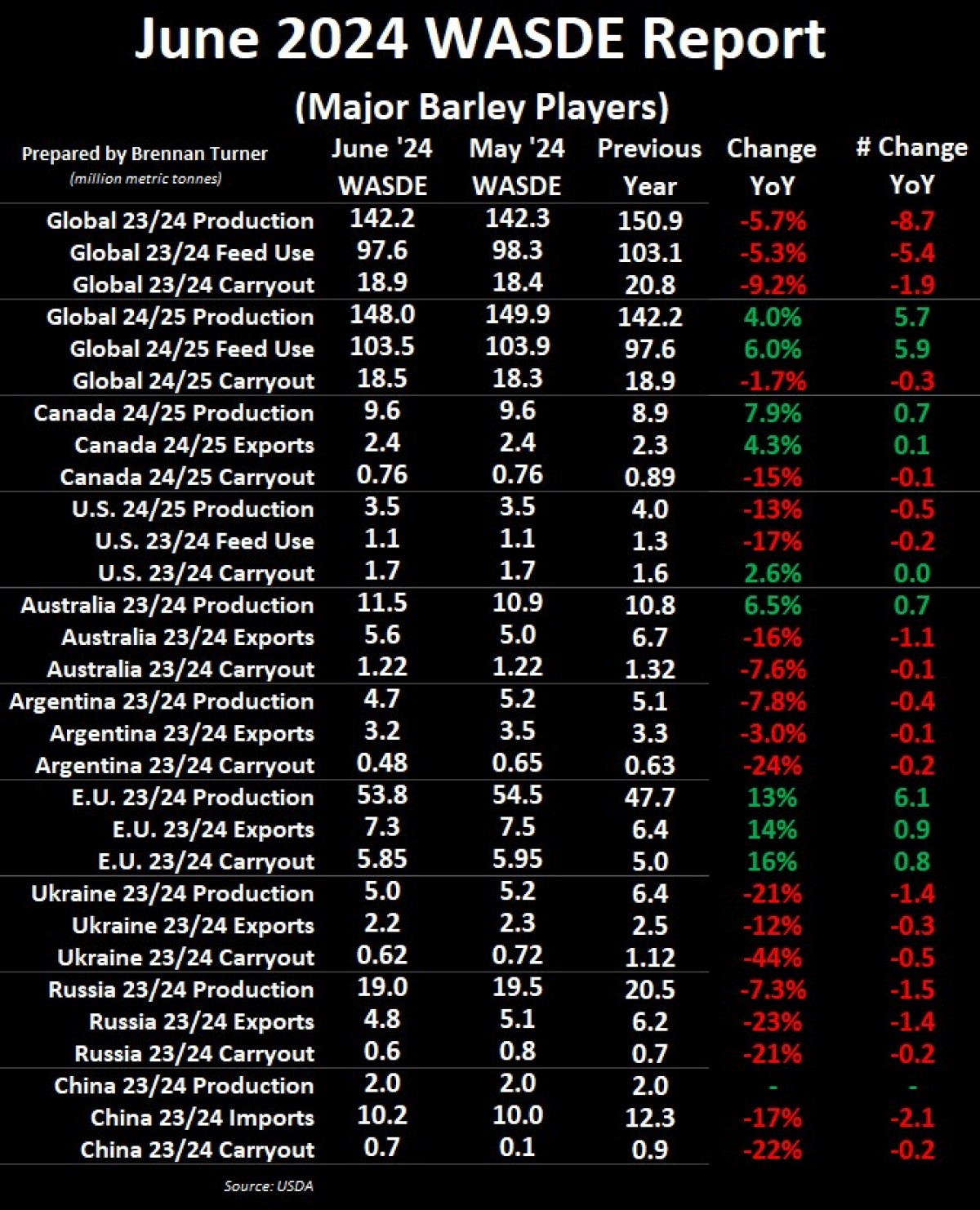

Less Barley in 2024/25

- In the USDA’s WASDE, global barley production estimates fell nearly 2 MMT as weather issues have reset what yields are possible in a variety of countries:

- European Union: -700,000 MT to 53.8 MMT

- Russia: -500,000 MT to 19 MMT

- Argentina: -500,000 MT to 4.7 MMT

- Ukraine: - 200,000 Mt to 5 MMT

- India: -650,000 MT to 1.5 MMT (interesting given last column’s discussion about the upside opportunity for India’s beer market).

- These lower harvest estimates also translate to lower exports from these countries, and the UDSA is looking at Australia to help out, raising their 2024/25 shipments by 600,000 Mt to 5.6 MMT, accounting for all of the production increase (now sitting at 11.5 MMT).

- China’s imports of barley keep going up as it appears the People’s Republic is buying more supplies with values at multi-year lows.

- Canada’s barley new crop balance sheet didn’t change but old crop feed use was reduced by 200,000 MT to raise 2023/24 ending stocks by the same amount to now sit at 885,000 MMT (AAFC at 850,000 MT).

- With seeding complete and conditions looking pretty good (i.e. 87% of Saskatchewan barley is in G/E shape), barley prices are trending lower again, matching that of other cereals.

- As such, there is some buzz that some buyers are pushing malt supplies into the feed market in order to empty their bins before Harvest 2024 supplies start coming in.

To growth,

Brennan Turner

Independent Grain Market Analyst